US Economic Indicators to Watch: Bitcoin Faces Fed Test

Traders and investors anticipate several US economic indicators this week, capable of influencing their crypto investment portfolios. These macroeconomic data become more concerning given the growing influence of macroeconomic data on Bitcoin (BTC) prices in 2025.

With Bitcoin price still consolidating within the $94,000 range, volatility around this week’s US economic events could influence the next directional bias.

US Economic Data Crypto Investors Should Watch This Week

The following are some US economic indicators that could interest crypto market participants this week.

ISM Services

This week, the ISM Services and the S&P final US services PMI are the first US economic indicators with potential crypto implications. These macroeconomic data will gauge the health of the US service sector in April.

A reading above 50 often signals expansion, while below suggests economic contraction. According to data on MarketWatch, the median forecast for the S&P final US services PMI is 51.0, after the previous reading of 51.4. Meanwhile, the ISM Services has a median forecast of 50.4% after the previous 50.8% reading.

“Tariffs have not had a major ripple effect on the services industry, financial conditions have remained tight. The US economy has shown some cracks in its resilience and Feds have not rushed pivoting. Expecting a lower outcome at 50.30-50.50, which can keep DXY bearish and still hold some intraday bulls on Gold? Lower services PMI shows continued signs of disinflation and supports rate cut bets,” wrote market intel Capital Hungry.

Strong data often bolsters confidence in traditional markets, inadvertently reducing Bitcoin’s appeal as investors favor equities. On the other hand, a weak PMI could point to an economic slowdown, driving demand for Bitcoin as a safe-haven asset amid uncertainty.

Given the crypto market’s reactions to macroeconomic signals, a faltering service sector could weaken the dollar, supporting Bitcoin prices due to its inverse correlation with USD.

However, if the PMI exceeds expectations, risk-on sentiment might still spill into crypto, though less aggressively than stocks. Given Bitcoin’s sensitivity to economic indicators, traders will closely watch this release, as it could set the tone for market sentiment, affecting crypto volatility and investor positioning.

US Trade Deficit

Another US economic indicator to watch this week is the US trade deficit, which will measure the gap between exports and imports in March.

There is a median forecast of -$136 billion after the previous reading of -$122.7 billion. Nevertheless, a widening deficit, especially amid Trump’s tariff discussions, could weaken the US dollar, as it reflects higher import reliance.

This typically benefits Bitcoin and crypto, which often move inversely to USD strength. Further, a larger-than-expected deficit might signal economic imbalances. This could prompt investors to seek alternatives like Bitcoin, viewed as a hedge against fiat depreciation.

Conversely, a narrowing deficit could strengthen the dollar, pressuring crypto prices, as investors might favor traditional assets.

Notably, in 2025, crypto markets became overly sensitive to trade-related news amid potential policy shifts under new administration priorities.

With traders assessing whether trade deficit trends foreshadow tighter monetary and trade policies, volatility is likely.

Against this backdrop, Bitcoin’s reaction will hinge on the data’s implications for dollar strength and global trade dynamics.

“America’s growing trade deficit is selling the nation out from under us,” analyst Zerohedge noted, citing Warren Buffett.

Reuters reported that economists downgraded their forecasts after the trade deficit hit a record high, with companies stockpiling amid tariff-induced uncertainty.

