Coinbase Premium Rises, Bitcoin to New ATH?

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee for insight into the current Bitcoin (BTC) price outlook. The pioneer crypto is steadily approaching its all-time high (ATH) recorded on May 22, 2025. Will Bitcoin record a new ATH anytime soon? Read on for more insights.

Crypto News of the Day: US Investors Push Bitcoin Towards New ATH

Bitcoin price is attempting to retake its ATH of $111,980. BeInCrypto reported that BTC’s latest run draws tailwinds from progress in the US-China trade talks and perceived truce between President Donald Trump and Elon Musk.

“BTC led a euphoric surge overnight, rallying from $107K to above $110K, as US-China trade talks resumed in London. The move was initially driven by optimism following headlines suggesting progress, though market enthusiasm quickly waned,” QCP analysts wrote.

Against this backdrop, investor sentiment has flipped from fear to greed, with traders interpreting both developments as a stabilizing force amid broader volatility.

However, amid rising greed and optimism, on-chain analyst and CryptoQuant Korea Community Manager Crypto Dan highlights the role of US investors in driving the surge in Bitcoin price.

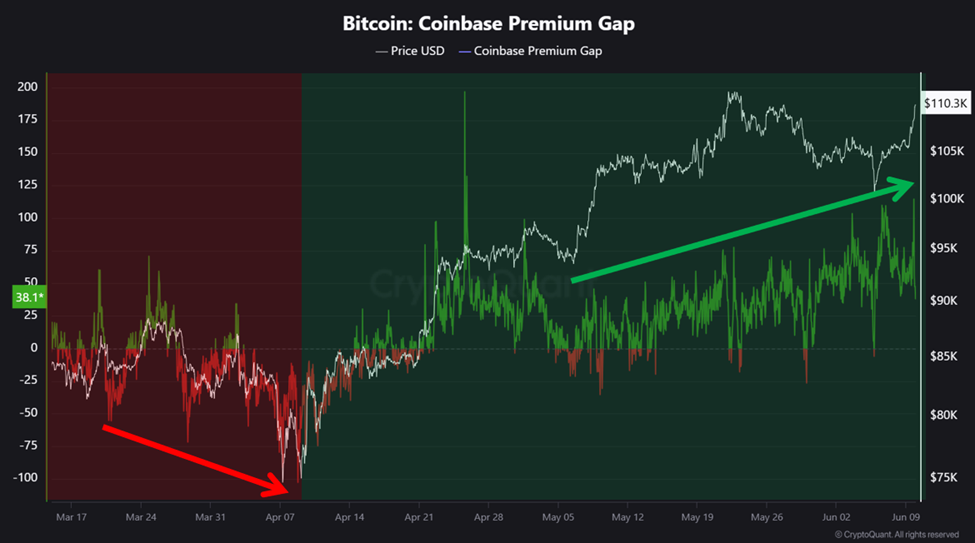

Specifically, Crypto Dan notes that the Coinbase premium is rising and whale buying activity is being observed incrementally.

“In particular, the Coinbase Premium is gradually rising, indicating that buying pressure from US investors is supporting the trend. Additionally, whale buying activity is being observed incrementally. This positive movement, without signs of overheating, is a typical pattern seen in a rising cycle following a correction, suggesting optimistic movements in the cryptocurrency market in the second half of 2025,” the analyst wrote.

Bitcoin’s Coinbase Premium Index measures the difference between coin prices on Coinbase and Binance. When its value grows above zero, it suggests significant buying activity by US-based investors on Coinbase.

Conversely, when it declines and dips into the negative territory, it signals less trading activity on the US-based exchange.

Notably, a positive Coinbase Premium Index is a bullish signal for BTC’s price. This means the coin trades at a higher price on Coinbase as demand from US-based investors strengthens.

Increased buying pressure from American institutional and retail traders like this often drives BTC’s price higher, pushing the market upward.

Bitcoin Quietly Builds Strength Near ATH, More Upside Potential in Sight

Positive developments in the US-China trade talks and the Musk-Trump thaw appear to have reignited buying pressure among American investors, who swiftly resumed accumulating Bitcoin.

“Bitcoin quietly builds strength near ATH. More Upside Potential in Sight. The Bitcoin price is continuing its steady trend. Currently, the Bitcoin price is on the verge of an all-time high, and it would not be strange if it recorded a new high at any time,” another analyst, pseudonymous CryptoQuant analyst Avocado_onchain, wrote in a post on X.

The analyst notes that compared to when Bitcoin broke the previous new high, this time the upward trend is unfolding in a relatively quiet market atmosphere.

Beyond the continuous increase in Coinbase premium, the Kimchi Premium (Korea Premium Index) is still low. This means there may be more room to the upside as the market is not “overheating.”

The Crypto Dan and Avocado analysis aligns with what BeInCrypto reported in a recent US Crypto News publication. Citing Markus Thielen in the latest 10X Research, BeInCrypto highlighted that a Bitcoin price breakout may be imminent.

However, as BeInCrypto articulated, the upside potential is contingent on BTC overcoming the supply zone between $109,242 and $111,774.

Traders looking to take long positions on the pioneer crypto should consider waiting for a candlestick close above the mean threshold of $110,478, the midline of the supply block.

If this supply zone holds as a resistance order block, Bitcoin could drop. However, only a candlestick close below $102239 would invalidate the bullish thesis in a downward directional bias.

Breaking this support level would signify a lower low for BTC, suggesting a trend reversal.

Chart of the Day

This chart shows that Bitcoin’s Coinbase Premium Index currently sits at 0.034.

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- Bitcoin surges nearly 4% to $109,275, driven by US-China trade talks and easing tensions between Trump and Musk.

- Plasma’s ICO raised $500 million from 1,111 participants, but a few whales dominated the allocation, raising concerns about fairness.

- SEC reviews DeFi rules to encourage innovation and investor protection. Guidance clarifies mining and staking activities under securities law, but legal cases influence regulatory clarity for decentralized finance.

- Bitcoin ETFs saw $386 million in inflows following BTC’s surge above $105,000, closing at $110,263.

- FARTCOIN price leads today’s crypto rally, surging nearly 20% amid Coinbase listing hype.

- Public companies like Oblong and Synaptogenix are investing millions in Bittensor (TAO), citing its fixed supply and AI utility.

- Polkadot’s native token, DOT, sees rising demand as the June 11 ETF decision approaches, fueling optimism among traders.

- Bitcoin approaches $110,000 resistance, but rising CPI and market sentiment in the “Greed” zone could trigger a price correction.

- Bitcoin Core’s v30 will increase the OP_RETURN limit from 80 bytes to 4MB, sparking debates over Bitcoin’s scalability and decentralization.

- An analyst highlights four reasons Ethereum may be on the verge of a breakout. Among them is BlackRock’s over $600 million ETH buy without any sales, which signals long-term bullish intent and parallels its impact on BTC’s historic rally.

Crypto Equities Pre-Market Overview

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.