Crypto Whales Buy These Altcoins in May: ONDO, RENDER & OP

Bitcoin’s breakout above the $105,000 mark earlier this week triggered a fresh wave of whale accumulation across the crypto market. On-chain data shows that several altcoins are drawing significant interest from large holders.

Among the standout picks in the third week of May 2025 are Ondo (ONDO), Render (RENDER), and Optimism (OP).

ONDO

This week, real-world asset (RWA) token ONDO has seen increased whale attention. According to Santiment, whale addresses that hold between 10,000 and 100,000 tokens have collectively acquired 2.63 million ONDO over the past seven days.

Currently, this cohort of ONDO whales holds 143.94 million tokens. The token trades at $0.99 at press time, noting a 3% price gain amid the broader market rally over the past 24 hours.

If whale activity strengthens, ONDO could reclaim the $1.00 level in the near term. In this case, the altcoin could rally toward $1.23.

However, if the whales stall or sell for profit, ONDO could lose its recent gains and plummet to $0.92.

Render (RENDER)

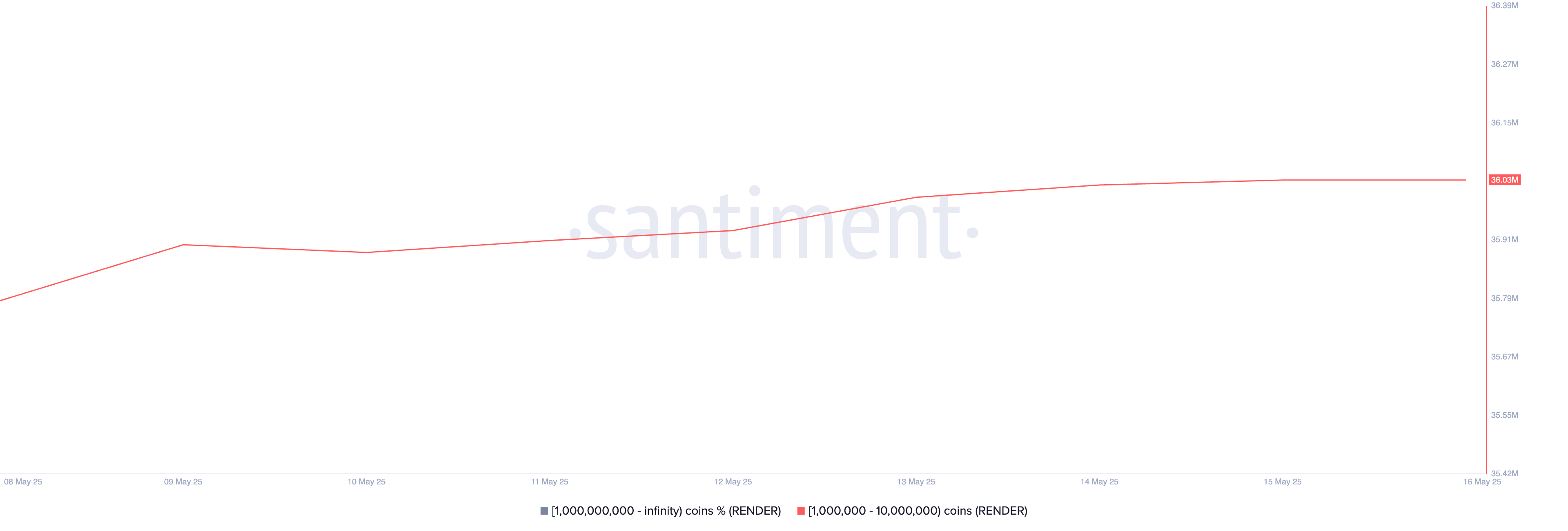

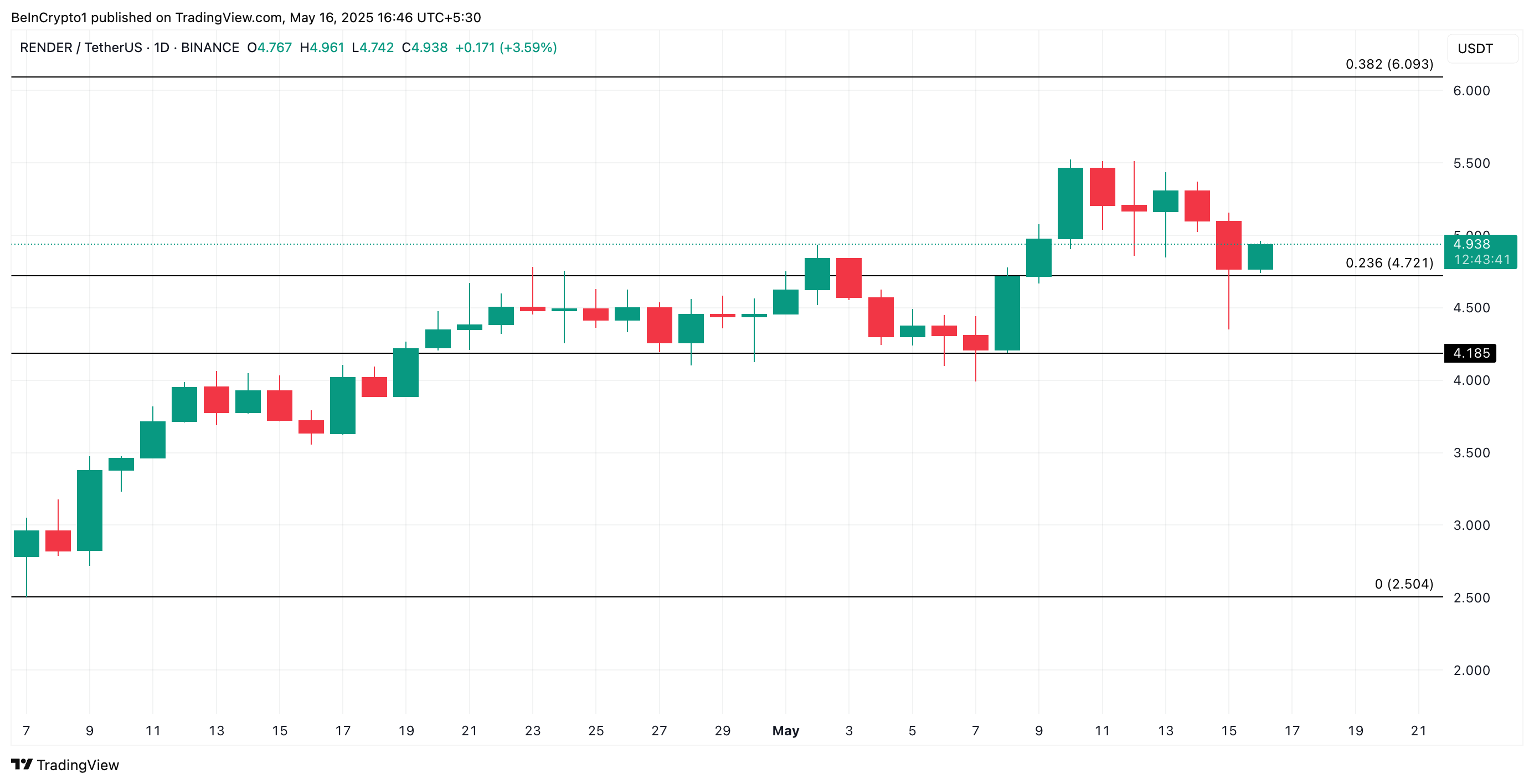

RENDER is another altcoin that crypto whales have paid attention to this week. Per Santiment, large investors who hold between 1 million and 10 million tokens have bought 250,000 RENDER, valued at approximately $1.22 million at current market prices.