FOMC Meeting and Jerome Powell’s Conference

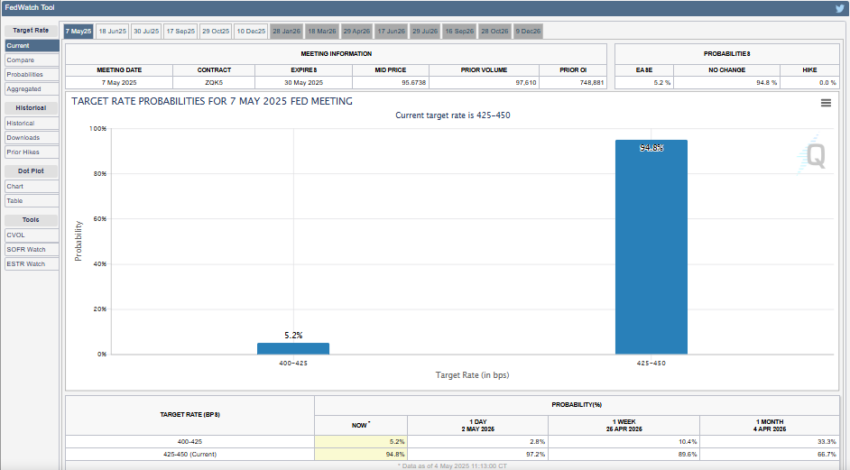

The highlight of this week’s US economic indicators, however, will be the FOMC meeting and the subsequent conference of Federal Reserve (Fed) chair Jerome Powell. While markets expect rates to remain at 4.25%- 4.5%, the Fed’s tone will drive sentiment.

Showing tighter policy or persistent inflation concerns, Hawkish signals could strengthen the dollar. Such an outcome would pressure the Bitcoin price, as investors shift to safer assets.

Conversely, dovish remarks, suggesting rate cuts or economic easing, might fuel risk-on sentiment. This would boost crypto as investors seek higher-yield alternatives.

Investors will scrutinize Powell’s comments on inflation, growth, and policy outlook, as Bitcoin often reacts sharply to the Fed’s rhetoric. Despite political pressure, Powell has committed to cautious decision-making, making significant downward revisions to its 2025 economic projections.

Further, after the FOMC and Powell’s conference on Wednesday, there is a lineup of Fed Governors on Friday, exacerbating the weight of this economic indicator division this week.

“FOMC meets on Wednesday and Chair Powell speaks. It will be less about the decision and more about Powell’s commentary. Very heavy “Fed speak” week as Friday a full day of Fed speakers,” wrote market expert Peter Tarr.

Accordingly, crypto volatility is likely, with traders positioning for directional cues. Given Bitcoin’s sensitivity to monetary policy shifts, any surprises in the Fed’s stance could amplify market moves.

Consumer Credit

Another US economic indicator to watch is the Consumer Credit data. This US economic data, due on Wednesday, tracks US borrowing trends while reflecting consumer confidence and spending power.

After the previous -$800 million reading, the median forecast is $11 billion. Rising credit levels suggest optimism, potentially diverting investment from speculative assets like Bitcoin toward traditional markets. This comes as consumers fuel economic growth.

Such a move could dampen crypto demand, especially if paired with strong economic signals in other economic indicators this week.

Conversely, stagnant or declining credit might signal caution, enhancing Bitcoin’s appeal as a hedge against economic slowdown or fiat instability.

Crypto markets often react to shifts in consumer behavior, as borrowing trends influence liquidity and risk appetite.

A surprise drop in credit could spark volatility, pushing investors toward decentralized assets. Bitcoin’s price may hinge on whether the data aligns with broader economic narratives, particularly in the context of Fed policy and trade dynamics, making this release a key factor for crypto market sentiment.

Initial Jobless Claims

Initial Jobless Claims, reported weekly, will also be a crucial watch for crypto traders this week. This data point measures new unemployment filings, offering a real-time snapshot of labor market health.

Initial jobless claims reported were 241,000 in the week ending April 26. However, data on MarketWatch shows a median forecast of 230,000.

“US initial jobless claims rose by 18,000 to 241,000 in the week ending April 26, the highest since February, and well above forecasts of 224,000,” analyst Michael Gayed noted.

Lower-than-expected claims signal economic strength, potentially boosting traditional markets and reducing Bitcoin’s appeal as investors favor equities. A strong labor market could also strengthen the dollar, pressuring crypto prices due to Bitcoin’s inverse USD correlation.

Conversely, higher claims might indicate economic weakness, driving demand for Bitcoin as a hedge against uncertainty or fiat depreciation.

Another reason why crypto markets are sensitive to labor data is that it influences Fed policy expectations. A spike in claims could fuel volatility, amplifying Bitcoin’s safe-haven narrative.

Meanwhile, a drop might dampen enthusiasm for decentralized assets. Traders will watch how claims align with broader economic signals like the FOMC meeting, as labor market trends could either stabilize or unsettle crypto markets this week.

BeInCrypto data shows BTC was trading for $94,126 as of this writing, down by almost 2% in the last 24 hours.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.