Top 3 Crypto Narratives to Watch For the Last Week of February

Automated Market Makers (AMMs), BNB Ecosystem Coins, and AI are the top three crypto narratives to watch for the last week of February. AMMs are facing a challenging week, with all top seven coins in red, but potential catalysts like Unichain’s growth and competition in Solana’s DEX space keep them relevant.

The BNB ecosystem is gaining momentum with CZ’s renewed advocacy, an AI-focused roadmap, and surging activity on PancakeSwap. Meanwhile, the AI narrative is showing mixed signals. While the broader AI crypto market struggles, projects like Story (IP), CLANKER, FORT, and BNKR are capitalizing on niche use cases.

Automated Market Makers (AMMs)

AMMs coins have had a rough week, with all seven top seven coins in red. Automated Market Makers are decentralized exchanges that allow users to trade digital assets without using a traditional order book.

They rely on liquidity pools, where users provide funds that facilitate trading and earn fees in return. This model enhances liquidity and removes the need for centralized intermediaries, making AMMs a crucial part of decentralized finance (DeFi).

RAY is the biggest loser among the top AMMs. Rumors about Pumpfun launching their own AMM solution could impact Raydium’s usage and fee generation, causing its price to fall almost 30% in just 24 hours.

UNI and CAKE are both down 15%, as the market doesn’t seem excited about Uniswap’s new chain, Unichain. Additionally, CAKE is correcting after its recent surge alongside the rising BNB ecosystem.

However, RAY continues to be a dominant force in Solana, which could lead some users to question whether the recent drop isn’t an overreaction.

Chris Chung, founder of Solana decentralized exchange aggregator Titan believes that this could be good for the Solana ecosystem after all.

“The fact that pump.fun is developing its own automated market maker (AMM) is no surprise – it’s an obvious business move. They’ve created so much volume with meme coin trading that it was only a matter of time before they built infrastructure to take advantage of the fees. This creates competition for Jupiter and Meteora, but Raydium is the most affected, given meme coins make up the majority of the volume on Raydium,” Chung told BeInCrypto.

Also, Unichain is in its early days, and a new altcoin season could boost its usage. Additionally, the BNB ecosystem appears to have built good momentum in the last few weeks, which could set the stage for a CAKE price recovery.

All that combined makes AMMs one of the most interesting crypto narratives for this week.

“Now that competition in the Solana DEX space is heating up, exchanges will likely start competing for token listings. Some expect this to lead to lower fees, but I believe we’re more likely to see other incentives, like revenue sharing, token allocations beyond liquidity pool fees, or advertising support. DEXs have large treasuries and we’re going to see them dipping into these to make their offering stand out,” said Chung.

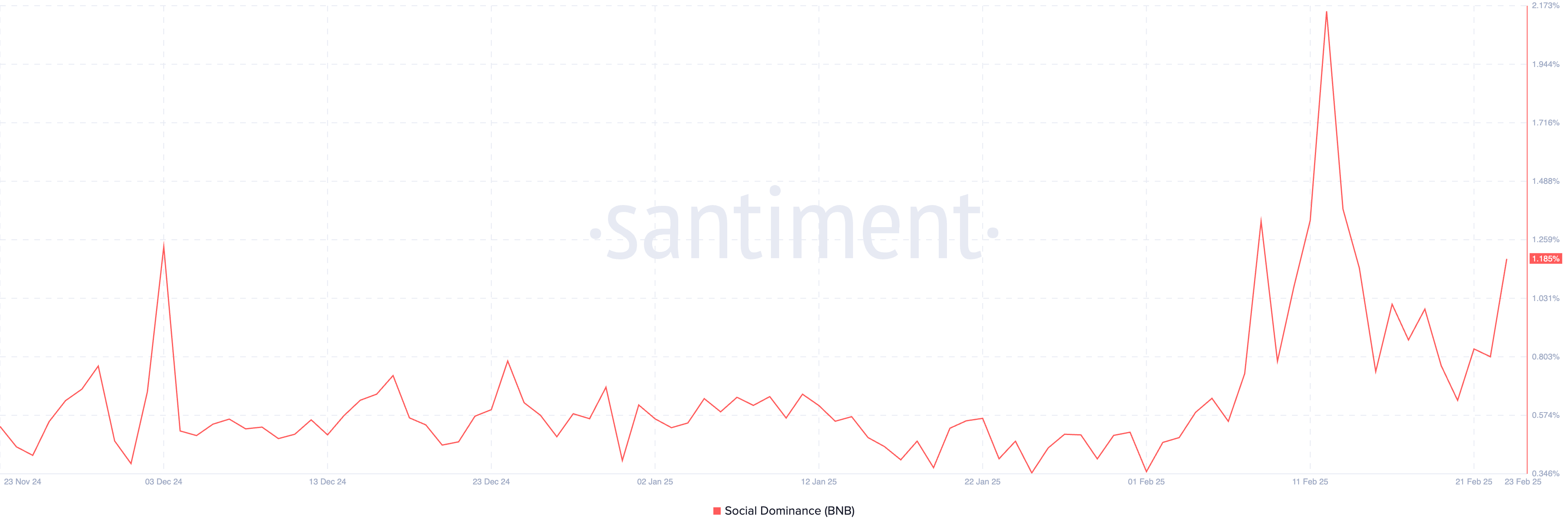

BNB Ecosystem Coins

BNB chain has been in the spotlight recently as CZ has renewed his advocacy for the network. The chain introduced an AI-focused roadmap and a new solution to make it easier for users to launch new coins.

