XRP Price Holds Steady as Whale Activity Declines

XRP price has dropped 22% in the past week, with technical indicators showing both bearish pressure and signs of potential stabilization. The RSI remains neutral after a sharp rebound from oversold levels earlier this month, while the number of whales has stabilized after a brief surge.

Meanwhile, XRP’s Exponential Moving Averages (EMAs) have formed a bearish death cross, suggesting that downside risks remain unless a reversal takes shape. Adding to the broader market narrative, XRP ETFs are now eyeing SEC approval following Cboe’s 19b-4 filing, which could play a key role in shaping future price action.

XRP RSI Is Still Neutral, Following The Same Pattern Since February 3

XRP Relative Strength Index (RSI) has surged from 35.2 to 44.6 in just a few hours, reflecting a shift in momentum after recent weakness. This increase suggests growing buying interest, though XRP remains within a neutral range.

RSI is a widely used momentum indicator that oscillates between 0 and 100. It helps traders gauge whether an asset is overbought or oversold.

Typically, an RSI above 70 indicates overbought conditions, where prices may be due for a correction, while an RSI below 30 signals oversold territory, often a potential buying opportunity. Values between 30 and 70 are considered neutral, meaning the market is neither in a strong bullish nor bearish phase.

Since February 3, XRP RSI has remained in neutral territory after hitting extreme lows of around 13 on February 2. This rebound suggests that the intense selling pressure that drove XRP to oversold levels has subsided, allowing price stabilization.

With the RSI now at 44.6, momentum is gradually shifting toward the upper end of the neutral range.

While this is not yet a clear bullish signal, it indicates increasing demand, which could lead to XRP testing resistance levels if buying pressure continues. A sustained push above 50 would be a stronger confirmation of bullish momentum, potentially opening the door for further upside in price action.

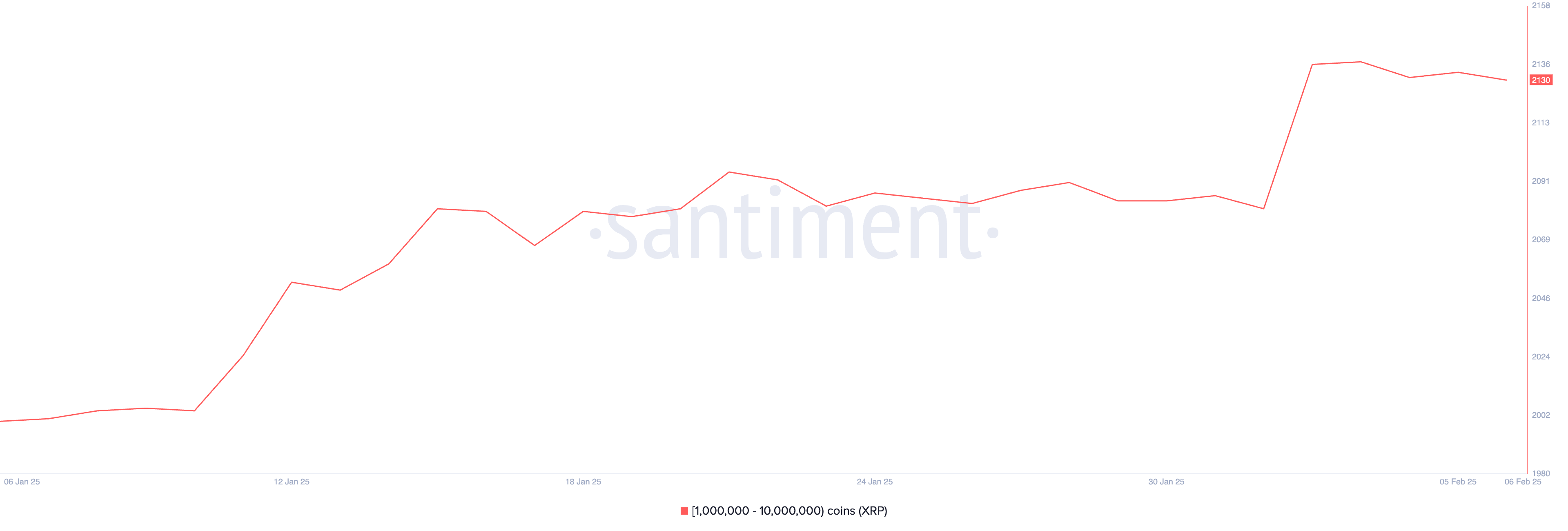

XRP Whales Are Slowly Declining After Surging 6 Days Ago

The number of XRP whales – addresses holding between 1,000,000 and 10,000,000 XRP – currently stands at 2,130. This figure surged from 2,081 to 2,136 between February 1 and February 2, indicating a sharp accumulation phase before slowly declining.

Tracking these large holders is crucial as they often have the ability to influence market trends due to the sheer volume of XRP they control.

When whale activity increases, it can signal growing confidence among high-net-worth investors, while a decline may indicate profit-taking or a shift in sentiment.

With the current number of XRP whales stabilizing at 2,130 after a brief surge, the market appears to be in a consolidation phase. If the number of whales continues to drop, it could suggest that some large holders are offloading their positions, potentially leading to short-term price weakness.

However, if the decline stabilizes or reverses into another accumulation phase, it could indicate renewed confidence in XRP’s prospects. A sustained increase in whale addresses would be a bullish signal.

This suggests that institutional or large-scale investors see long-term value in XRP and are positioned for potential future upside.

XRP Price Prediction: Will XRP Trade Above $3 In February?

XRP’s Exponential Moving Average (EMA) lines indicate a bearish setup, as a new death cross formed two days ago. This occurs when short-term EMAs cross below long-term EMAs, signaling sustained downward momentum.

Over the past seven days, XRP price has declined by 22%, reinforcing the negative sentiment.

If the bearish trend persists, key support levels to watch are at $2.32, with further downside potential to $2.20 and even $1.99 if selling pressure intensifies.

The continued positioning of short-term EMAs below long-term EMAs suggests that bears still have control, and a failure to hold critical support levels could lead to further downside exploration.

However, a trend reversal could shift momentum in XRP’s favor, with the first resistance level at $2.60. If buyers regain strength and push XRP beyond this mark, the next targets lie at $2.82 and potentially above $3.

Should XRP price recover the bullish momentum seen in previous months, potentially driven by the SEC’s approval of the XRP ETF, it could extend gains toward $3.15, a level that would indicate renewed confidence in its uptrend.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.