Bitcoin Price Prediction: U.S. vs China Crypto Race Heats Up – What Comes Next for BTC?

Bitcoin (BTC/USD) is trading around $99,536, reflecting the growing competition between U.S. and Chinese crypto ambitions. As the world’s two largest economies push for digital asset dominance, BTC’s market dynamics are becoming increasingly complex.

U.S. Regulatory Push for Crypto Dominance; Bitcoin Gains

U.S. Treasury Secretary Scott Bessent recently added fuel to this debate during a House Financial Services Committee hearing on May 7. Bessent emphasized that the U.S. should be the “premier destination for digital assets” and backed two major crypto bills moving through Congress:

Bessent emphasized that the U.S. should be the “premier destination for digital assets” and argued that a robust market structure, coupled with stablecoin legislation, could help achieve this goal.

This position aligns with previous statements from President Donald Trump, who has repeatedly advocated for making the U.S. the global hub for digital assets.

Key legislative efforts include:

- Digital Asset Market Structure Bill: Drafted by House Republicans, this bill aims to establish clear trading and custody guidelines for digital assets. It seeks to reduce regulatory uncertainty and boost institutional investment in cryptocurrencies like BTC.

- GENIUS Stablecoin Bill: Set for a Senate vote on May 8, this legislation targets stablecoin regulation, focusing on transparency and security. It aims to ensure that stablecoins, critical to crypto liquidity, have strong backing and oversight.

Political Divides Over Crypto Legislation; Impact on Bitcoin

Despite strong Republican support, resistance remains. On May 6, nine Senate Democrats announced their opposition to the GENIUS stablecoin bill, citing concerns over Anti-Money Laundering (AML) risks and potential foreign influence.

This ongoing debate could create near-term uncertainty for Bitcoin, potentially slowing institutional inflows until clearer regulations emerge.

Key concerns include:

- AML and National Security: Some lawmakers argue the bill lacks sufficient safeguards against money laundering and foreign interference, which could expose the U.S. financial system to higher risks.

- Potential Conflicts of Interest: Critics have raised questions about the influence of major crypto holders on U.S. policy, particularly following Trump’s recent dinner for top memecoin investors.

As lawmakers weigh the risks and benefits of expanded digital asset adoption, the outcome could significantly impact Bitcoin’s long-term price stability and institutional appeal.

Bitcoin Technical Analysis: Key Levels to Watch

Bitcoin is currently trading around $99,536, nearing the critical 1.414 Fibonacci extension level at $99,824, a key resistance area.

A breakout above this level could open the path to the 1.618 Fibonacci extension at $100,756, potentially pushing BTC toward the psychologically significant $102,501 mark.

Key Technical Indicators:

- 50-Day EMA: Bitcoin remains well above the 50-day Exponential Moving Average (EMA) at $95,715, signaling strong bullish momentum.

- MACD: The MACD histogram is in positive territory, supporting a bullish outlook, with the signal line also pointing upward, indicating continued buying interest.

Trade Setup:

- Buy Above: $99,824 (on strong volume)

- Take Profit: $102,501 (next key resistance)

- Stop Loss: $97,932 (recent support)

This setup aims to capture potential upside while managing downside risk if the breakout attempt fails. Traders should watch for sustained volume and momentum as BTC approaches the critical $100K level.

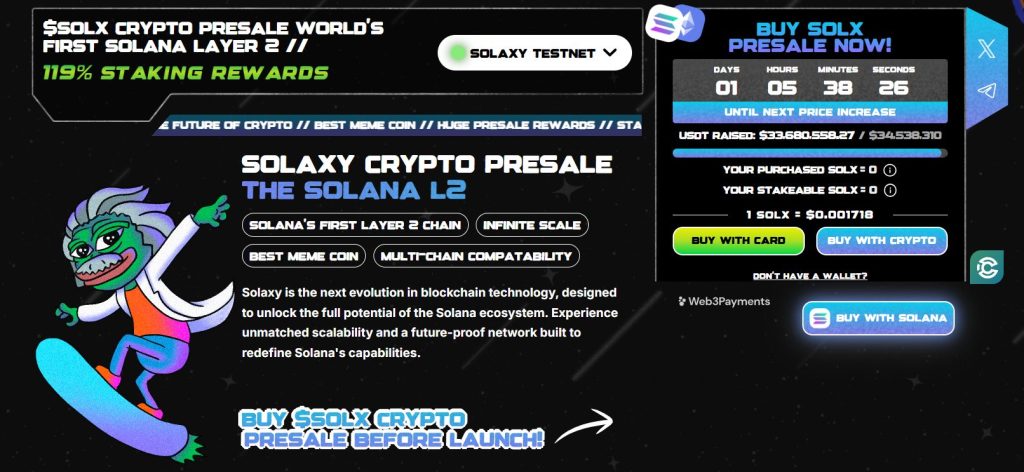

Solana’s First L2? Solaxy Hits $33.68M as Presale Nears Milestone

Solaxy (SOLX) is positioning itself as Solana’s first major Layer-2 protocol, addressing critical scalability gaps in a network often challenged by sudden surges in meme coin trading. Unlike typical projects, Solaxy aims to deliver real throughput upgrades through off-chain processing, reduced congestion, and significantly lower transaction fees.

Key Features of Solaxy (SOLX)

- Optimized Scalability – Off-chain processing reduces mainnet congestion and speeds up transactions.

- Cross-Chain Flexibility – Bridge to Ethereum for seamless multi-chain asset transfers.

- Low-Cost Transactions – Bundled transactions reduce fees, making micro-payments more practical.

- High Yield Staking – Earn up to 119% annual returns by staking SOLX.

- Strong Community – Over 60,000 followers on X and a growing Telegram user base.

Presale Progress and Current Price

The Solaxy presale has now crossed $33,679,156.62 out of its $34,538,310 goal, reflecting strong early demand. Currently priced at $0.001718 per SOLX, the token has seen steady appreciation from its starting price of $0.0016.

Security and Trust

Solaxy’s smart contracts have been fully audited by Coinsult, helping establish baseline trust as interest builds. With 9,631,719,101 SOLX tokens already staked, the project is gaining traction as a scalable, multi-chain infrastructure layer for decentralized applications.

The post Bitcoin Price Prediction: U.S. vs China Crypto Race Heats Up – What Comes Next for BTC? appeared first on Cryptonews.