RAY Price Jumps 20% After Strong Market Correction

Raydium’s (RAY) price has rebounded more than 10% after the Monday morning crash, pushing its market cap close to $2 billion. Technical indicators are now showing signs of a potential bullish continuation.

RAY’s revenue and trading volume remain among the highest, reinforcing its position as a leading Web3 protocol. Whether RAY can sustain this momentum or face another downturn will depend on its ability to hold key support levels and confirm an uptrend.

Raydium Is One of The Biggest Blockchain Applications In The Market

Raydium has emerged as one of the top revenue-generating blockchain protocols, bringing in over $42 million in the last seven days. This puts it ahead of major players like Circle, Uniswap, and even Ethereum in terms of earnings.

Over the past year, Raydium has generated nearly $1 billion in revenue, coming remarkably close to Solana’s $965 million.

In terms of trading volume, Raydium has handled around $3.4 billion in the last 24 hours and $21 billion over the past week, solidifying its place as one of the most used Web3 projects ever.

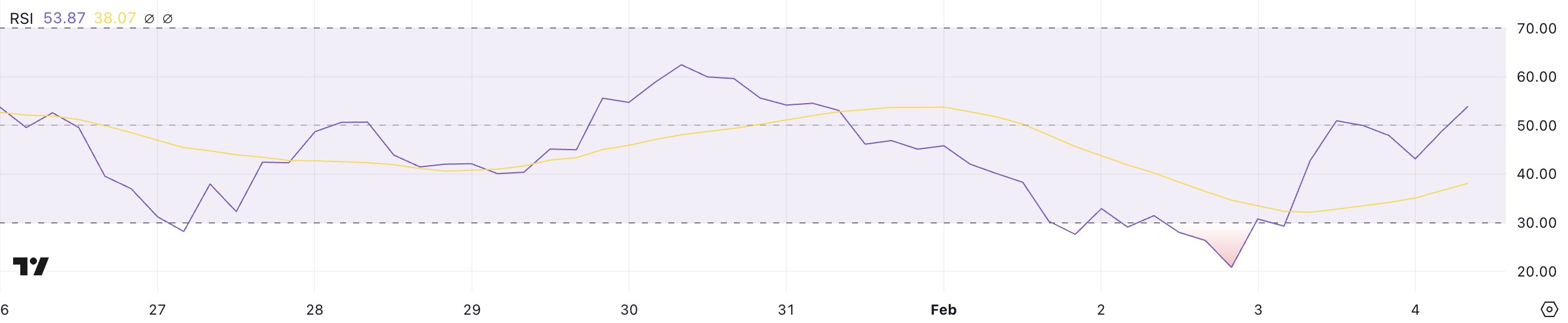

RAY RSI Is Recovering After Hitting Oversold Levels

Raydium’s RSI is currently at 53.87, rising sharply from 20.8 just two days ago. The Relative Strength Index (RSI) measures momentum by tracking recent price movements, with values below 30 indicating oversold conditions and above 70 signaling overbought levels.

The recent jump suggests that buying pressure has increased, bringing Raydium out of oversold territory and into a more neutral range.

At 53.87, Raydium’s RSI is neither strongly bullish nor bearish, leaving room for further price movement in either direction. Notably, RAY hasn’t touched the 70 levels, which would indicate overbought conditions, since January 19.

This suggests that while the asset has seen renewed strength, it hasn’t yet entered a strong bullish phase. The next trend confirmation will depend on whether the RSI continues to rise or stall at current levels.

RAY Price Prediction: A Further 33% Upside?

Raydium’s price recently corrected by 34% between January 30 and February 3 but has since rebounded nearly 30%. Its EMA lines suggest that a golden cross, where the shortest-term moving average crosses above the longer-term ones, could be forming soon.

If this happens, RAY price could continue its recovery, with a strong uptrend potentially pushing it to retest $7.92. A breakout above that level could lead to further gains, with $8.7 as the next major target, representing a possible 33% upside.

However, if RAY fails to maintain its momentum, it could test support at $5.85, with a breakdown leading to $5.36. A deeper sell-off could see it drop further to $4.71 or even $4.14, marking its lowest level since January 13.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.