Cardano (ADA) Whales Buy 130M Tokens, Bull Run Incoming?

As the Cardano (ADA) price continues to consolidate near a crucial support level of $0.65, whales and investors appear to be capitalizing on this opportunity. Recently, a prominent crypto expert posted on X (formerly Twitter) that whales have purchased millions of dollars worth of ADA tokens in the past three days.

Whales Buy 130 Million ADA Tokens

In a post on X, the expert emphasized that crypto whales have bought nearly 130 million ADA tokens in the past 72 hours. This substantial ADA purchase by Whales signals a potential buying opportunity, as the price has dropped significantly in recent days.

Impact on ADA Price

The impact of this substantial ADA purchase has started to reflect in the asset’s price. According to CoinMarketCap data, ADA is currently trading near $0.75, having surged over 4% in the past 24 hours. Additionally, during the same period, the asset’s trading volume jumped by 10%, indicating increased participation from traders and investors looking to capitalize on the current price.

Cardano (ADA) Technical Analysis and Upcoming Levels

According to the expert’s technical analysis, ADA appears bullish as it has broken out of a small consolidation phase that it had been experiencing for the past five days and is currently trading above that zone.

Based on recent price action and historical momentum, if the asset closes a daily candle above the $0.75 level, it will confirm a successful breakout and could soar by 13% to reach $0.85 in the coming days.

Following the breakout, ADA has surged above the 200 Exponential Moving Average (EMA) on the daily timeframe, confirming its uptrend.

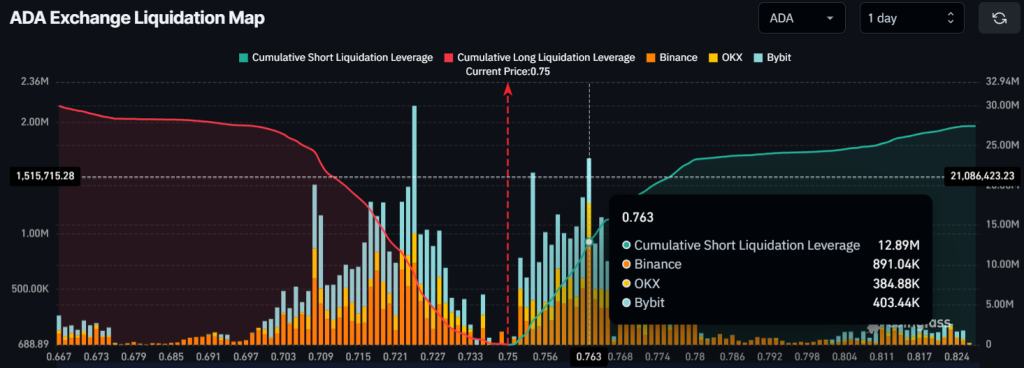

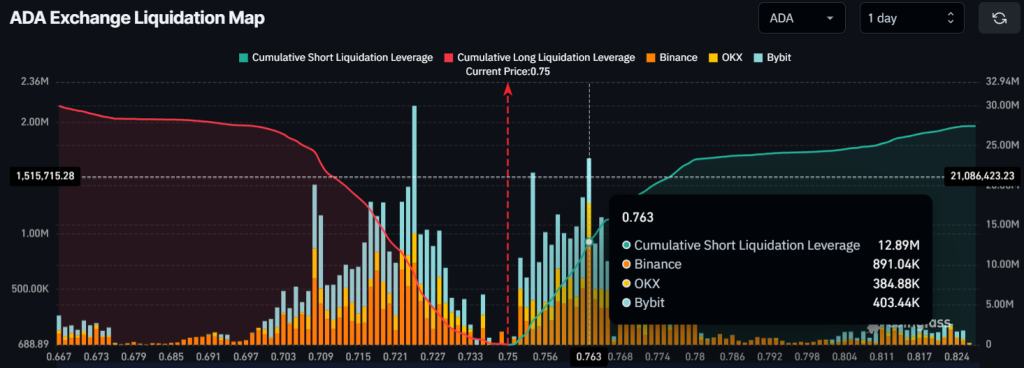

ADA Traders’ Over-Leveraged Positions

Aside from this bullish outlook, intraday traders appear to be strongly betting on the bearish side, as reported by the on-chain analytics firm Coinglass.

The data revealed that traders are currently over-leveraged at $0.724 on the lower side, with bulls holding $9 million worth of long positions. Meanwhile, $0.763 is another over-leveraged position where traders betting on the short side have held $13 million worth of positions.

This data clearly reveals traders’ sentiment despite the breakout.