This growing accumulation trend among whales may prompt retail traders to follow suit, as increased buying activity from large holders often signals confidence in the asset’s potential.

Historically, whale-driven momentum usually attracts broader market participation, which could drive RENDER’s price up in the near term. If accumulation persists, the altcoin could rally to $6.09.

Converesly, if demand falls, RENDER could breach support at $4.72, and plunge toward $4.18.

Optimism (OP)

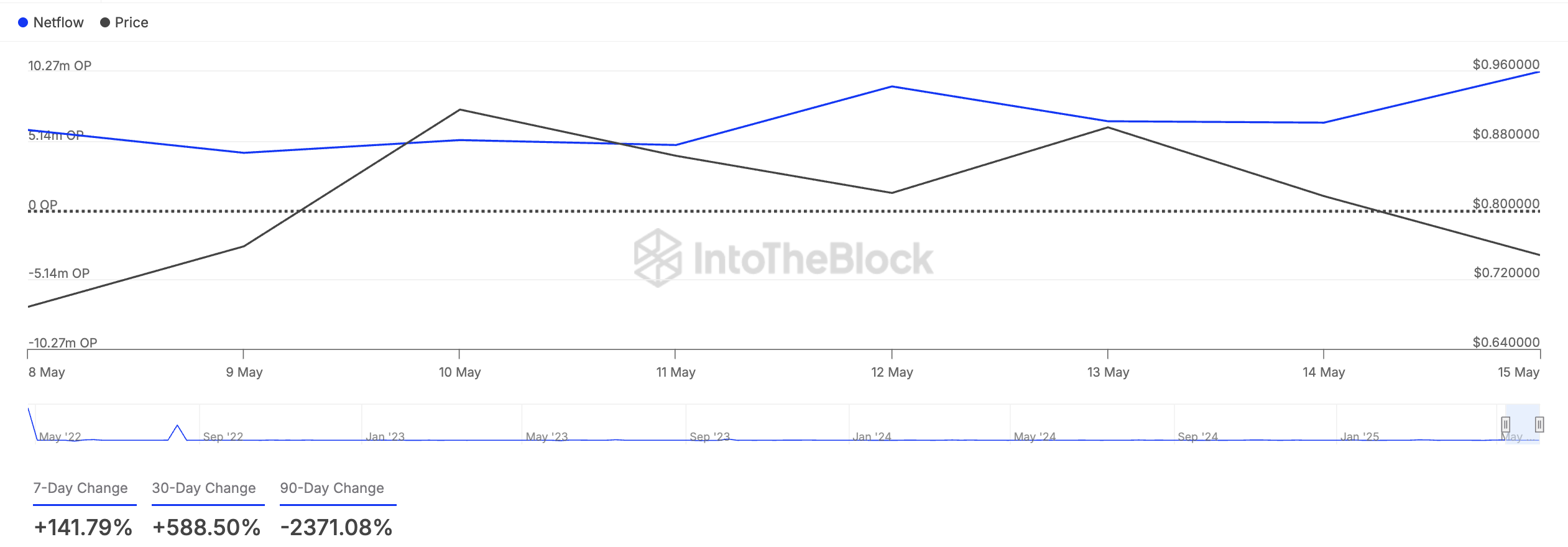

Layer-2 (L2) token OP is another asset with a surging whale accumulation this week. This is reflected by an uptick in the altcoin’s large holders’ netflow, which has rocketed over 140% in the past seven days, according to IntoTheBlock.

Large holders’ netflow tracks the total amount of tokens entering and exiting wallets classified as large holders (those who control more than 0.1% of an asset’s circulating supply).

When this metric rallies, it indicates that significant amounts of the asset are moving into the possession of these investors, signaling strong buying interest. A rising netflow often precedes price appreciation, hence OP’s price could climb to $1.08.

On the other hand, if selloffs resume, OP’s value could dip to $0.54.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.