Bitcoin Peaks at New ATH, $110,000 Emerges as Key Zone

Bitcoin (BTC) broke above a new all-time high of $109,000 before facing sharp resistance and pulling back. The quick reversal underscored the psychological weight of the $110,000 level, which now stands as a key hurdle for bulls.

Despite the rejection, whale accumulation has quietly increased, signaling that large holders may be positioning for another leg up. Combined with bullish Ichimoku Cloud signals, BTC appears to be building a technical foundation—though follow-through above resistance remains essential.

Whale Activity Picks Up: What 2,019 Large BTC Holders Could Mean for the Market

The number of Bitcoin whales—wallets holding between 1,000 and 10,000 BTC—increased from 2,007 to 2,021 between May 13 and May 19, before slightly dipping to 2,019 yesterday.

While the net change is small, the upward movement suggests renewed accumulation among large holders during the recent price range. Fluctuations in this metric often reflect shifts in institutional or high-net-worth investor sentiment, making it a critical signal for broader market trends.

Even a modest rise in whale addresses can indicate growing confidence, particularly during uncertain or consolidating price action.

Tracking Bitcoin whales is important because these entities have enough capital to influence the market significantly.

Their behavior often precedes major price movements, either by providing liquidity support during pullbacks or driving rallies through large-scale accumulation.

The current whale count suggests underlying support, with large holders either positioning for a breakout or reinforcing long-term conviction. If this trend of accumulation holds or resumes, it could signal a bullish foundation forming beneath the surface, even if price remains range-bound in the short term.

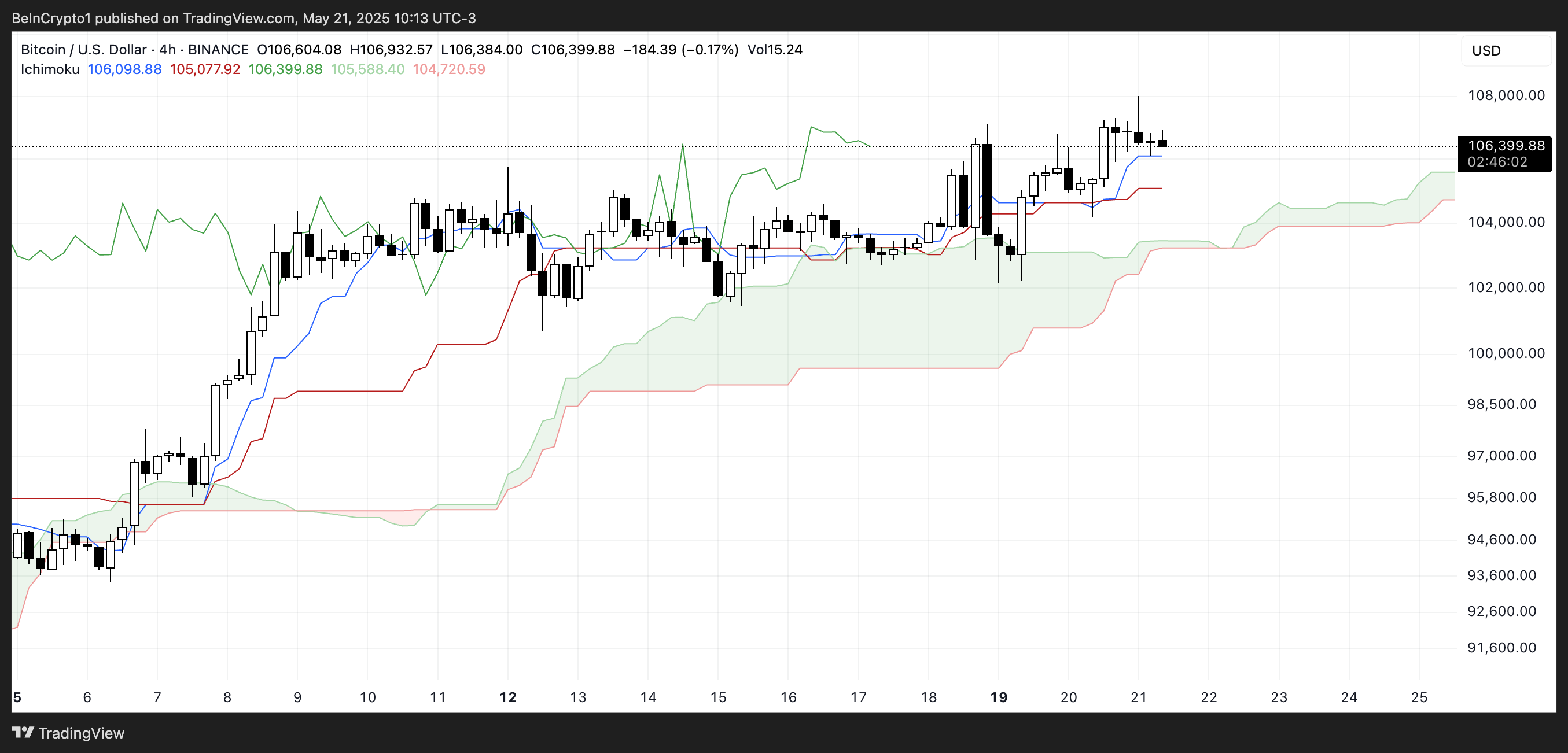

Bitcoin’s Ichimoku Cloud Flashes Bullish Continuation Signal

Bitcoin’s Ichimoku Cloud structure remains strongly bullish. The price is positioned well above the cloud, which is thick and green—indicating solid support and a continuation of the upward trend.

