Cardano Founder Draws Line In The Sand–’I’ll Retire If This Fails’

Charles Hoskinson has delivered his sharpest ultimatum yet to the Cardano community, telling viewers of a June 16 white-board livestream that he will “simply retire” if the network rejects his plan to overhaul its 1.7 billion ADA treasury—now worth about US $1.1 billion at the current spot price of roughly $0.64 per ADA—into an actively managed, multi-asset sovereign wealth fund.

Cardano At A Crossroads

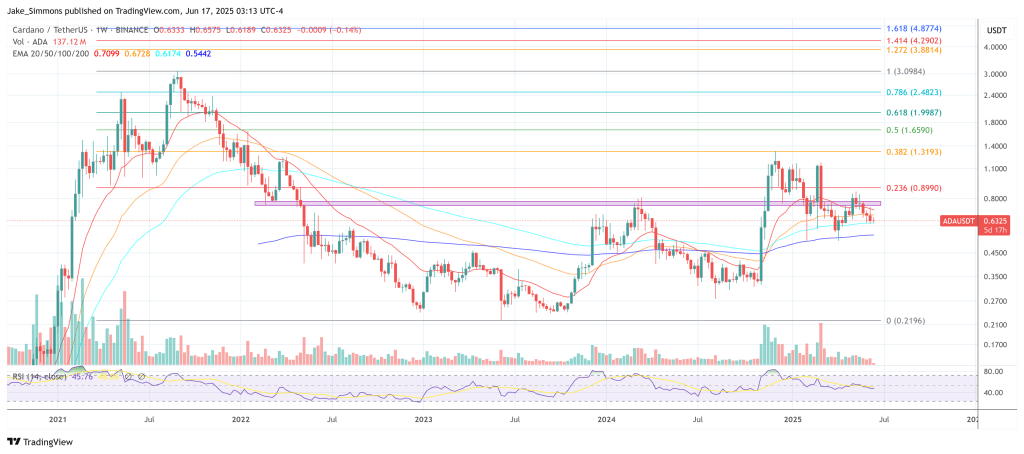

Hoskinson opened with a stark assessment: the on-chain treasury—about 1.7 billion ADA, worth roughly $680 million at current market prices—remains a “passive, single-asset, unmanaged” pool whose purchasing power collapsed when ADA fell from its 2021 peak near $3 to last year’s $0.25 lows. “If ADA collapses, you lose enormous amounts of your spending power,” he warned, contrasting today’s diminished war-chest with the “almost five billion dollars of buying power” the treasury briefly commanded during the last bull run.

Hoskinson’s remedy is the same sovereign-wealth-fund architecture he first floated a week ago, but this time the IOG chief drilled into mechanics—divesting up to 100 million ADA into cash via OTC “iceberging,” redeploying proceeds across Bitcoin, asset-backed and algorithmic stablecoins, and real-world-asset yield strategies, then recycling profits back into ADA or further investments. The structure would sit under a Wyoming DAO that owns an offshore vehicle in BVI or Cayman, employing professional asset managers and subject to an elected, audited governing board.

What rendered the session extraordinary—and electrified social channels—was Hoskinson’s tone. He confessed to being “thoroughly tired” of “paralysis analysis” and vitriol on X , declaring: “I’m not going to cuddle people anymore… I’m going to tell you in a frank, adult way what we need to do.”

Then came the ultimatum: “Our burden is to submit a governance action and you get to decide. […] It’ll become very clear to me if I share ideas and they don’t get adopted that the ecosystem has lost confidence in my ability to lead, in the ideas that I bring to the table. In which case I don’t provide value to the ecosystem and I’ll just simply retire. If you adopt the ideas and they’re successful, well then I’ll stay. If you adopt the ideas and they fail, obviously I have bad ideas. There’s no ego in that. That’s just objective reality. And that’s where we’re at.”

Hoskinson further alluded to the recent fraud allegation and the conflict with the Cardano Foundation. Clearly emotional, he continued: “I again wish I could be nicer, but again, rubicons were crossed, things were done, and wounds will never heal because of what’s been said and done. And I am thoroughly tired of the current paralysis analysis that we’re stuck in.”

He warned the Cardano community that the ecosystem still has a lot of catching up to do in many areas compared to its competitors, and that this will only be possible with a functional treasury. “We are not the market leader. Even though we enjoy technological superiority, we currently do not have a fully functioning governance superiority, nor do we have the investment momentum necessary to go to number one. Now, with good strategy, good governance, and decisive action, we can grow every year and get into a very strong position. But we have to act.”

Mechanics Of The Cardano Sovereign Wealth Fund

Hoskinson argued that the proposed fund could “prime the pump” by seeding both Cardano-native stablecoin issuers (USDM, USDA) and Bitcoin DeFi protocols, using treasury-owned BTC to entice liquidity from the world’s largest crypto asset. “The headline that Cardano takes a position in Bitcoin as an ecosystem is a very powerful one,” he said, hinting at cross-chain partnerships and on-chain fee capture that would ultimately flow back to ADA holders.

Critics inside Cardano have voiced fears that off-loading nine-figure ADA tranches could crater the token’s price or saddle the DAO with Wall Street-style fees. Hoskinson countered both points. First, he cited OTC liquidity data, noting “billions and billions of dollars of divestments” have already been absorbed during past sell-offs without existential damage. Second, he framed manager fees—“25 to 100 bps”—as standard in an industry that already services MicroStrategy, Grayscale and BlackRock-sized allocations.

To insulate the treasury from mismanagement, the DAO’s elected board would control asset-manager mandates, while an independent audit layer would “verify that everything that’s happening in this structure is correct.” A built-in “rip-cord” would allow Cardano Governance to liquidate positions back into ADA if strategies sour.

A formal governance action is expected to surface at Rare Evo in Denver this August, giving ADA voters the first opportunity to bless or reject the framework. Hoskinson made it clear that his future rests on the outcome: “If you adopt the ideas and they’re successful, then I stay… If not, I’ll retire.”

For an ecosystem that has long prided itself on measured, peer-reviewed progress, the founder’s demand for decisive action—and his threat to walk away—marks a pivotal moment. Whether Cardano embraces an active sovereign wealth fund or clings to its passive reserves may dictate not only the chain’s DeFi prospects but also the role Hoskinson plays in the project he created eight years ago.

At press time, ADA traded at $0.63.