Avalanche Price Breaks Feb Low ,$20.07 in Danger as ETF Delay

Key Takeaways:

- AVAX dropped 13.49% this week to $20.07, breaking February’s low and nearing the March critical support at $15.28.

- A 6.82% drop in DeFi TVL and $2.47M net outflow on May 31 shows strong risk-off behavior.

- SEC’s delay of Grayscale’s AVAX ETF decision to July 15 hit market confidence.

- Descending triangle breakdown confirmed as price slips below $21 support.

- Over 90% of AVAX holders remain in losses, signaling ongoing downside pressure.

AVAX Price Update: Avalanche Slips Below February Floor

Avalanche (AVAX) broke under February’s low of $20.20, sliding below $21 to trade at $20.07 — its weakest level in three months. Despite a 24-hour volume exceeding $568 million, sellers remain in control.

Attempts to hold the $20.85–$21.00 support failed, with price now approaching March’s key low of $15.28. The price has now broken its short-term structure, increasing the probability of continued downside pressure.

ETF Delay and Market Mood Drag AVAX and ADA

The SEC delayed Grayscale’s AVAX ETF verdict to July 15, shortly after VanEck launched a purpose-built institutional fund for Avalanche. Instead of boosting confidence, this delay shook sentiment, cooling prior optimism around institutional interest.

Cardano (ADA), facing a similar delay, also witnessed drawdowns, showing that ETF indecision continues to weigh on layer-1 ecosystems.

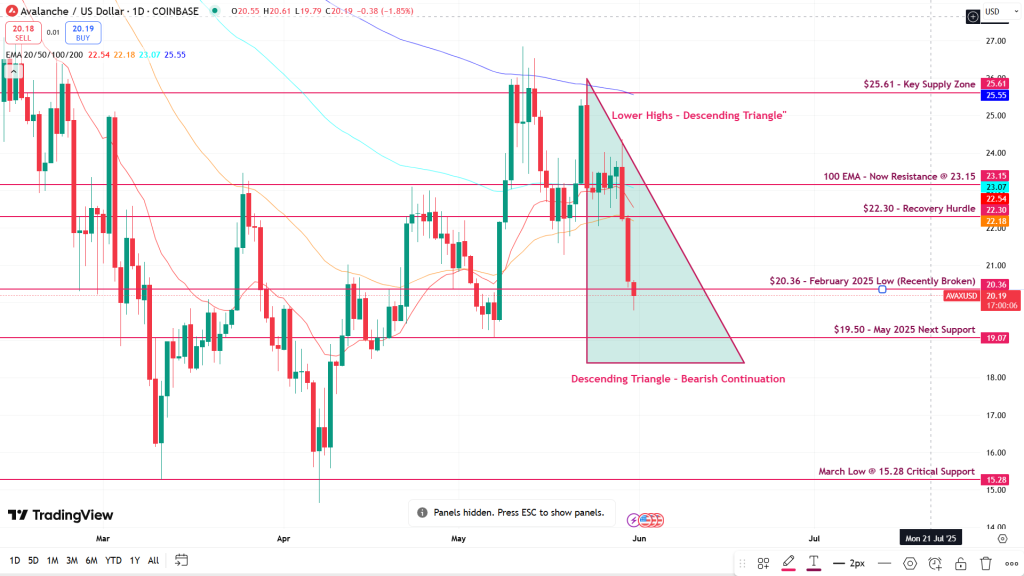

Technical Outlook: Descending Triangle Breakdown in AVAXUSD

The daily AVAXUSD chart reveals a breakdown from a descending triangle pattern. Lower highs since April were compressing toward the $21 support base, which has now given way.

The bearish continuation was confirmed by rising sell volume and failure to defend $20.50.

If $19.50 breaks, the $15.28 level becomes the next significant support. The descending triangle confirms lower highs, and unless $22.30 is reclaimed, every rally remains suspect.

Moreover, AVAX remains under all major EMAs — with the 20-day EMA at $22.55, 50-day at $22.18, 100-day at $23.15, and 200-day at $25.55 — forming a full bearish EMA stack that reinforces downside pressure.

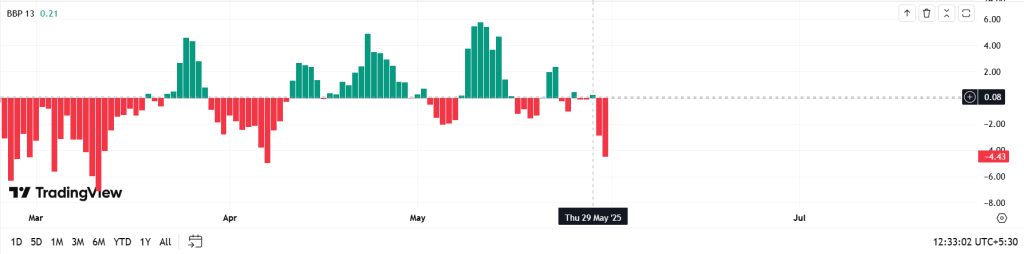

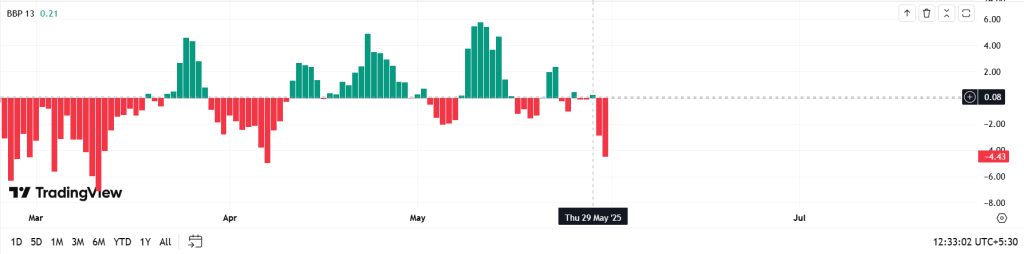

Momentum Indicators Confirm Bearish Bias

RSI is now at 39.79, showing clear bearish momentum. The MACD histogram has deepened into red territory, with both the MACD and signal lines declining further apart — strengthening the downside confirmation.

The Bull-Bear Power (BBP) indicator has dropped to -4.44, its lowest level since April. This sharp dip highlights that sellers have completely overwhelmed any bullish strength, reinforcing that the current move is not just corrective, but part of a sustained bearish trend.

On-Chain Trends Signal Persistent Weakness

Avalanche’s DeFi TVL dropped from $1.581b on May 28 to $1.473b by May 31 — a $108M erosion in three days, reflecting capital flight and reduced protocol engagement.

Exchange activity also supports the bearish case. Over May 30–31, net outflows reached $4.34M, showing consistent user exits.

More than 90% of AVAX holders are now underwater, with only 3.93% in profit. This highlights risk-off sentiment and increases the likelihood of further capitulation if support levels break.

Conclusion: Breakdown Below $20.20 Sets Up Retest of March Support

AVAX has now breached its February low and is heading toward March’s $15.28 level. This confirms a bearish structure with potential continuation unless strong buyer interest emerges.

The full bearish EMA alignment and momentum indicators continue to support downside pressure. If $19.50 fails to hold, AVAX could test $15.28 in the short term.

Given ETF delays and heavy holder losses, the bearish trend may persist well into mid-June unless market structure flips decisively bullish.