PinLink (PIN) Price Jumps 15%, Nears $90 Million Market Cap

PinLink (PIN) price has been gaining momentum, surging 15% in the last 24 hours as it nears a $90 million market cap. Technical indicators show mixed signals, with the RSI cooling down from near-overbought levels while the ADX suggests the uptrend is still strong but possibly stabilizing.

A recent golden cross in the EMA lines indicates that if bullish momentum continues, PIN could test resistance at $1.17 and potentially push toward $1.41 or even $2 if AI, DePIN, and RWA narratives regain traction. However, if the uptrend loses strength, PIN could retest support at $0.70, with a deeper correction down to $0.51 still on the table.

PinLink RSI Is Still Neutral After Almost Touching Overbought Zone

PinLink defines itself as the first RWA-tokenized DePIN marketplace. It aims to reduce costs for artificial intelligence developers while enabling new revenue streams for DePIN asset owners.

By integrating real-world assets (RWA) with decentralized physical infrastructure networks (DePIN), PinLink aims to provide an efficient marketplace for developers to access AI-related resources at lower costs.

At the same time, asset owners can monetize their infrastructure, creating a more decentralized and cost-effective ecosystem.

Currently, PIN’s RSI is at 58.6 after briefly touching 69.98 a few hours ago, surging from just 24.4 four days ago. The Relative Strength Index (RSI) is a momentum indicator that measures whether an asset is overbought or oversold, ranging from 0 to 100.

Readings above 70 suggest overbought conditions and a potential pullback, while values below 30 indicate oversold conditions and the possibility of a rebound.

With PIN’s RSI rising sharply in a short period but now cooling down from overbought territory, it suggests that buying pressure has been strong but is now stabilizing.

If RSI continues to hold above 50, PIN could maintain bullish momentum, but if it declines further, it may indicate weakening demand, increasing the risk of a short-term correction.

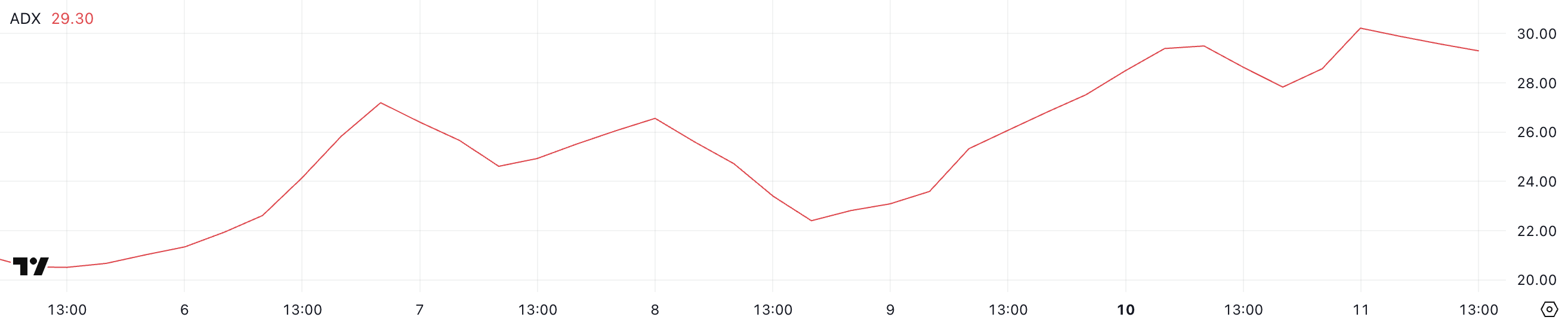

PIN ADX Shows the Uptrend Is Still Strong, But Could be Easing

PinLink ADX is currently at 29.3, slightly down from 30.2 a few hours ago, after surging from 22.4 just three days ago. The Average Directional Index (ADX) is a key indicator used to measure the strength of a trend rather than its direction.

Readings above 25 typically indicate a strong trend, while values below 20 suggest weak or nonexistent trend momentum. A rising ADX signals that a trend – whether bullish or bearish – is gaining strength, while a declining ADX can indicate fading momentum or potential consolidation.

With PIN’s ADX currently at 29.3, the indicator suggests that the uptrend is still holding strength but may be slowing slightly. The recent increase from 22.4 confirms that PIN has been building a stronger trend over the past few days, reinforcing bullish momentum.

However, the small dip from 30.2 could indicate that trend strength is stabilizing rather than accelerating.

If ADX remains above 25 and continues rising, it would confirm that the altcoins’ uptrend is gaining traction, but if it starts dropping toward 20, it could signal that the bullish momentum is weakening, leaving room for potential consolidation or a shift in the market direction.

PIN Price Prediction: Can PinLink Reach $2 In February?

PinLink EMA lines indicate a bullish signal, as a short-term moving average has just crossed above another short-term line, forming a golden cross. If this uptrend remains strong, PIN, which is based on Ethereum, could test its next resistance at $1.17, and a breakout above this level could push the price toward $1.41.

Additionally, if narratives around AI, DePIN, and RWA regain momentum, PinLink could benefit from renewed market interest, potentially driving its price toward the $2 mark.

On the downside, if PIN fails to sustain its current bullish momentum and the trend reverses, it could face a retest of the $0.70 support level.

A break below this level could accelerate selling pressure, leading to a deeper decline toward $0.51 – a potential 50% correction from current levels.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.