Strategy to offer $21 billion in preferred stock to expand Bitcoin holdings

Key Takeaways

- Strategy plans to offer up to $21 billion in preferred stock to expand its Bitcoin holdings.

- The company uses various financing methods, such as debt offerings and equity issuances, to fund Bitcoin acquisitions.

Share this article

Strategy has announced plans to offer up to $21 billion in 8.00% Series A Perpetual Strike Preferred Stock, as detailed in a Monday filing with the SEC. The company, known for its aggressive Bitcoin acquisition strategy, aims to use the proceeds from the offering to further expand its BTC holdings.

The Nasdaq-listed company is registering 8.00% Series A Perpetual Strike Preferred Stock with a par value of $0.001 per share. The securities will be issued over time under Rules 457(o) and (r), with a registration fee of $3.2 million.

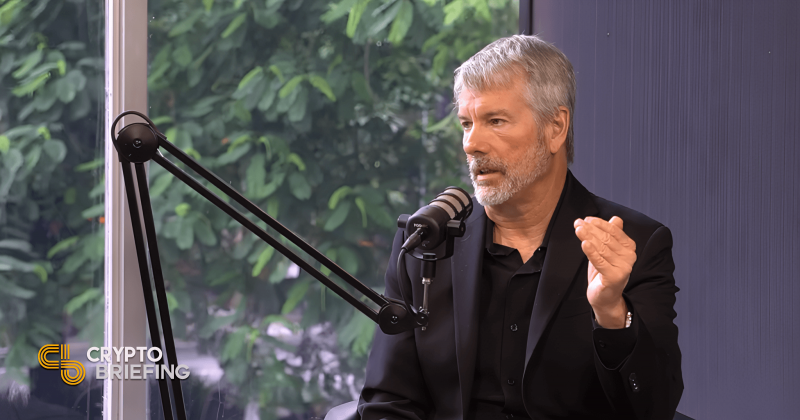

The offering marks another move by Strategy to increase its Bitcoin Treasury position. The company has previously used debt offerings and equity issuances to fund Bitcoin acquisitions under the leadership of Executive Chairman Michael Saylor, who has championed Bitcoin as a Treasury reserve asset.

Strategy currently holds 499,096 BTC, valued at $41.5 billion at current market prices.

Story in development.

Share this article