Flare (FLR) surges 57% in a week as technicals flash overbought

- RSI currently at 67.13, nearing overbought levels.

- Awesome Oscillator flipped positive for the first time since January.

- FLR broke past resistance at $0.016.

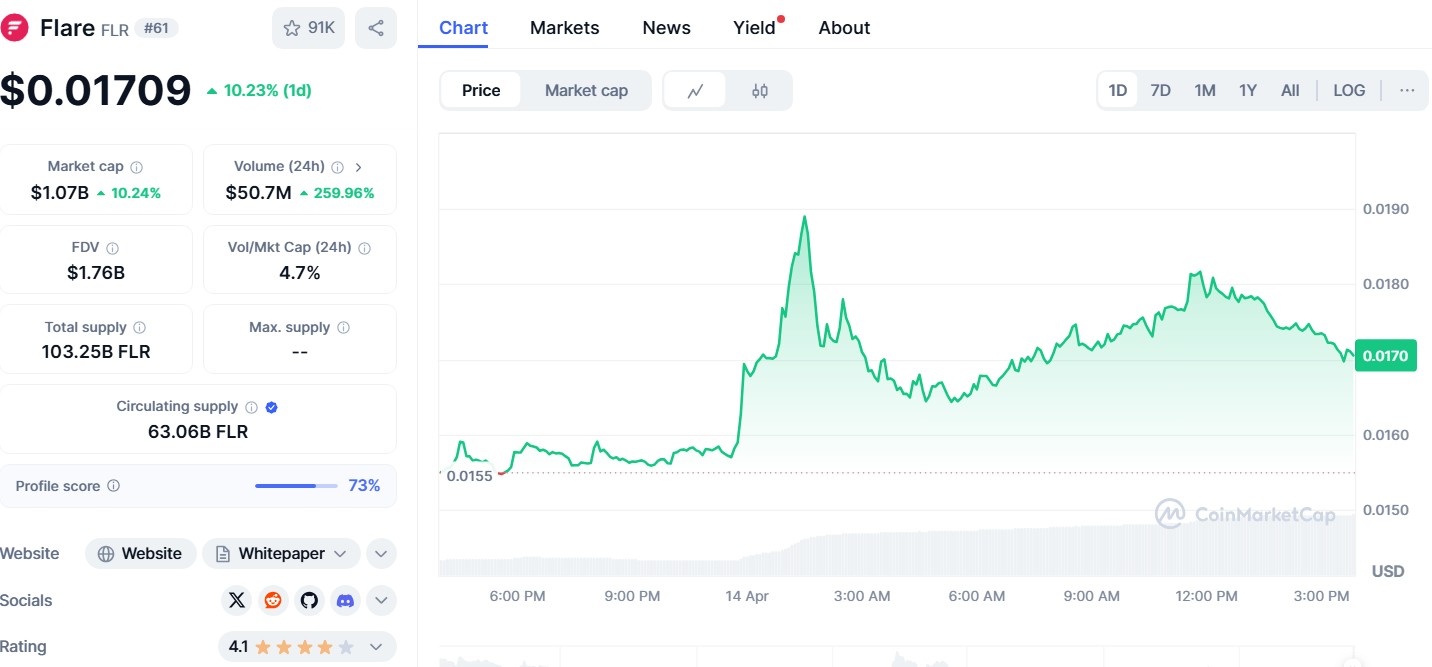

Flare (FLR) has emerged as one of the strongest performers in the altcoin market this week, surging by 57% over the past seven days to hit a new local high of $0.018, trading at $0.017 at the time of writing.

Source: CoinMarketCap

The move marks a continued bullish rally that began on April 9, with FLR recording new daily highs each day since.

Key technical indicators like the Relative Strength Index (RSI) and Awesome Oscillator (AO) now suggest that strong buying activity continues to outpace selling pressure.

However, with RSI levels approaching overbought territory, analysts warn that a pullback may be on the horizon if profit-taking intensifies.

RSI at 67 shows strong buying trend

Flare’s Relative Strength Index stands at 67.13 at the time of writing, nearing the key 70 mark that typically signals overbought conditions.

The RSI indicator tracks momentum by comparing the magnitude of recent gains and losses over a set period, on a scale of 0 to 100. An RSI above 70 often suggests that an asset could be overbought and may correct soon, while values below 30 indicate the opposite.

FLR’s upward-trending RSI suggests that buyers are currently dominating the market, reflecting sustained interest in the asset. While it has not yet crossed the 70 threshold, the present value indicates that FLR is nearing a potential inflection point.

If current momentum continues, the RSI may soon confirm an overbought signal, increasing the likelihood of a short-term price dip.

AO flips positive for the first time in 2 months

Adding to the bullish sentiment, Flare’s Awesome Oscillator has turned positive for the first time since January 26.

The AO comprises histogram bars that measure the difference between a 5-period and 34-period simple moving average, providing insight into market trends and reversals.

The bars recently flipped above the zero line and have continued to grow in height, signalling an increase in positive market momentum.

When AO bars move above zero, it typically points to a strengthening trend. In FLR’s case, the consistent growth in these bars implies bullish conviction is building across the market.

This technical development supports the idea that FLR’s recent gains are not just short-term spikes, but part of a broader uptrend driven by improving investor sentiment.

Price breaks past $0.016 resistance, eyes $0.021

FLR’s recent rally saw it break through the resistance level at $0.016, a price point that had previously capped upward movement. Sustaining above this level is seen as a critical factor in determining whether the rally can extend.

If $0.016 holds as a new support, analysts suggest the altcoin could rise further to test the next key resistance at $0.021. However, the possibility of near-term profit-taking could challenge this bullish projection.

A renewed wave of selling pressure might push FLR back below $0.016 and towards $0.010, especially if RSI crosses into overbought territory and market participants seek to lock in gains.

Technical signals support short-term gains

Overall, technical indicators for FLR remain largely positive. The combination of a rising RSI, positive AO crossover, and breakout above previous resistance levels points to continued bullish momentum in the short term.

However, traders are advised to monitor the RSI closely. A move past 70 could indicate that a correction is due, especially if volume begins to fall or candlestick patterns suggest hesitation among buyers.

At this stage, FLR’s ability to consolidate above $0.016 will likely determine the next phase of its price action.

The post Flare (FLR) surges 57% in a week as technicals flash overbought appeared first on CoinJournal.