Crypto market faces $950 million in leveraged liquidations as Trump’s tariff threats reintroduce inflation concerns

Key Takeaways

- The announcement of new tariffs by Trump caused nearly $900 million in leveraged liquidations in the crypto market.

- Bitcoin and Ethereum prices dropped significantly, triggering major losses among traders.

Share this article

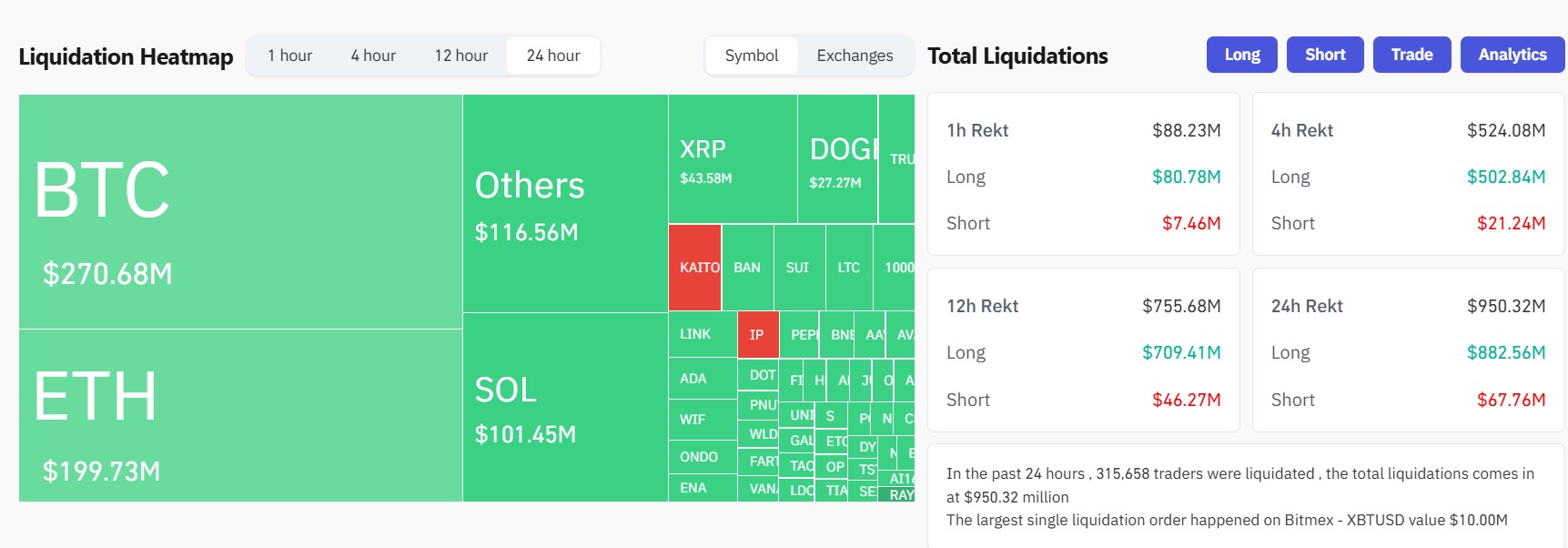

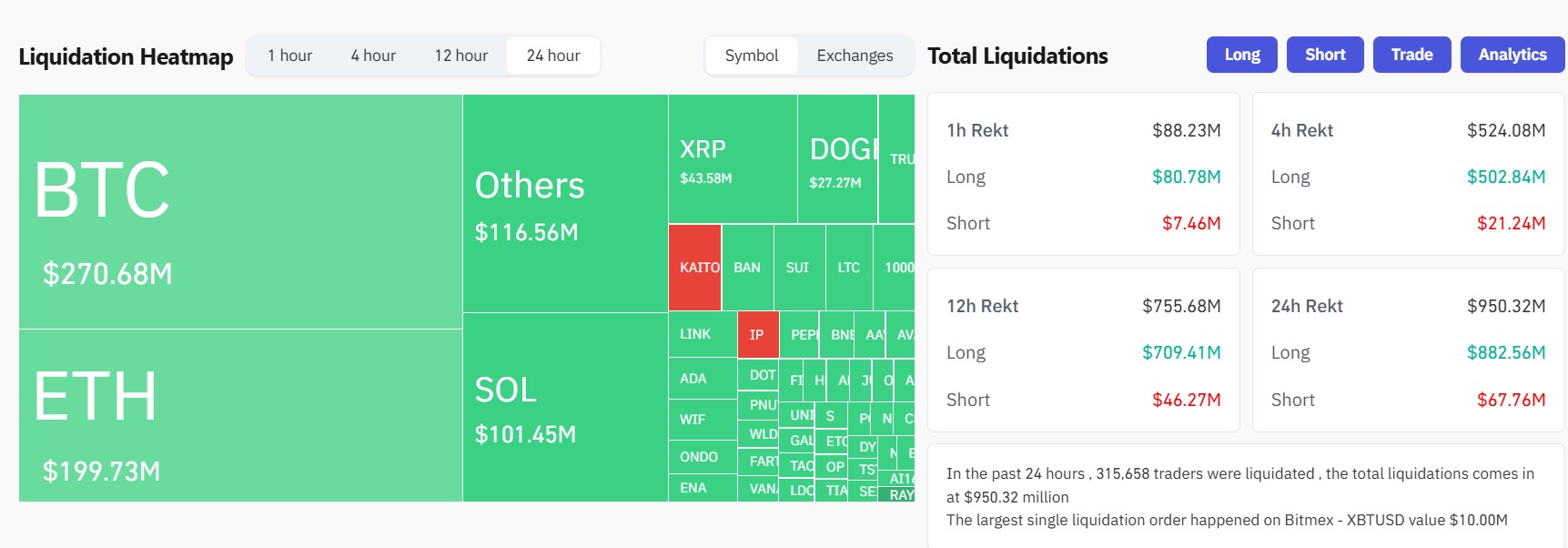

Bitcoin’s slide to a multi-week low sparked a $950 million liquidation wave on crypto exchanges. The sell-off followed President Trump’s statement indicating reactivated Canada and Mexico tariffs, ending a month-long pause and, again, raising inflation concerns.

Trump said Monday that tariffs on imports from Canada and Mexico will be implemented next month, ending a monthlong suspension of planned import taxes.

The 25% tariff on Canadian and Mexican goods will begin in early March 2025, affecting over $900 billion worth of US imports including automobiles, auto parts, and agricultural products.

“We’re on time with the tariffs, and it seems like that’s moving along very rapidly,” Trump said at a White House news conference with French President Emmanuel Macron. “The tariffs are going forward on time, on schedule.”

Trump has maintained that other countries impose unfair import taxes that harm domestic manufacturing and jobs. While he claims the tariffs would generate revenue to reduce the federal budget deficit and create new jobs, his threats have raised concerns among businesses and consumers about a potential economic slowdown and accelerating inflation.

The tariff announcement immediately triggered crypto market volatility.

