PI Network Struggles to Hit $2 – More Losses Ahead?

Pi Network has witnessed a double-digit decline in the past week, shedding nearly 20% of its value. This price dip comes amid an uptick in the market’s volatility triggered by Donald Trump’s trade war, which has weighed heavily on investor sentiment across risk assets.

With bullish momentum fading, Pi Network remains vulnerable to further losses. This analysis explains why.

PI’s Decline Far From Over? Key Indicators Hint at Further Downside Risks

PI’s declining on-balance volume (OBV) on a four-hour chart confirms the surge in bearish pressure. Since March 6, this momentum indicator, which tracks money flow into and out of an asset, has trended downward, falling 20%.

When an asset’s OBV falls, selling pressure outweighs buying pressure, as more volume is associated with price declines than price increases.

This suggests weakening momentum in the PI market and hints at the likelihood of a potential further downside as traders continue to offload their positions.

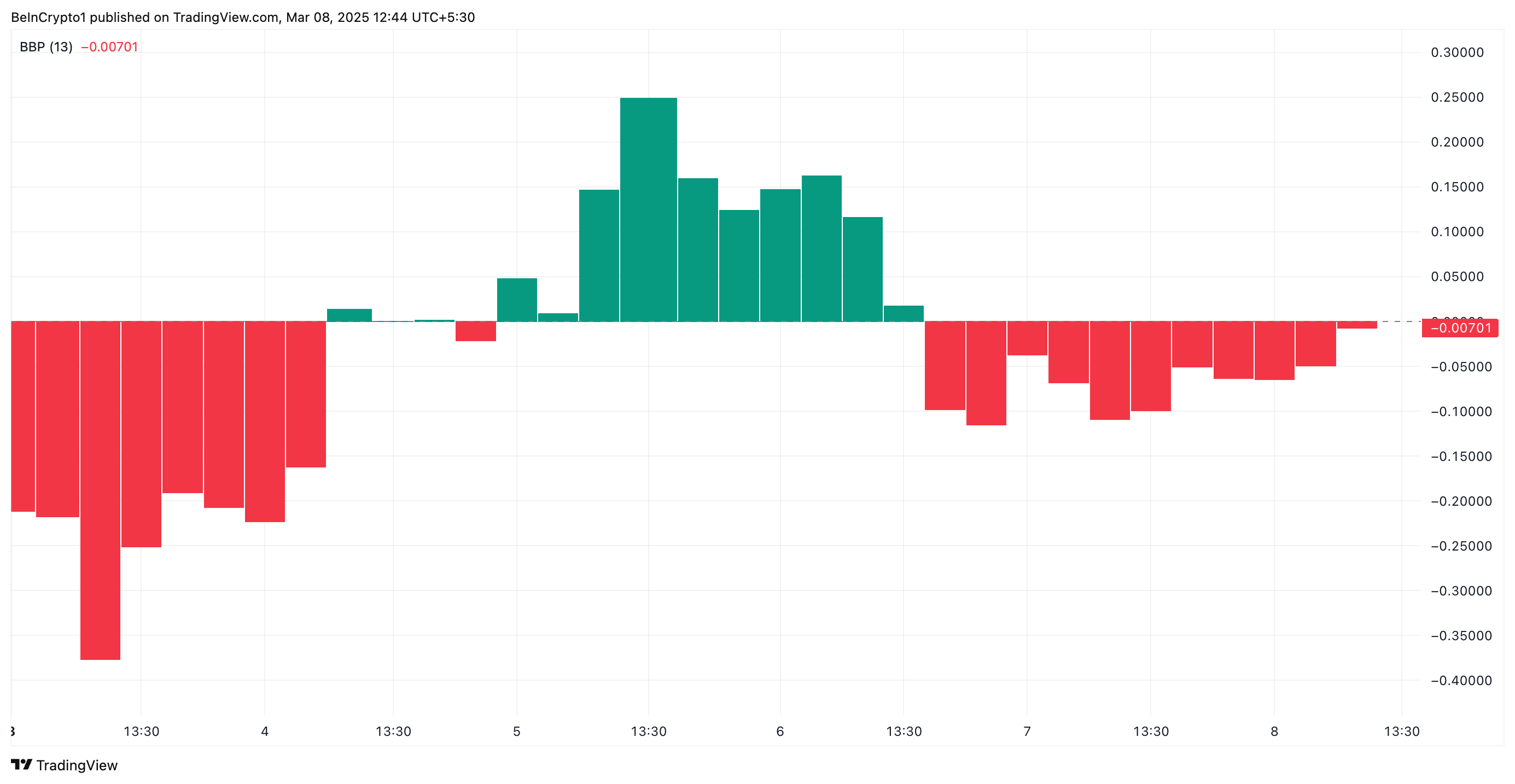

Further, readings from its Elder-Ray Index confirm this bearish outlook. At press time, the indicator posts a negative value of -0.0070, reflecting the high selloffs among market participants.

An asset’s Elder-Ray Index compares the strength of its bulls and bears in the market. When the index declines like this, it signals increasing bearish strength, suggesting that sellers are gaining control and downward pressure is intensifying.

Bulls vs. Bears: PI Faces Critical Battle Between $1.62 and $2.12

Pi Network currently trades at $1.80, resting above the support formed at $1.62. If sellofs strengthen, the bulls may be unable to defend this level. In this scenario, the altcoin’s value could plummet to $1.62.

On the other hand, a resurgence in PI demand could invalidate this bearish projection. If the altcoin sees a rise in new demand, its price could rocket above $2 to trade at $2.12. A successful breach of this resistance could propel PI price to revisit its all-time high of $3.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.