Breakout to $3,000 or Breakdown to $2,200?

Ethereum price has been range-bound near the $2,650 level after a strong 45% monthly rally. As of press time, ETH is trading at $2,631, down 3.79% in the past 24 hours, suggesting short-term selling pressure. But beneath the surface lies a classic technical setup that could decide the next big move to its resistance around $2,700–$2,800.

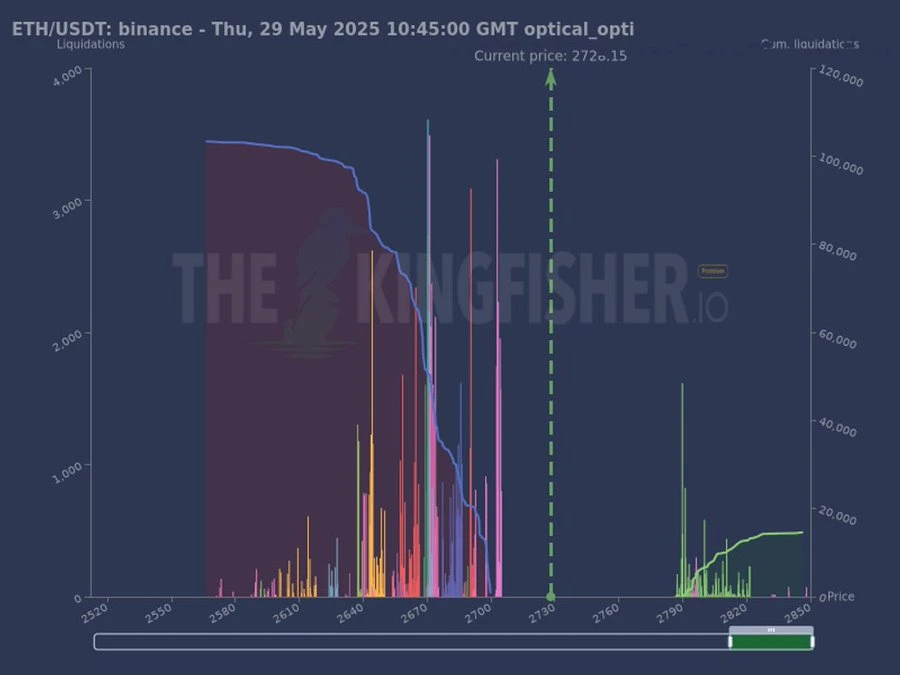

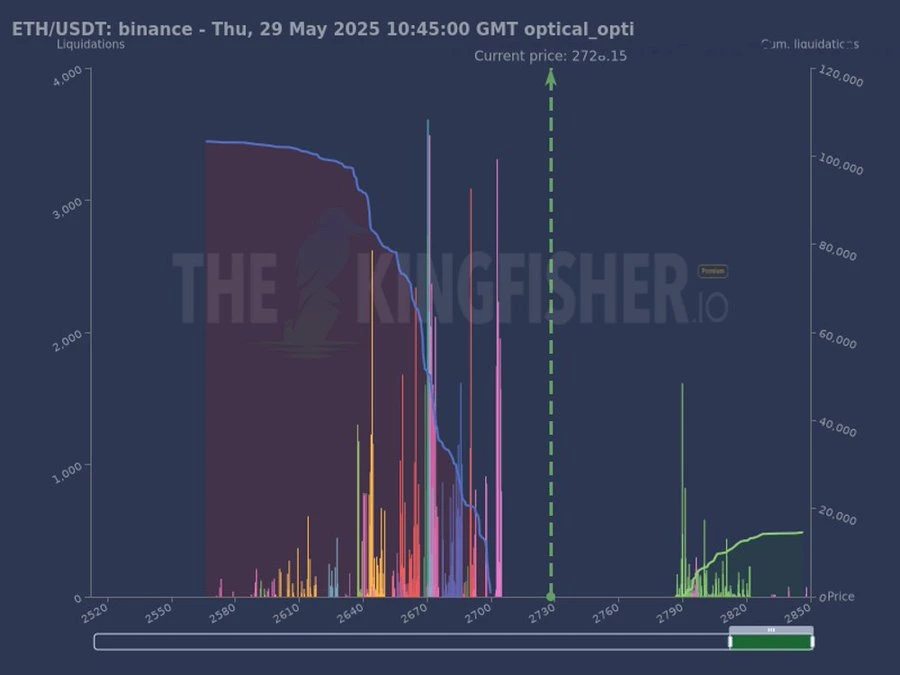

Liquidation Cluster: A Trouble or an Opportunity?

According to a post analyst, “The Kingfisher”, there’s a significant concentration of long liquidations between $2,600 and $2,700. This creates a liquidity “magnet” meaning, if ETH dips into this zone, we could see a domino effect of liquidations. With price currently near $2,631, ETH is closer to is crucial zone.

The thesis highlights that the short liquidations above are comparatively light. This asymmetry suggests a steeper downside risk, especially if market sentiment flips bearish. A slip could trigger a flush toward $2,510, or even $2,319 if panic sets in.

Ethereum (ETH) Price Analysis:

Ethereum’s 1-D chart shows an ascending triangle, a bullish continuation pattern, with resistance holding near $2,800. A strong daily close above $2,800 would confirm the triangle breakout. In that case, ETH could rise above the $3,000 psychological resistance to surge toward $3,100–$3,300, backed by short squeezes and breakout momentum.

Conversely, If ETH fails to break out and drops below $2,510, it would invalidate the bullish pattern. A further breakdown below $2,320 would open the gates to $2,200, where the next major support lies.

Read our Ethereum (ETH) Price Prediction 2025, 2026-2030 for long-term targets!

FAQs

Ethereum price today is at $2,631.27 with a daily change of -3.79%.

Key levels include $2,800 for a bullish breakout, $2,510 for a bearish bias, and $2,319 for confirmation of a steeper correction.

If you’re a long-term investor, accumulation on dips within the $2,400–$2,500 range may offer value. Short-term traders should wait for a breakout above $2,800 or a breakdown below $2,510 for clearer signals.