Solana Price Prediction: SOL Rose to $176.40— Can This L1 Outperform as ETH and BTC Gain Ground?

Solana (SOL) is at $176.40, with $4.86 billion in trading volume and $91.78 billion in market cap. While Ethereum and Bitcoin go up, Solana’s Layer 1 is quietly building momentum with new DeFi innovations and a good price structure.

Now the question is can SOL ride this wave and outperform its big brothers?

Jupiter Lend Drives Solana’s DeFi Growth

Jupiter, a major decentralized exchange aggregator on the Solana blockchain, has launched Jupiter Lend, a lending protocol announced during the Solana Accelerate conference.

Unlike traditional asset-collateralized platforms, Jupiter Lend has an 90% debt-to-asset ratio, allowing users to borrow more with less assets.

This is designed to attract both retail and institutional players looking for efficient capital management.

Features:

- One-click deposits and a “vault protocol” for easy borrowing

- Low fees of 0.1%

- Integration with Fluid, bringing Ethereum expertise to Solana’s ecosystem

Jupiter has about 95% of Solana’s DEX aggregator volume, so it’s a big player. After the launch, JUP surged 12%. Analysts think this will boost Solana’s transaction volume and its position in DeFi.

Kraken’s xStocks Expands Use Cases of Solana

Kraken has launched xStocks, tokenized versions of Apple, Tesla, Nvidia and other major global equities, all tradable on the Solana blockchain.

This is for international investors, especially in Europe, Asia and Latin America, to access US stocks through tokenized assets backed by real-world securities.

Advantages:

- 24/7 trading on a blockchain known for speed and low fees

- Real-world asset backing via partnerships with Backed Finance

- Liquidity options to redeem for cash or use as collateral in DeFi strategies

This puts Solana as a bridge between traditional finance and crypto, and attracts global traders looking for flexible, 24/7 access to both markets.

Solana Technical Analysis – Bullish Bias In Play

Solana price prediction remains bullish as on the 2-hour chart, SOL is consolidating in an ascending channel, making higher highs and higher lows—a sign of a strong uptrend.

The 50-period EMA at $175.42 and the trendline at $173.06 are strong buy zones. Candlestick patterns show spinning tops, meaning indecision, but the recent bullish engulfing candle means buying is back.

Technicals:

- Break above $181.57 and it’s $187.64 and $192.98

- MACD crossover could mean momentum turns bullish

- Risk management: pullbacks to $173.06 are buys with stops below $165.50

For new and experienced traders, this is a clear opportunity to ride Solana’s breakout if momentum aligns with ETH and BTC.

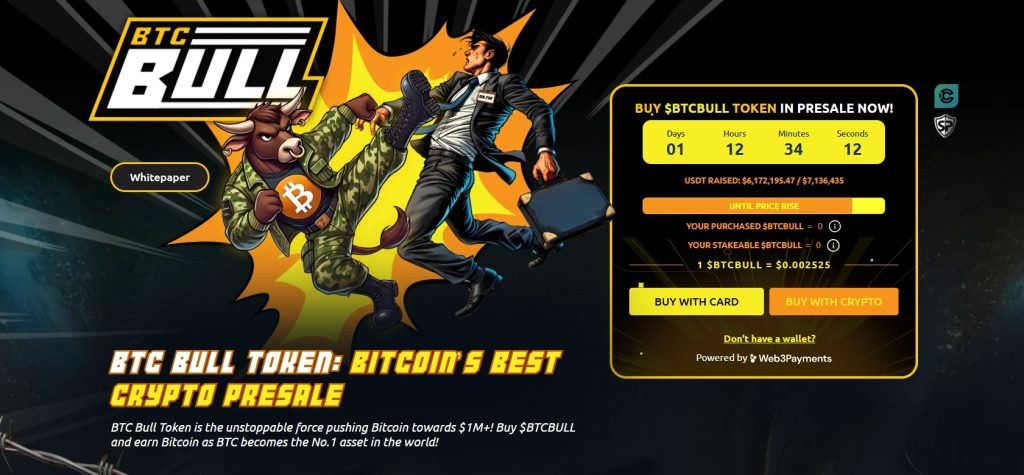

BTC Bull Token Nears $7.14M Cap as 71% Staking Yield Fuels FOMO

As the SOL/USD pair hovers near $176.40, attention is rapidly turning to high-upside altcoins — and BTC Bull Token ($BTCBULL) is stealing the spotlight. With $6.17 million raised out of its $7.14 million cap, momentum is accelerating as the next presale price jump closes in fast.

What sets BTCBULL apart is its unique rewards model — token holders receive Bitcoin airdrops directly tied to BTC’s price rallies. The higher Bitcoin climbs, the more BTC gets distributed — with presale buyers receiving priority rewards over post-launch DEX investors.

Key Stats:

- USDT Raised: $6,221,583.95 / $7,136,435

- Token Price: $0.002525

- Staking Pool: 1.47B BTCBULL

- Yield: ~71% APY

Built-in scarcity adds even more firepower: every time Bitcoin rises by $50K, BTC Bull triggers a token burn, reducing supply and increasing upside potential for long-term holders.

Meanwhile, staking is turning heads. BTCBULL offers a whopping ~71% APY on its Ethereum-based staking pool (currently holding 1.47B BTCBULL), with no lockups or withdrawal fees. That means passive yield — with full liquidity.

The post Solana Price Prediction: SOL Rose to $176.40— Can This L1 Outperform as ETH and BTC Gain Ground? appeared first on Cryptonews.