Cardano (ADA) Price Prediction for March 1, 2025

While the crypto market sees a broad recovery, Cardano (ADA) remains stuck below a key resistance. As of today, March 1, 2025, ADA has gained 2% and is currently trading near $0.63, fluctuating within a tight range between $0.625 and $0.64.

Cardano (ADA) Short-Term Price Analysis

With modest upside momentum, ADA is still trading below its key level of $0.65. Over the past 24 hours, the price attempted to rally but failed to gain traction. According to expert technical analysis, ADA remains in a bearish zone, continuing to trade below the critical $0.65 level.

Despite these factors, if the asset breaks out of its ongoing consolidation and closes four consecutive candles above $0.6425, there is a strong possibility it could soar by 5.50%, reaching the $0.67 level.

Additionally, if the asset fails to breach the upper boundary of consolidation and closes a daily candle below the $0.62 mark, ADA could see a 7% price drop to $0.58, with the potential for further decline.

Bullish On-Chain Metrics

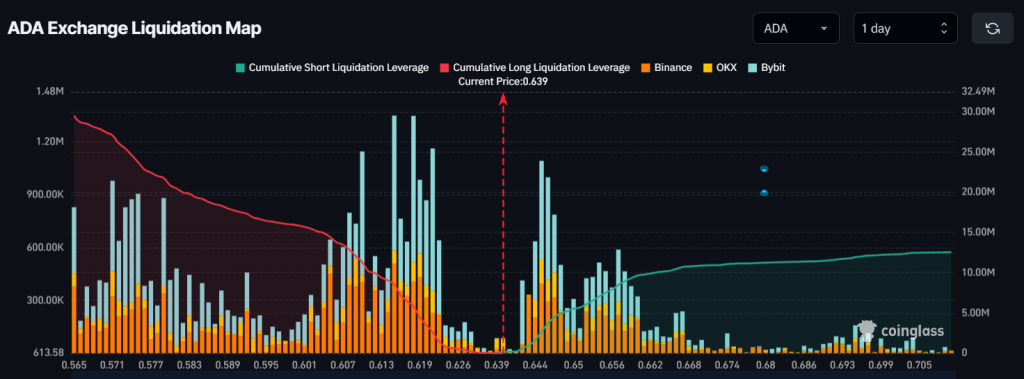

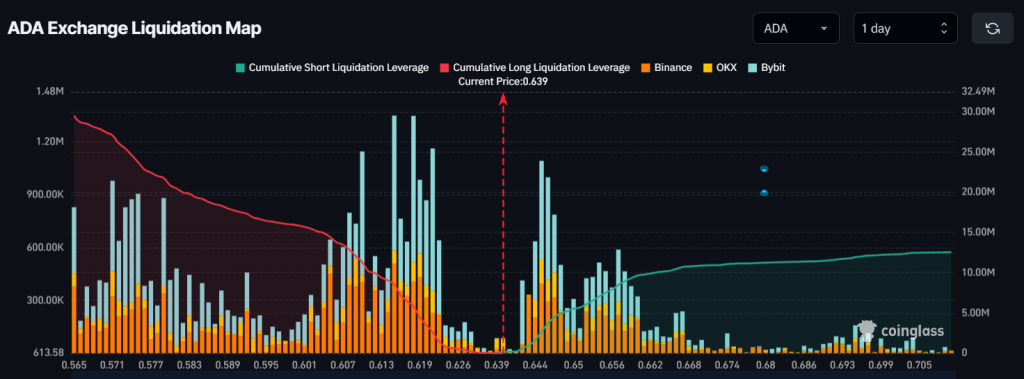

Looking at the current market sentiment, it appears that bulls are returning to support the asset. Amid this, traders and investors have been engaging in bullish activity, as reported by the on-chain analytics firm Coinglass.

Over-Leveraged Levels

Data from Coinglass reveals that ADA traders betting on long positions are over-leveraged at $0.618, holding $5.90 million worth of long positions. Meanwhile, $0.645 is another over-leveraged level, where traders betting on short positions have built $3.67 million worth of positions.

When combining these on-chain metrics, it appears that a shift in market sentiment has begun. This notable participation on the bullish side could push ADA in an upward direction.

$14.65 Million Worth of ADA Outflow

Meanwhile, investors and long-term holders have been accumulating tokens during the same period, as reported by the on-chain analytics firm Coinglass. Data from spot inflow/outflow reveals that exchanges have witnessed a significant outflow of $14.65 million worth of ADA tokens.

When examining these on-chain metrics alongside technical analysis, it appears that investors and traders are driving the asset toward a rally, aiming to regain the crucial $0.65 level.