The Leading Span A (the upper edge of the cloud) is climbing above Leading Span B, confirming a positive momentum outlook.

This upward-sloping cloud suggests that the bulls are in control and the path of least resistance is still to the upside.

The Tenkan-sen (blue line) is above the Kijun-sen (red line), maintaining a healthy bullish spread between the two. This alignment is a classic confirmation of short-term bullish strength.

Meanwhile, the Chikou Span (green lagging line) is well above the price candles, reinforcing the trend from a historical perspective.

As long as price remains above the blue and red lines—and the cloud remains supportive—the bullish scenario is likely to continue building strength.

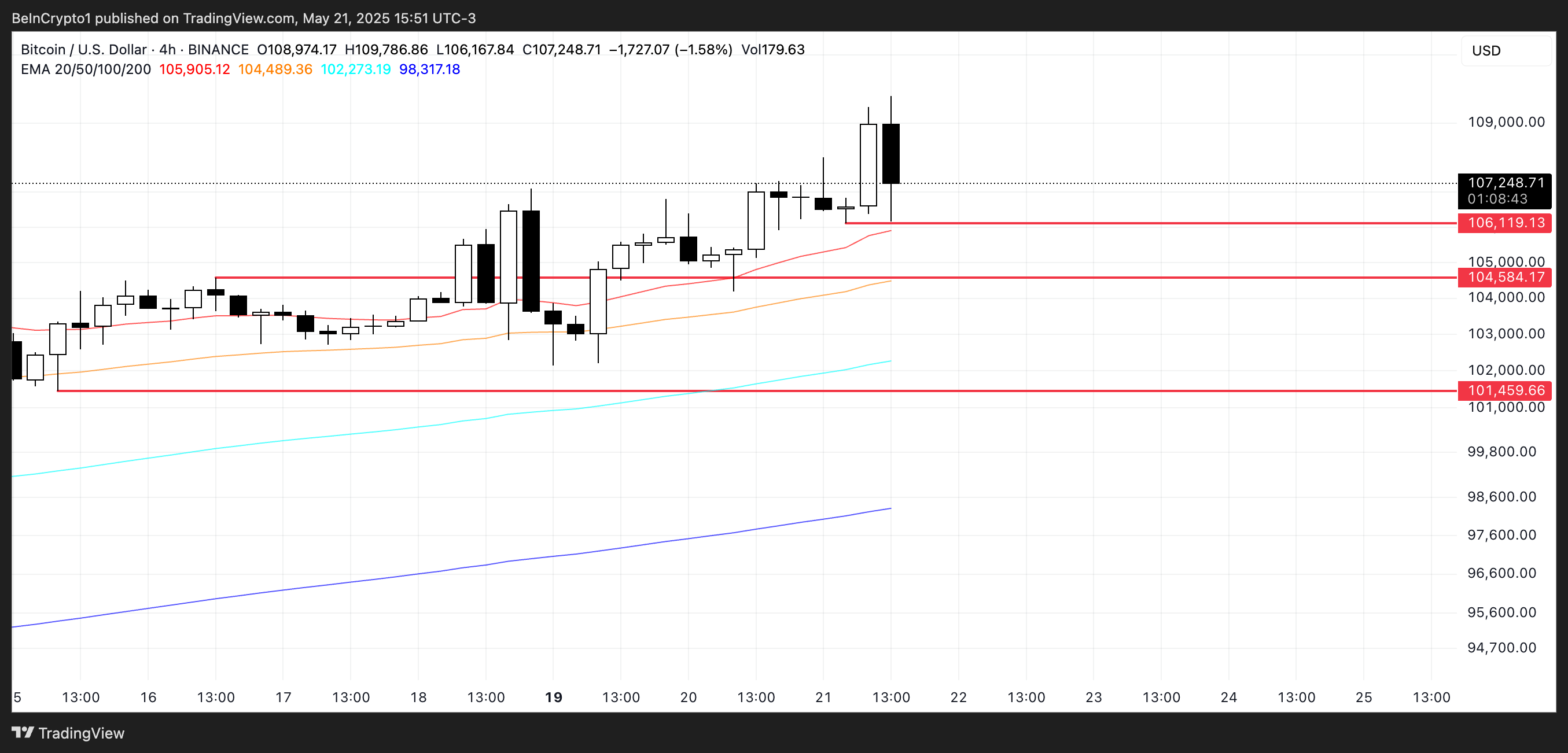

BTC Pulls Back After $109K Breakout — Will $106K Hold?

Bitcoin briefly surged to a new all-time high above $109,000, but the breakout was quickly met with resistance.

The price retraced over 3% after touching the milestone, signaling that the $110,000 level is acting as a critical psychological and technical barrier.

This pullback highlights how future bullish momentum may hinge on BTC’s price ability to firmly close above that threshold. Until that happens, price action could remain choppy or range-bound near current levels.

On the downside, Bitcoin’s nearest support lies around the $106,119 zone. If that level fails to hold, it may trigger a deeper correction toward the next support near $104,584.

A stronger bearish shift could open the door to a larger retracement toward the $101,549 area.

Overall, the recent rejection suggests bulls still need stronger follow-through to flip key resistances into support and sustain the uptrend.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.