Bitcoin Poised for Summer Rally as Gold Leads and Liquidity Peaks

The crypto market and broader economy are moving fast as global liquidity reached an all-time high in April 2025. Gold has already broken past $3,200, setting a new record. Meanwhile, Bitcoin is still 30% below its previous peak.

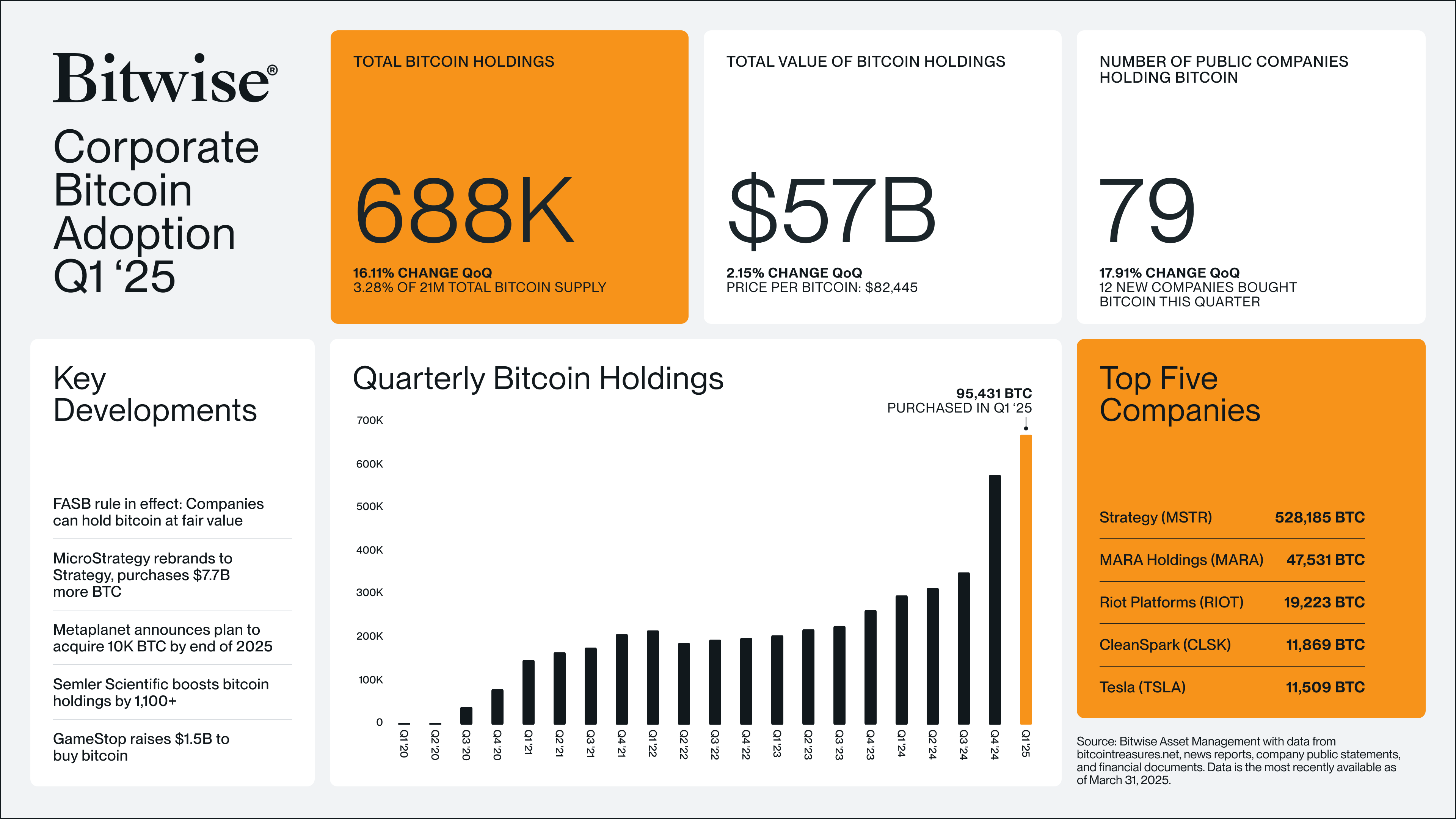

Amid this backdrop, analysts are taking a closer look at the link between Bitcoin and gold. Fresh data also shows strong corporate demand for Bitcoin, with record levels of buying in Q1 2025.

What Bitcoin’s Ties to Gold and Liquidity Signal for Its Price

According to Joe Consorti, Head of Growth at Theya, Bitcoin tends to follow gold’s lead with a lag of about 100 to 150 days. A chart shared by Consorti on X, based on Bloomberg data, illustrates this trend from 2019 to April 14, 2025.

The chart shows gold (XAU/USD) in white and Bitcoin (XBT/USD) in orange. The data reveals that gold usually moves first during upswings, but Bitcoin often rallies harder afterward—especially when global liquidity is rising.

“When the printer roars to life, gold sniffs it out first, then Bitcoin follows harder,” Consorti said.

That 100-to-150-day lag is notable. It suggests Bitcoin could be set for a sharp move higher within the next 3 to 4 months. The recent surge in global liquidity also supports this view.

According to analyst Root, M2 money supply from major central banks—including the US Federal Reserve, European Central Bank (ECB), People’s Bank of China (PBoC), Bank of Japan (BoJ), Bank of England (BoE), Reserve Bank of Australia (RBA), Bank of Canada (BoC), and others—has hit a record high as of April 2025.

The sharp rise points to more cash flowing through the global economy.

Historically, Bitcoin bull markets have often lined up with major increases in global liquidity, as more money in the system tends to push investors toward riskier assets like Bitcoin.

Why Bitcoin Might Outperform Gold and Stocks

Matt Hougan, Chief Investment Officer at Bitwise Invest, states that Bitcoin is not just outperforming gold but is also surpassing the S&P 500 in the long run. This indicates that Bitcoin is becoming a stronger investment option despite its price volatility.

Data also supports this. A recent Bitwise report shows corporations bought over 95,400 BTC in Q1—about 0.5% of all Bitcoin in circulation. That makes it the largest quarter for corporate accumulation on record.

“People want to own Bitcoin. Corporations do too. 95,000 BTC purchased in Q1,” Bitwise CEO Hunter Horsley said.

With rising corporate demand and Bitcoin’s strong performance against traditional assets, the stage may be set for a major rally in summer 2025—driven by peak global liquidity and Bitcoin’s historic tendency to follow gold’s lead.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.