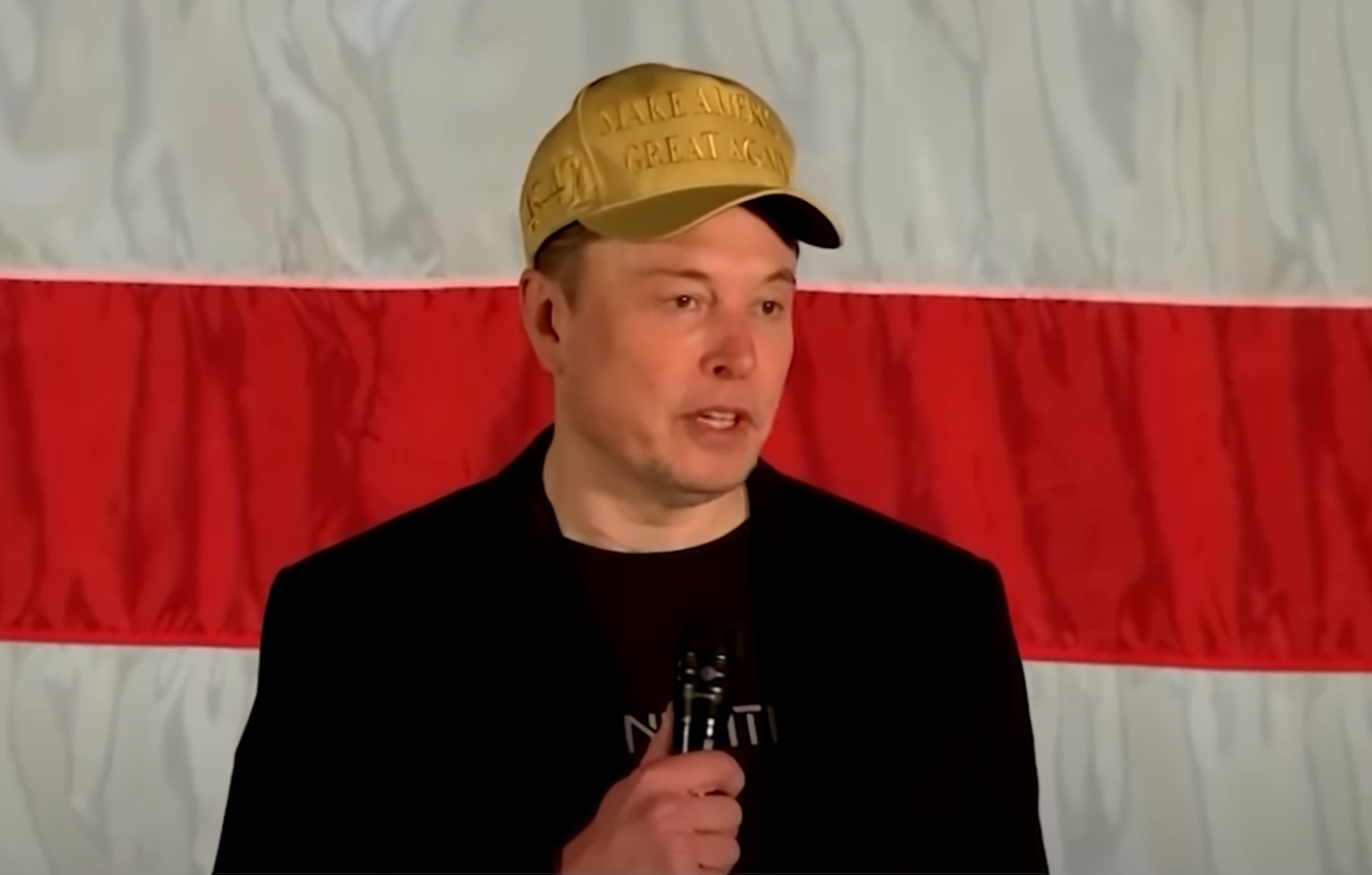

Elon Musk Likely To Integrate Crypto Into X: Scaramucci

Anthony Scaramucci, the founder of SkyBridge Capital and a long-time crypto advocate, believes Elon Musk is poised to weave digital assets into the fabric of X’s planned “super app,” even if the precise mechanism remains under wraps.

In a recent interview with Saxo Group, Scaramucci disclosed that although he has “not spoken to Elon directly,” he maintains an investor’s line of sight into SpaceX, xAI and X after taking stakes in all three ventures. “I do speak to people in management in those two companies as a private investor,” he said, adding that he owns no Tesla shares.

Crypto Likely Part Of Musk’s Vision

Based on those conversations, the former White House communications director predicts that Musk will soon pivot from headline-grabbing political skirmishes back to the operational overhaul of X. “I predict that Musk returns to his businesses… and I do think that you will see X-XL—whatever you want to call that conglomeration—he’s going to build a super app there and I think he’s going to be using crypto,” Scaramucci remarked.

The SkyBridge chief outlined several possible rails for this integration. “Will it be his own coin the way Telegram is doing it? Will it be stable-coin? It will be something. I don’t know what it will be but it will be something.” His comments arrived despite Musk’s earlier insistence that “none of his companies will ever launch a native crypto token,” underscoring the open question of whether X will opt for existing assets such as Bitcoin, Dogecoin or stablecoins, or instead pursue a bespoke digital instrument.

Scaramucci’s forecasts are anchored in Musk’s well-publicised ambition to turn X into what he once called “the biggest financial institution in the world.” In 2023 the Tesla and SpaceX chief invoked China’s WeChat as a model for integrating messaging, payments and business services. The first concrete step toward that vision emerged earlier this year when X announced a partnership with Visa for an X Money Account, a digital wallet designed to shuttle funds between bank accounts and the app’s peer-to-peer rails.

Beyond the Musk-X thesis, Scaramucci used the Saxo Group interview to reiterate his broader market convictions. He credited the Trump administration for their pro-crypto policies. “There is going to be crypto-friendly, pro-crypto regulation. I see that as very positive,” he stated.

He also repeated his stance that bitcoin’s twin role as an inflation hedge and risk asset would remain intact should a recession materialise: “We’re finally seeing this non-correlation where it’s trading a little bit like gold, which is outperforming, but it’s trading a little bit like gold in the last three weeks. And I think this is a direct result of the Wall Street sales machine. I think you have an enormous amount of inflows taking place in the BlackRock ETF and other ETFs.”

At press time, Dogecoin traded at $0.177.

Featured image from YouTube, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.