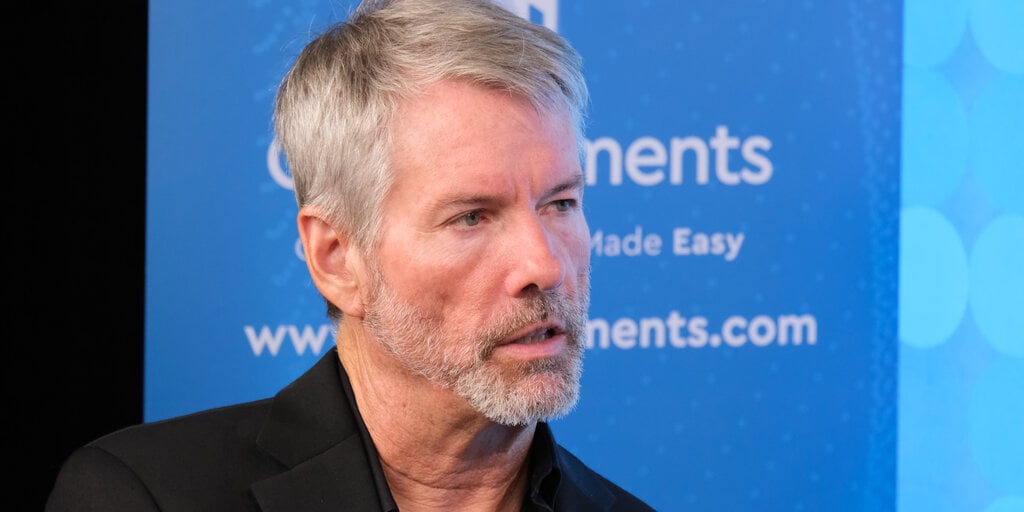

Strategy CEO Michael Saylor met with the SEC’s Crypto Task Force on Friday to discuss regulatory reforms in the U.S. as the country begins its pivot to a more favorable environment under President Donald Trump.

The tech executive presented several strategies for supporting innovation in the digital asset industry and protecting crypto holders’ rights, according to a memo from the meeting.

He also advocated for new regulatory guidelines for the crypto industry to reduce costs and time constraints related to issuing and listing tokens in the U.S.

It comes as the SEC begins to relax its stance against the asset class under a new regime headed by acting chair Mark Uyeda.

Earlier this month, the Commission announced it was dropping its legal complaint against trading platform Coinbase.

Soon afterward, the agency also abandoned an investigation into Robinhood‘s crypto trading arm, fueling rumors that regulators might soon abandon enforcement actions against other digital asset firms such as Ripple Labs, too.

During the meeting, Saylor shared several ideas on how to reduce financial burdens on crypto companies aiming to launch new tokens and investment products in the U.S.

He proposed capping asset-issuing expenses at 1% of businesses’ assets under management and limiting the cost of maintaining asset listings to 10 basis points per year.

More broadly, Saylor stressed that federal regulators should establish clear definitions for different classes of digital assets, including non-fungible tokens, stablecoins, tokenized real-world assets, and meme coins.

He also argued for regulators to clarify the rights and responsibilities of crypto businesses and holders.

Saylor has been a leader in the U.S. crypto scene for many years, fighting to secure support for the industry on Capitol Hill.

Last month, Saylor met with President Donald Trump’s son, Eric, at Mar-a-Lago in Florida to discuss the future of Bitcoin in the U.S. The Bitcoin maxi has also publicly supported a plan to establish a U.S. Bitcoin reserve for several months.

New Task Force, New Rules

The SEC’s Crypto Task Force was created last month, shortly after the inauguration of pro-crypto President Donald Trump.

Led by SEC Commissioner Hester Pierce, the initiative aims to foster collaboration between crypto firms and regulators on regulatory guidelines for the U.S. digital assets industry.

Since its debut, the task force has convened meetings with several major players in the crypto industry.

Last Thursday, digital trading platform Robinhood’s team talked with members of the Securities Commission’s new crypto committee, according to the agency’s website.

A day later, roughly 20 members of the Crypto Council for Innovation, including Coinbase and OpenSea, also met with the SEC Crypto Task Force.

Edited by Sebastian Sinclair

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.