Crypto Whales Are Buying These Altcoins Post Market Crash

Crypto whales are making quiet moves in Ethereum (ETH) and Optimism (OP), while accumulation remains stagnant—or even negative—across most other major coins. Between April 4 and 6, both ETH and OP saw a notable increase in large wallet holders despite a harsh market correction.

This behavior often signals early confidence from institutional players, hinting at potential reversals ahead. With ETH nearing $1,400 and OP trading at three-year lows, the next few days could be pivotal if whale accumulation translates into renewed bullish momentum.

Ethereum (ETH)

Between April 5 and April 6, crypto whales accumulated ETH. The number of Ethereum whale wallets—those holding between 1,000 and 10,000 ETH—increased from 5,340 to 5,388, signaling a quiet accumulation phase during the broader market correction.

Tracking these large holders is crucial, as their behavior often precedes major market moves; when whales accumulate, it can indicate growing confidence in the asset’s long-term value and hint at a potential trend reversal.

If Ethereum’s current downtrend continues, ETH price could break below $1,400 for the first time since January 2023, opening the door to deeper losses.

However, the recent uptick in whale activity suggests some optimism beneath the surface. If momentum shifts and ETH manages to reclaim $1,748, it could rise further toward $1,938 and, with a strong enough rally, even retest the $2,000 mark—restoring a key psychological and technical level for bulls.

Optimism (OP)

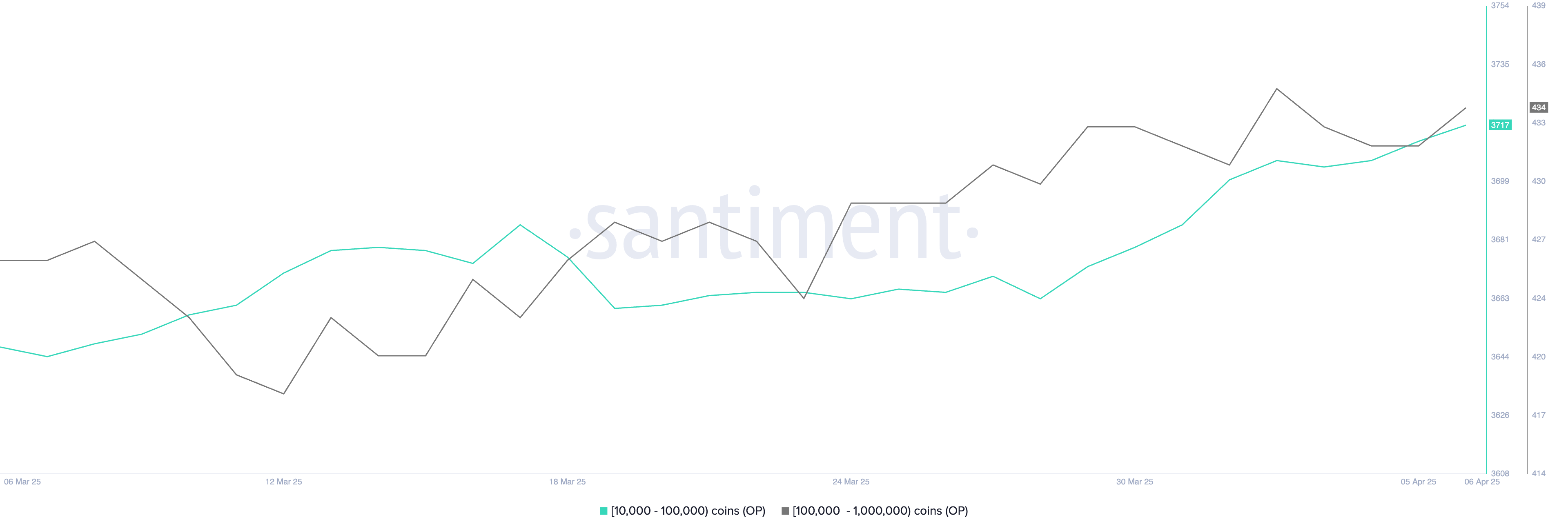

The number of Optimism whale wallets—holding between 10,000 and 1,000,000 OP—rose from 4,138 on April 4 to 4,151 on April 6, suggesting that large holders are accumulating despite the ongoing market correction.

This increase in whale activity may indicate long-term confidence in the project, even as the broader market faces heavy selling pressure.

In periods of uncertainty like now, such accumulation can be an early sign of a potential price reversal, as institutional or high-net-worth investors often act ahead of retail sentiment.

Currently trading near its lowest levels in nearly three years, OP is under significant downward pressure. If the correction persists, the token could break below the $0.50 support level.

However, if the recent whale accumulation reflects a shift in momentum, OP could rebound to test resistance at $0.65.

A breakout from that level may open the path toward $0.77 and, in a stronger recovery, even retest $0.84.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.