Japan’s Bond Crisis Puts Metaplanet’s Bitcoin Bet in the Spotlight

Japan’s long-dormant inflation is roaring back to life, rippling through the nation’s bond markets and fiscal projections. Amid rising concerns, Metaplanet, a rather unlikely company, has captured the market’s attention and skepticism.

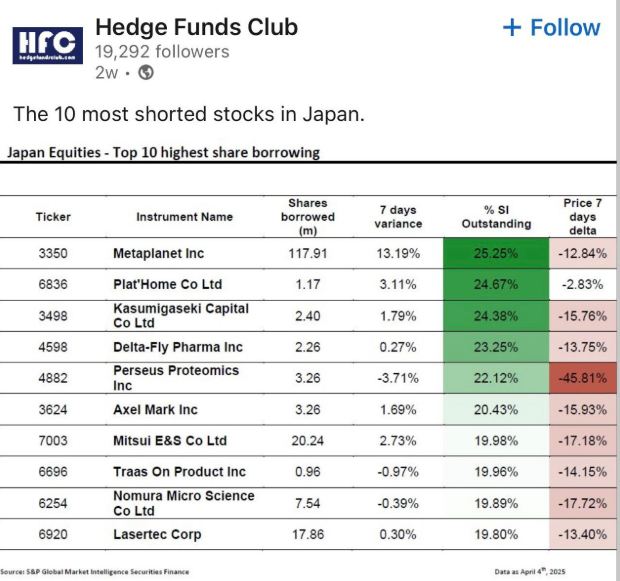

Metaplanet, the Tokyo-listed firm that skyrocketed over 5,000% in 2024 following its bold Bitcoin treasury strategy, is now the most shorted stock in Japan, according to its CEO.

The rise in short positions against Metaplanet comes amid an unraveling in Japan’s long-term debt market. Inflation in the country has reached 3.6%, now exceeding the US Consumer Price Index (CPI).

“Apparently, Metaplanet is the most shorted stock in Japan. Do they really think betting against Bitcoin is a winning strategy?” CEO Simon Gerovich posted.

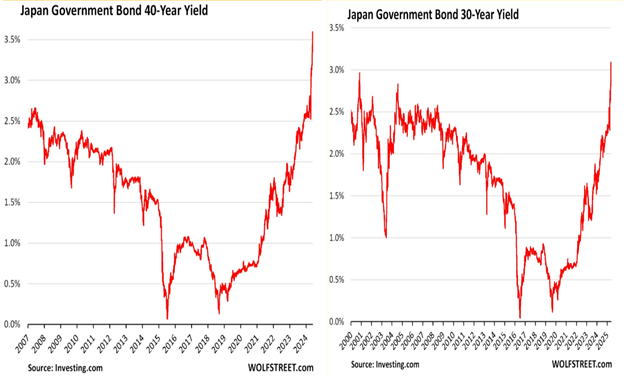

High inflation has triggered an unprecedented selloff in Japanese government bonds (JGBs). The 40-year yields surged 1% since April to a staggering 3.56%, the highest in over two decades. Similarly, the 30-year yields have skyrocketed to a 25-year high.

“It’s not just a ‘sell America’ trade that’s driving yields higher. In Japan, 30-year yields surged to the highest levels in 25 years after a very weak bond auction. The Prime Minister [Shigeru Ishiba] called Japan’s fiscal situation extremely poor, worse than Greece’s,” wrote Lisa Abramowicz, co-host at Bloomberg Surveillance.

Against this backdrop, the Bank of Japan (BoJ) has begun aggressively cutting bond purchases, offloading 25 trillion yen ($172 billion) since the start of 2024.

Despite this tightening, real yields remain negative. Investors who previously bought low-yield JGBs suffer steep losses, prompting a shift in capital flows.

“Japan’s long-term bond market is in free fall, causing yields to spike, losses to spread, and global fallout,” Thuan Capital noted in a post.

The structural shift in Japanese bond demand has also raised alarms abroad, particularly in the US, where Japan holds $1.13 trillion in Treasuries.

A sustained retreat from US debt could further pressure the already fragile American bond markets.

Amid this macroeconomic upheaval, Japanese investors are seeking refuge. For many younger citizens wary of traditional salaryman paths, Bitcoin, and by extension, Metaplanet, has emerged as a radical alternative.