These developments for the BNB chain also align with other crypto narratives, such as meme coins and artificial intelligence.

PancakeSwap, the largest decentralized exchange on the BNB ecosystem, experienced a surge in fees, jumping from $2 to $3 million in early January to consistently staying above $4 million and even reaching $18 million on some days since January 16.

This growth reflects increased activity and interest in the BNB chain.

The chain has also seen the rise of trending meme coins, such as BROCCOLI, inspired by CZ’s dog, and TST, which has become one of the biggest native meme coins on the BNB chain.

If this momentum continues, it could attract more builders and new coins to the chain, benefiting existing products and altcoins within the ecosystem.

Artificial Intelligence

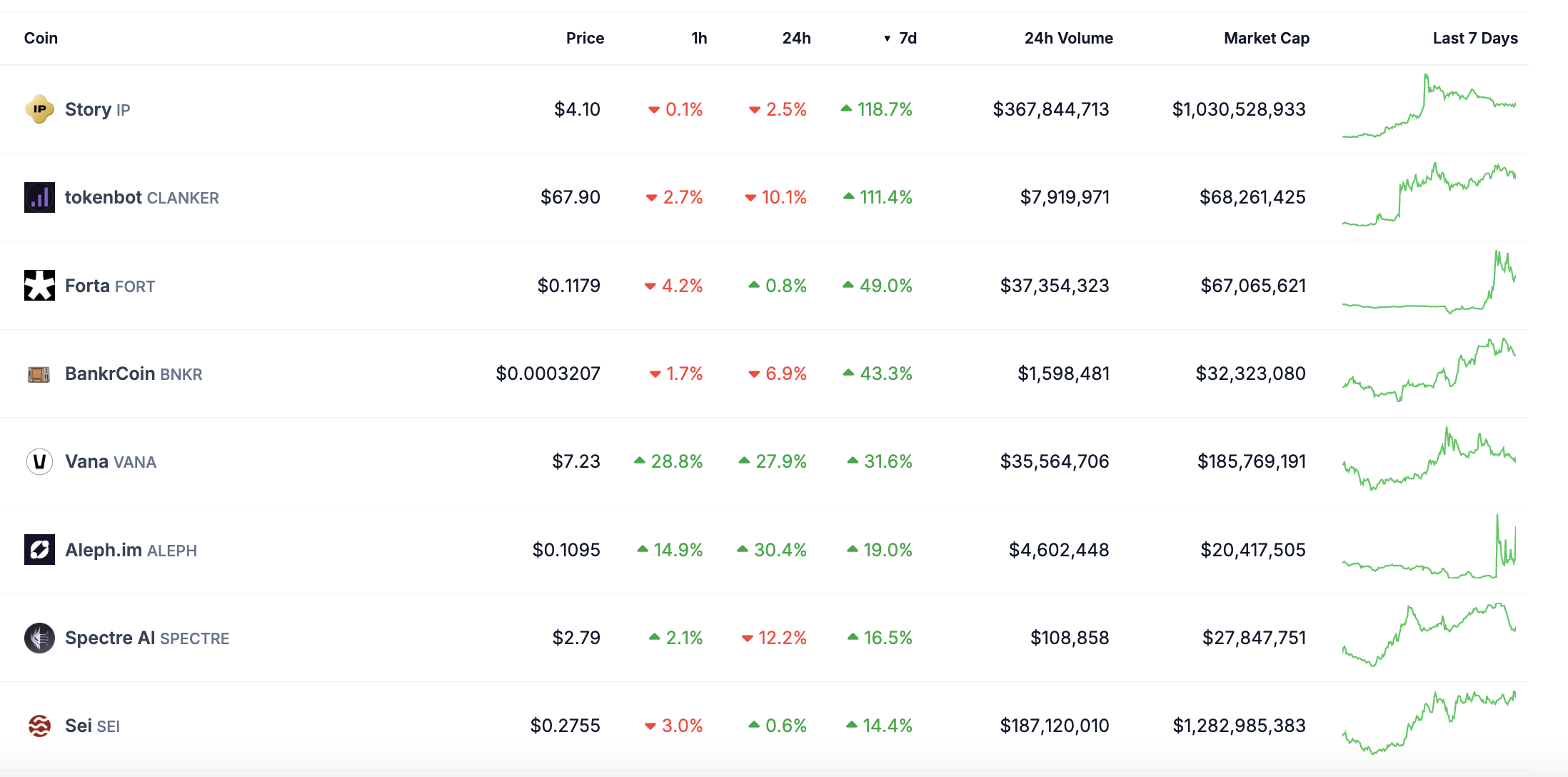

Although several AI coins are struggling, with RENDER, FET, and VIRTUAL all registering double-digit losses in the last seven days, some specific segments are managing to rise despite the overall narrative correction.

Story (IP) is a standout performer, up roughly 120% in the last week. It has become one of the most trending altcoins and quickly reached a $1 billion market cap. Similarly, CLANKER, one of Base’s biggest coin launchpads, is up 111%, reaching its highest price levels since early January 2025.

FORT is up 49%, leveraging on its security crypto firewall following the Bybit hack. BNKR has also gained 43%, capitalizing on the narrative around crypto AI agents and crypto companions.

Maybe the market is signaling that merely branding as an “AI coin” isn’t enough anymore. This shift could open up more space for coins that are becoming more specific about their use cases and not just defining themselves as a “crypto AI framework” or a “crypto AI agent coin.”

The post Top 3 Crypto Narratives to Watch For the Last Week of February appeared first on BeInCrypto.