Rising stablecoin supply signals crypto’s bull run isn’t over yet

Key Takeaways

- Historical patterns show crypto cycle peak is not yet here.

- Stablecoins increasingly serve as a bridge between fiat currencies and crypto markets, comprising the majority of crypto trading pairs.

Share this article

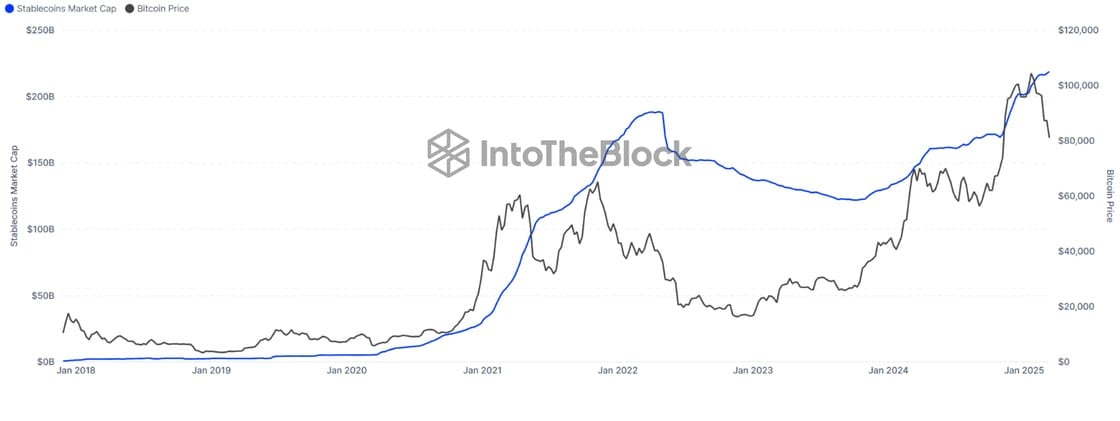

The total supply of stablecoin has reached $219 billion and continues to climb, suggesting the crypto bull run is still far from over, IntoTheBlock said in a Friday statement.

According to the crypto analytics firm, historical data shows stablecoin supply typically peaks during market cycle highs, with the previous peak of $187 billion recorded in April 2022 just before the market started declining.

Since stablecoin supply is now higher than ever and increasing, this suggests the market has not yet peaked and is still in a growth phase.

After a drop below $77,000 earlier this week, Bitcoin climbed above $85,000 on Friday morning, TradingView data shows. At press time, Bitcoin was trading at around $84,700, up 4.5% in the last 24 hours.

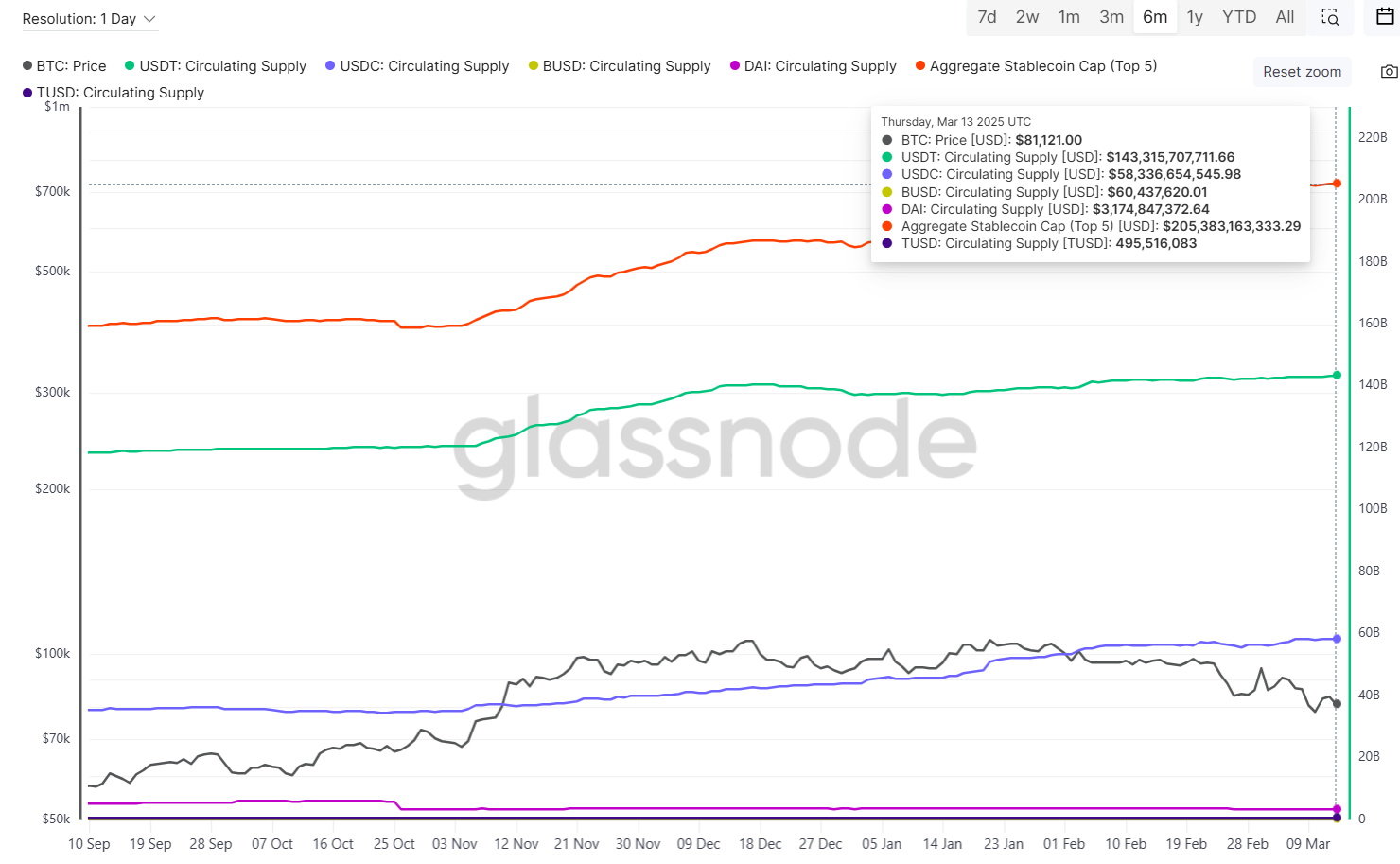

The recent resurgence of Bitcoin coincides with a rise in the market capitalization of major stablecoins, including USDT, USDC, BUSD, and DAI. Their combined market cap increased from around $204 billion to over $205 billion between March 10 and 14, according to Glassnode data.

Stablecoins serve as a bridge between fiat currencies and crypto markets, comprising the majority of crypto trading pairs and market liquidity. The rising market cap indicates higher stablecoin adoption and their growing role as a preferred medium for crypto transactions.

The increase in supply likely reflects a market-wide movement of assets into stablecoins in preparation for trading, suggesting anticipated market activity in the coming weeks.

The aggregate market cap of five leading stablecoins has increased over 28% since November 5, 2024, US Election Day.

Share this article