Bitcoin ETFs Struggle with No Inflows Amid Market Pullback

Bitcoin ETFs kicked off the week in the red, with zero net inflows recorded across all funds yesterday. This marks a cautious start, as investor sentiment appears to be worsening

In the derivatives market, the king coin continues to record an increase in put contracts, aligning with a more optimistic outlook.

BTC ETFs See No Inflows as Outflows Soar

On Monday, capital exit from spot BTC ETFs surged to a seven-day high of $109.21 million. The spike comes in the aftermath of the weekend cryptocurrency market bloodbath, which triggered over $1 billion in liquidations.

According to SosoValue, Grayscale’s ETF GBTC noted the highest net outflow on Monday, totaling $74.01 million. This brings its net assets under management to $22.70 billion.

Invesco and Galaxy Digital’s BTCO followed with the second-largest daily outflow of $12.86 million. At press time, BTCO’s total historical net inflow stands at $85.32 million.

Notably, none of the twelve spot Bitcoin ETFs recorded a net inflow yesterday. This trend highlights a broad pullback in institutional interest to start the week.

BTC’s Short-Covering Rally Faces Bearish Bets in the Derivatives Market

As BTC struggles under $80,000, its trading activity continues to plummet. This is reflected in the coin’s plunging futures open interest, which stands at $50.95 billion as of this writing, noting a 2% dip over the price day.

Interestingly, BTC’s price has climbed 3% during the same period as the market attempts a recovery. When an asset’s futures open interest falls while its price rises like this, it suggests that the rally may be driven by short covering rather than fresh buying.

This signals that BTC futures traders are likely closing bearish positions, temporarily pushing the price up.

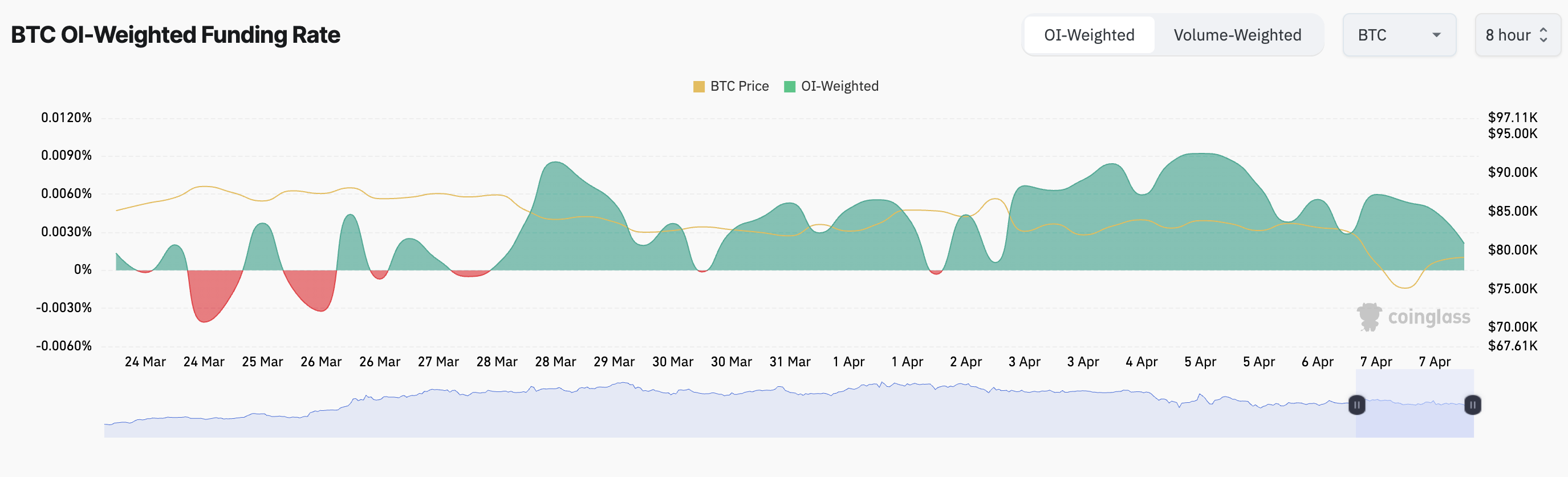

However, despite the dip in BTC’s price and open interest, the steady positive funding rate indicates that sentiment remains tilted to the bullish side. Traders are still willing to pay a premium to hold long positions, suggesting continued optimism about the coin’s near-term price trajectory.

On the derivatives side, things are not as rosy. Investors continue to open more puts contracts, further confirming the bearish outlook on the asset’s price.

This indicates that BTC traders are preparing for potential downside risk and expecting the price to fall.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.