Bitcoin No Longer a Hedge? Crypto Market Loses $1 Trillion

Once viewed as a hedge against financial uncertainty, Bitcoin (BTC) struggles to maintain this title amid global economic shifts. Its market trajectory increasingly resembles that of traditional risk assets.

Since Donald Trump’s inauguration on January 20, the crypto market has seen an unprecedented decline, erasing nearly $1 trillion in value.

Bitcoin’s Changing Role in Financial Markets

Historically, Bitcoin has been considered a hedge, moving in tandem with gold during times of uncertainty. However, this trend has reversed since President Trump took office. While gold continues to rise, Bitcoin has undergone a severe correction, suggesting a fundamental shift in market perception.

“Since Trump became president on January 20, the market has dropped from $3.7 trillion to $2.5 trillion. This is strange cause the moment Trump took office marked a local top for crypto Even though he is the most pro-crypto president ever,” noted crypto analyst Symbiote.

One key factor in this change is Bitcoin’s growing correlation with traditional financial assets. In 2024, BTC moved in synchrony with the Nasdaq 100 and S&P 500 approximately 88% of the time, a stark contrast from its earlier role as a negative-correlated asset.

Now, the 30-day rolling correlation has dropped to around 40%. This suggests Bitcoin is now trading more like a high-risk technology stock than a hedge against inflation or economic turmoil.

Liquidity is another major concern. Since 2020, financial markets have been pricing in reduced liquidity, a trend severely affecting crypto. Market watchers note that liquidity flows back into the US dollar, which was historically the most stable asset during trade wars.

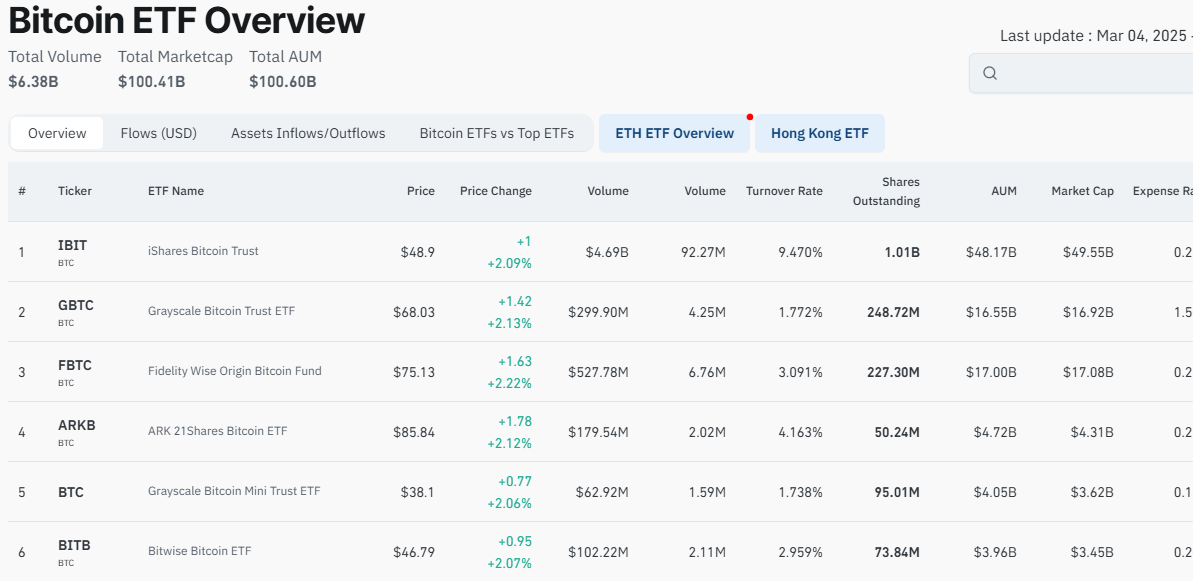

This shift has resulted in repeated flash crashes in crypto markets, increasing volatility and investor uncertainty. Coinglass data supports this trend, showing that Bitcoin ETF (Exchange-Traded Funds) assets under management (AUM) have dropped from $120 billion to $100 billion in weeks.

Additionally, decentralized finance (DeFi) has taken a hit. Data on DefiLlama shows the total locked value (TVL) dropping from the 2025 peak of $128.7 billion to $93.2 billion as of this writing. The decline signals a broad loss of confidence in crypto’s ability to provide financial stability during economic uncertainty.

Trump’s Trade War Fears Weigh on Crypto Sentiment

A recent Bank of America survey highlights growing fears about global trade wars. Specifically, 42% of respondents identified it as the most bearish development for risk assets in 2025, up from 30% in January.

“When asked which global development would be seen as the most bearish for risk assets in 2025, 42% said a global trade war, primarily due to the new Trump administration’s threats of new tariffs. That response is up from 30% that replied in January that a global trade war would be the most bearish,” Pensions & Investments reported.

Notably, only 3% of respondents believe Bitcoin would perform best in a full-blown trade war, starkly contrasting gold and the US dollar. These findings highlight a critical shift in perception—markets no longer see Bitcoin as a hedge in times of economic strife.

The pioneer crypto, which thrived during geopolitical instability, is now seen as too volatile to offer meaningful protection against financial shocks.

Furthermore, Goldman Sachs’ volatility panic index has surged from 1.4 in December to over 9.1, with expectations of even greater swings ahead. The Kobeissi Letter, a widely followed financial news source, suggests that Bitcoin’s price action will likely remain turbulent as trade war fears intensify.

Is There Hope for Bitcoin’s Revival? Experts Weigh In

Despite the bearish sentiment, some experts argue that Bitcoin still holds long-term potential. BeInCrypto recently reported how Bitcoin could serve as America’s financial lifeline amid soaring national debt. By embracing digital assets as part of a broader economic strategy, the US could leverage Bitcoin’s decentralized nature to maintain financial resilience.

“You can buy Bitcoin though as a way to vote with your dollars, send a clear message, and potentially even save the US long term. A return to the gold standard,” Coinbase CEO Brian Armstrong said.

Additionally, Bitcoin’s ability to provide liquidity to struggling companies remains a strong argument in its favor. BeInCrypto highlighted how firms looking to boost their stock performance have increasingly turned to Bitcoin as an alternative asset.

“We have a nice core business, but it’s too small to be relevant to the capital markets. I think as we start investing more into our Bitcoin treasury strategy, we’ll be able to create more liquidity in our stock and attract investors,” Bloomberg reported, citing Goodfood CEO Jonathan Ferrari.

If corporate adoption continues to grow, Bitcoin could regain its position as a critical financial tool rather than just another risk asset. Nevertheless, one idea is proving apparent: Bitcoin’s role in global finance is changing.

“I get the rationale for a Bitcoin reserve. I do not agree with it, but I get it. We have a gold reserve. Bitcoin is digital gold, which is better than analog gold,” BTC critic Peter Schiff admitted recently.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.