China’s Robot Dog Lead Could Outpace US Humanoid Efforts: ‘A Hole In Tesla, Figure And Apptronik’s Portfolio,’ Says Analyst – Invesco QQQ Trust, Series 1 (NASDAQ:QQQ), SPDR S&P 500 (ARCA:SPY)

Chinese robotics company, Unitree, sold 23,700 robot dogs or quadrupeds last year, and an ARK Invest analyst explains how these fleets could provide strategically valuable data for humanoid robot programs, thus putting China ahead of the U.S. in this arena.

What Happened: Brett Winton, the chief futurist at ARK Invest, highlights a strategic gap in U.S. humanoid robot programs that could affect companies like Elon Musk‘s Tesla Inc. TSLA, Figure AI, and Apptronik Inc.

According to him, the sale of these quadrupeds or robot dogs provides a data advantage to the seller to learn more about the bipedal or humanoid robot’s behavior on the road.

“This is conditioned on the idea that you can release quadrupeds at a lower price point and sell in a larger volume (than you can vehicles), so you could get a data domain that is a closer match to bipedal,” he explains.

He highlights that the data could help the humanoid robots to navigate in buildings, narrow walkways, and uneven terrain.

“Given the choice a humanoid AI team would almost certainly prefer data from 3 million robospots than 3 million robotaxis (though a mix would be even better),” stated Winton.

He explains this by highlighting that the Chinese Unitree Robotics sold 23,700 units in 2024, priced at $2,700; however, the U.S.-based Boston Dynamics’ Spot is priced at $74,500.

Thus, this enables the Chinese firm to have higher sales volumes and more real-world data collection, which Winton argues is more valuable for training humanoid AI.

“Quadruped fleets should provide strategically valuable data for humanoid robot programs. (A hole in Tesla, Figure, and Apptronik’s portfolio),” he adds.

See Also: S&P 500’s Expensive Valuation Combined With All-Time High Household Holdings: A Look At Where US Stock Market Stands

Why It Matters: A recent Reuters report shows that Ray Kurzweil, the AI futurist best known for predicting the rise of the singularity, secured a $100 million investment from Gauntlet Ventures in a Series B round for its startup Beyond Imagination, pushing its valuation to $500 million.

Meanwhile, Tesla was also making significant strides in humanoid robotics as Musk revealed last week that the company’s Optimus robot is developing the ability to learn tasks by watching videos, similar to human learning patterns.

However, Tesla’s production is taking a hit due to new Chinese export restrictions on rare earth magnets, key components for Optimus actuators, as revealed by Musk during their first-quarter earnings call.

Price Action: Tesla shares rose 6.94% on Tuesday and advanced 1.26% in after-hours. It was -4.32% lower on a year-to-date basis but up 105.31% over a year.

Benzinga Edge Stock Rankings shows that Tesla had a stronger price trend over the short, medium, and long term. Its momentum ranking was solid, and its value ranking was poor at the 8.69th percentile. The details of other metrics are available here.

The SPDR S&P 500 ETF Trust SPY and Invesco QQQ Trust ETF QQQ, which track the S&P 500 index and Nasdaq 100 index, respectively, rose on Tuesday. The SPY was up 2.08% to $591.15, while the QQQ advanced 2.35% to $521.22, according to Benzinga Pro data.

The futures of the S&P 500, Dow Jones and Nasdaq 100 indices were trading lower on Wednesday.

Read Next:

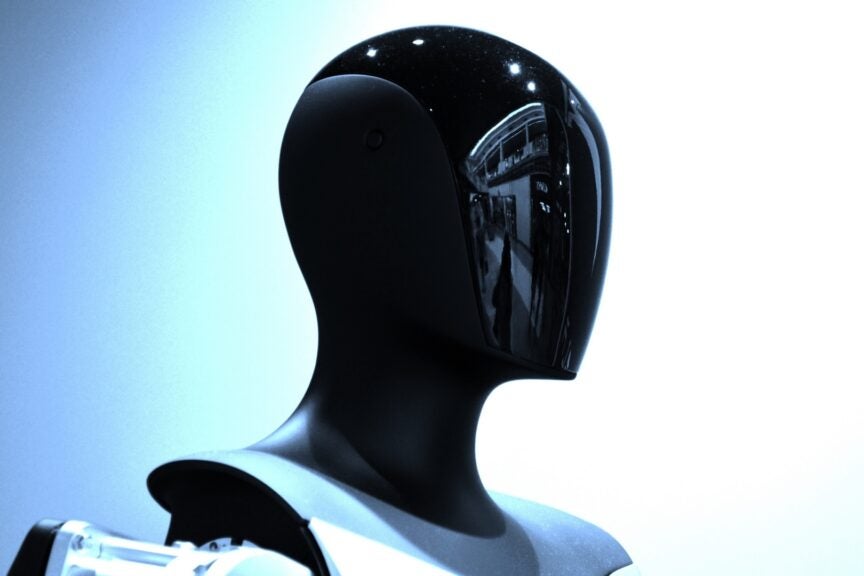

Photo courtesy: Shutterstock