“Younger Japanese are looking for an escape hatch to avoid toiling as salarymen till the grave,” one user quipped on X.

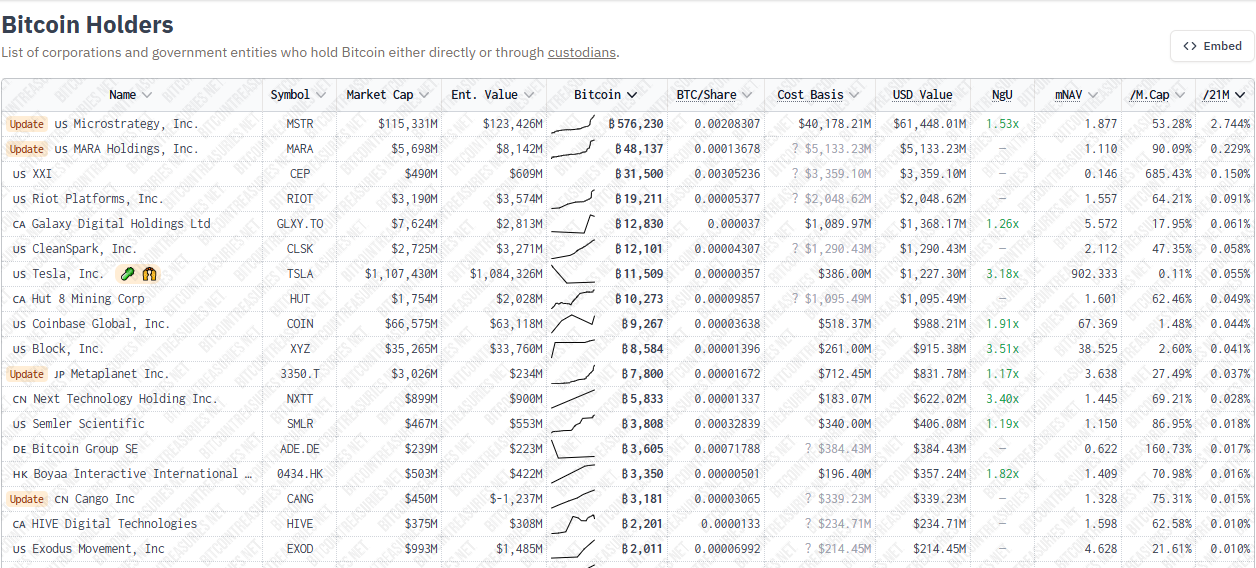

Metaplanet’s Bitcoin-centric strategy, reminiscent of MicroStrategy’s in the US, has made it a standout. BeInCrypto reported that its stock, MTPLF, hit a three-month high after a $104 million Bitcoin purchase.

Similarly, its Q1 revenue hit $6 million, with Bitcoin earnings contributing 88%. The firm also surpassed El Salvador on metrics of Bitcoin holdings following a recent BTC purchase worth $126.7 million.

However, its rise has drawn heavy scrutiny from hedge funds and institutional traders. Some analysts suggest the short positions may be part of sophisticated arbitrage strategies.

“Sell meta / buy MSTR! Or sell meta / buy BTC spreads alone will look like shorts but in fact are spreads — it’s too wide,” investor Gary Cardone explained.

This suggests traders exploit valuation differentials between Metaplanet, Bitcoin, and Bitcoin proxy stocks like MicroStrategy. These dynamics mirror the Jim Chanos playbook, shorting MSTR while going long BTC.

As BeInCrypto reported, he cited an unsustainable premium in the stock relative to Bitcoin itself. Yet others view the shorts with disbelief.

“Japanese hedge funds bet against a Bitcoin treasury in the land of yield curve control and 263% debt-to-GDP? You really can’t make this up,” remarked finance analyst Peruvian Bull.

Japan is teetering on the edge of a sovereign debt crisis. Meanwhile, Metaplanet has become a lightning rod for domestic financial anxiety and a broader ideological clash between fiat fragility and crypto conviction.

“The Japanese bond market is imploding, and Metaplanet is the exit,” said Joe Burnett, director of market research at UnChained.

Whether the shorts are opportunistic or misguided, Metaplanet has become ground zero in Japan’s historic financial reset.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.