Bitcoin Miners To Pay 13%-15% Tax As Russia’s Upper House Approves Landmark Crypto Bill

Russia’s Federation Council – the country’s upper house of parliament – has approved a landmark cryptocurrency taxation bill. Among its key provisions, the legislation imposes a maximum tax rate of 15% on Bitcoin (BTC) and other digital asset mining operations.

New Cryptocurrency Tax Law Set To Come Into Effect

Russia’s upper house of parliament has given the green light to the new landmark cryptocurrency tax bill that seeks to foster a conducive regulatory environment for Bitcoin and other digital asset businesses in the country.

The legislation was approved on November 27th, and now awaits the signature of Russian President Vladimir Putin. After the consent, the law will come into effect once officially published.

The bill imposes a maximum tax limit of 15% on all individual cryptocurrency transactions and mining operations, essentially aligning income from digital assets to tax rates imposed on income from securities transactions.

Bitcoin and other crypto miners must pay taxes ranging from 13% to 15% on their revenue. The bill states that income arising from mining activities will be taxed on its market value at the time of receipt.

In addition, the bill classifies digital currencies used for many purposes – including as a means of payment for services – as property. Notably, the bill exempts all crypto activities from value-added-tax (VAT).

Once it becomes a law, Bitcoin and other crypto mining infrastructure operators in Russia must share relevant client information with the local authorities. Failure to do so may attract penalties of up to $360.

It is worth emphasizing that the bill won’t place any tax liability on services by authorized mining operators within Russia’s territorial boundaries. Crypto mining businesses can also deduct operating expenses to reduce their total tax liability.

Bitcoin Hits All-Time High Against Russian Ruble

The bill’s approval comes when the Russian ruble is in freefall on global currency markets. Year-to-date (YTD), the ruble has depreciated by more than 17% against the US dollar.

This devaluation has contributed to Bitcoin reaching an all-time high (ATH) against the ruble. BTC trades above 10 million rubles at press time, with YTD gains exceeding 200% against the struggling fiat currency.

Russia has been actively leveraging cryptocurrencies in an attempt to evade sanctions imposed on it since the onset of the Ukraine conflict. During this year’s BRICS summit in Kazan, Russia, key lawmakers proposed selling BTC to international buyers to circumvent Western sanctions effectively.

Similarly, Russia expressed interest in adopting digital assets for cross-border payments in September. Earlier this year, President Putin signed a bill granting legal status to cryptocurrency mining in the country.

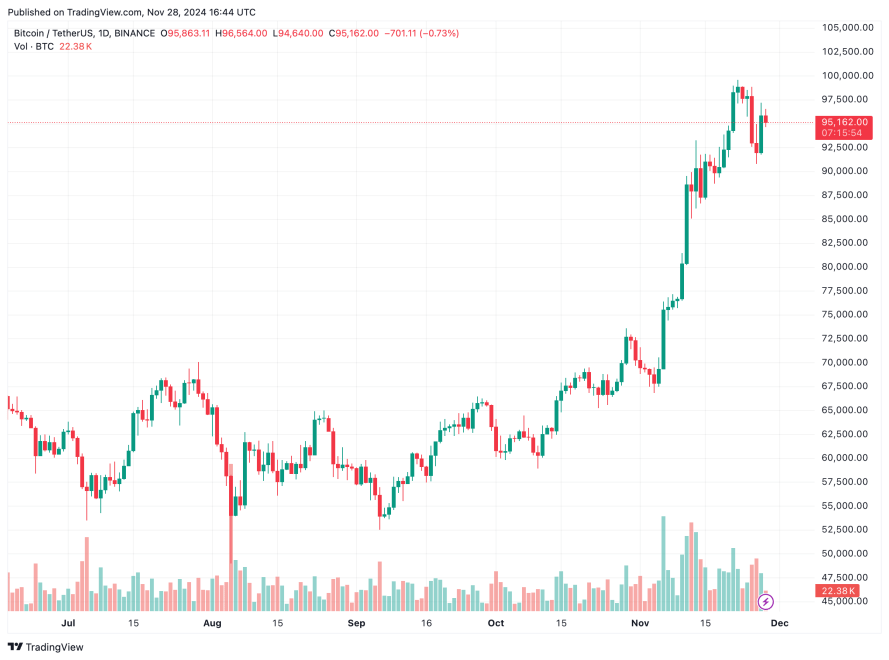

Russia is also grappling with an energy crisis, forcing it to ban crypto mining in certain regions due to its energy-intensive nature. BTC trades at $95,162 at press time, down 0.9% in the past 24 hours.

Featured Image from Unsplash.com, Charts from CoinGecko and TradingView.com