Bitcoin Cycle Theory Obsolete, TradFi Liquidity Reshapes Market

Bitcoin’s once-predictable boom-and-bust cycles are becoming increasingly irrelevant, says CryptoQuant CEO Ki Young Ju.

The sentiment comes as Bitcoin’s (BTC) price holds above the $100,000 threshold. The pioneer crypto is drawing tailwinds from institutional interest and macroeconomic tides.

Bitcoin Cycle Theory Is Obsolete, Ki Young Ju Says

CryptoQuant CEO Ki Young Ju admitted his earlier prediction that Bitcoin’s bull cycle had ended two months ago was wrong.

“Two months ago, I said the bull cycle was over, but I was wrong. Bitcoin selling pressure is easing, and massive inflows are coming through ETFs…In the past, the market was pretty simple… old whales, miners, and retail passed the bag to each other,” he wrote.

This sentiment comes as traditional finance (TradFi) players like ETFs (exchange-traded funds) and institutional investors inject new dynamics into the digital asset market. According to the CryptoQuant executive, ETFs, MicroStrategy (now Strategy), and institutions are rewriting the script.

Historically, on-chain analysts tracked miner reserves, whale movements, and retail inflows to identify cycle tops.

According to Ki, the system worked well when everyone scrambled to exit simultaneously. However, today, those indicators are blurring in relevance. Strategy alone now holds 555,450 BTC, a stake recently expanded by 1,895 BTC purchased for $180.3 million.

The firm’s Bitcoin holdings are up 50.1% due to long-term accumulation strategies and sustained institutional conviction, not because of cyclical timing.

The entry of spot Bitcoin ETFs in the US and rising allocations from global TradFi players are forcing analysts to revise their assessments of liquidity flows.

BeInCrypto also reported that US-based ETFs saw net inflows return in May, propelling Bitcoin back above $100,000. This milestone has further destabilized traditional cycle narratives, a structural shift that Ki also echoes.

“It feels like it’s time to throw out that cycle theory… Now, instead of worrying about old whales selling, it’s more important to focus on how much new liquidity is coming from institutions and ETFs,” the CryptoQuant analyst stated.

Still, Ju insists that on-chain data retains analytical value. He cites the Signal 365 MA chart as a long-term barometer. This metric tracks Bitcoin’s price deviation from its 365-day moving average.

Yet even that model, which once accurately framed cyclical extremes, now struggles amid newer variables and shows signs of recalibration.

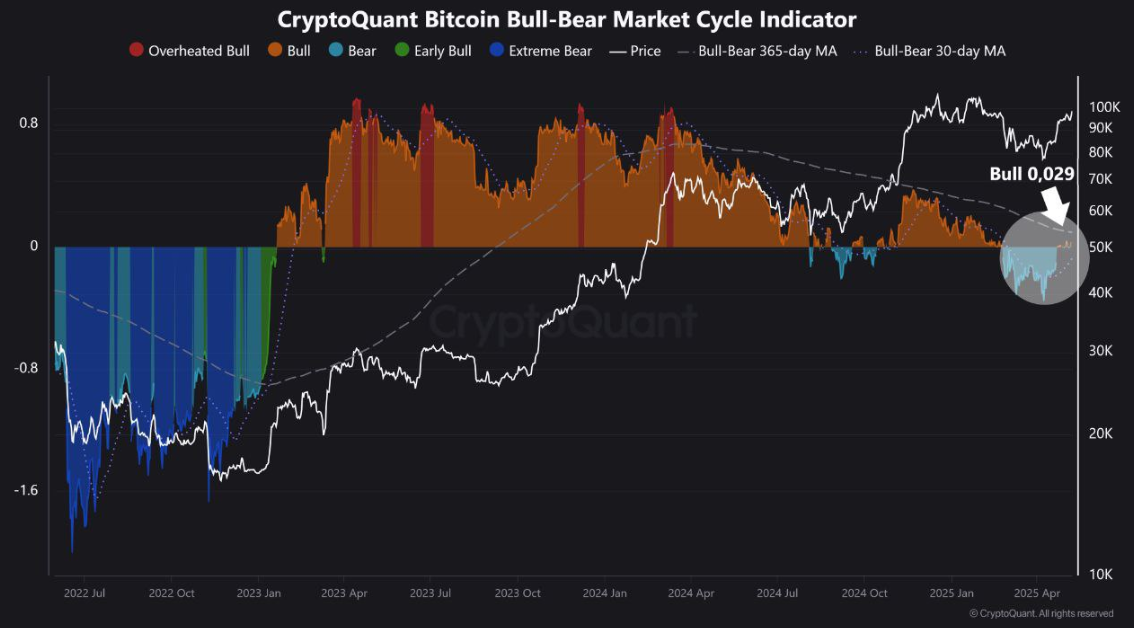

Elsewhere, analyst Kyledoops noted on X that CryptoQuant’s Bull-Bear Indicator just flipped its first bullish reading since February, albeit weakly, as BTC reclaimed $100,000.

“The 30DMA is curling up. A cross above the 365DMA has historically kicked off big runs. Might be nothing. Might be everything,” he observed.

Beyond chart signals, macro forces also accelerate Bitcoin’s fusion with TradFi. BeInCrypto reported that Bitcoin is increasingly viewed as a hedge against US Treasury risk and fiat debasement. Traditional asset management circles now echo this sentiment.

The Bitcoin market no longer fits into the old cyclical box. Analysts may be compelled to adjust their frameworks with ETF inflows, institutional reserves, and TradFi’s growing footprint.

“Just because I was wrong doesn’t mean on-chain data is useless. Data is just data, and perspectives vary. I will strive to provide higher-quality analyses in the future,” Ju concluded.

This perspective suggests that the Bitcoin market is maturing, and with TradFi progressively taking the reins, the playbook is being rewritten in real time.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.