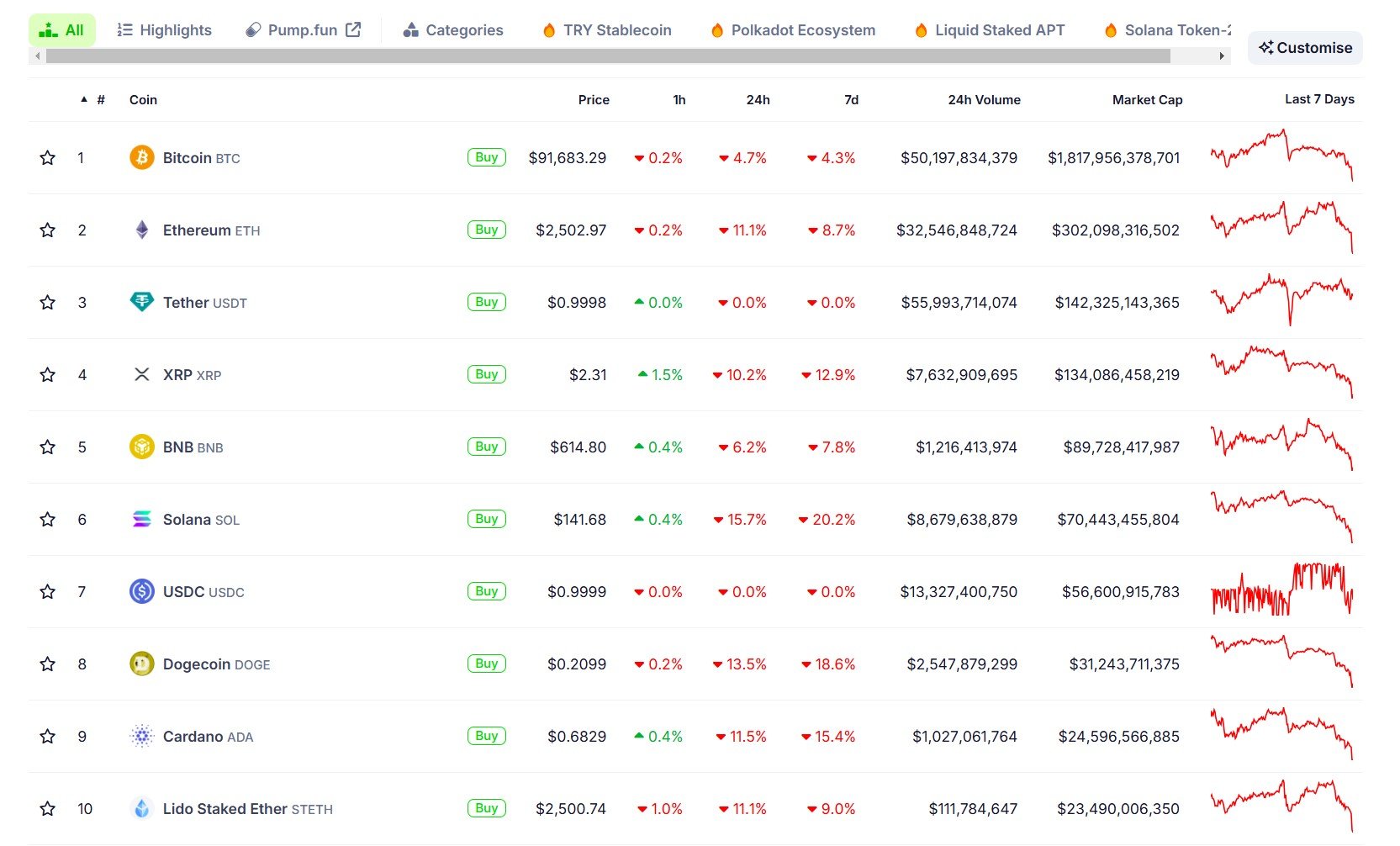

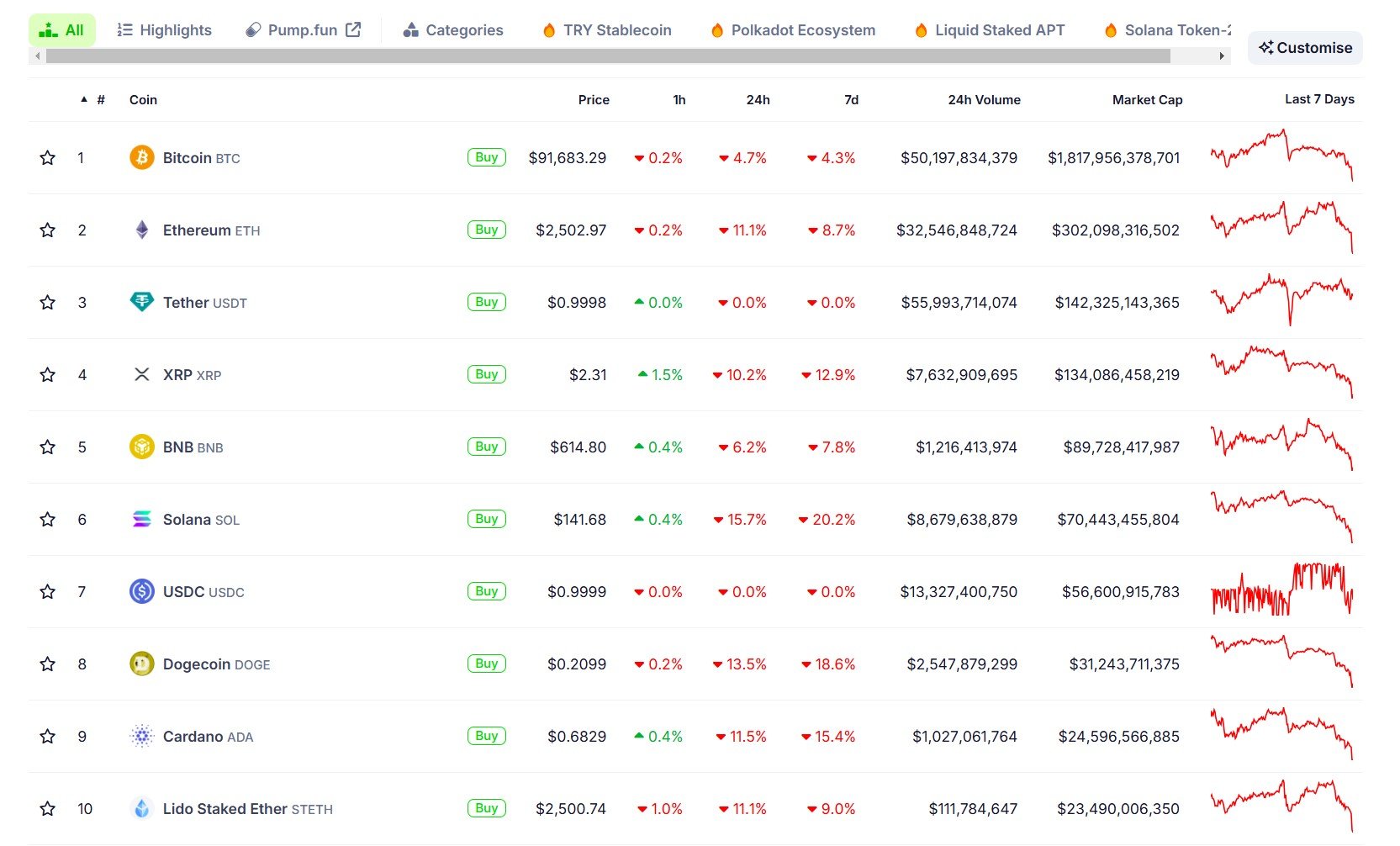

The price of Bitcoin fell below $95,000 and continued sliding to around $91,000, while Ethereum dropped 11% to $2,500, according to CoinGecko data.

The broader crypto market saw widespread losses, with the total market capitalization declining by approximately 8%.

The market turmoil resulted in $880 million in long position liquidations over 24 hours. Ethereum traders suffered $255 million in losses, while Bitcoin traders experienced $185 million in liquidations, according to Coinglass data.

Most altcoins posted double-digit losses. XRP fell 10%, while SOL dropped almost 16%. DOGE declined 13%, and ADA fell 11%. BNB decreased by around 6% in the last 24 hours.

Bitcoin reserve bills fail in multiple US states

Elsewhere, the push for states to hold Bitcoin as part of their reserves has hit a wall. Bitcoin reserve bills have been defeated in Montana, North Dakota, Wyoming, and South Dakota.

Montana’s House Bill 429, which sought to allocate up to $50 million to Bitcoin, precious metals, and stablecoins, was defeated in a decisive 41-59 vote.

North Dakota’s HB 1184, designed specifically for a Bitcoin reserve, met a similar fate, falling short with a 57-32 rejection.

Wyoming lawmakers also rejected HB 0201, which would have empowered the state treasurer to invest public funds in Bitcoin, by a 7-2 margin.

In South Dakota, HB 1202, proposing a 10% Bitcoin allocation, was effectively stalled when legislators employed a procedural maneuver to delay the vote beyond the session’s deadline.

Share this article