What To Expect From XRP In June 2025?

XRP price has experienced a notable decline in the last few days, erasing most of May’s gains and shifting momentum from bullish to bearish going into June.

As the altcoin faces the final month of Q2, traders and investors are left questioning whether this downward trend will persist or if a recovery is possible.

XRP Does Not Have The Best Record

Historically, June has been a challenging month for XRP investors. Data from the past 11 years shows that the median monthly return for XRP in June stands at -8.49%. This pattern highlights that June may prove unfavorable for holders seeking profit, especially after recent losses.

The consistent historical trend suggests that XRP could continue facing selling pressure in June. Investors should be cautious, as the typical seasonal weakness could intensify the current bearish sentiment, further pressuring the altcoin’s price.

Crucial XRP Investors Are Selling

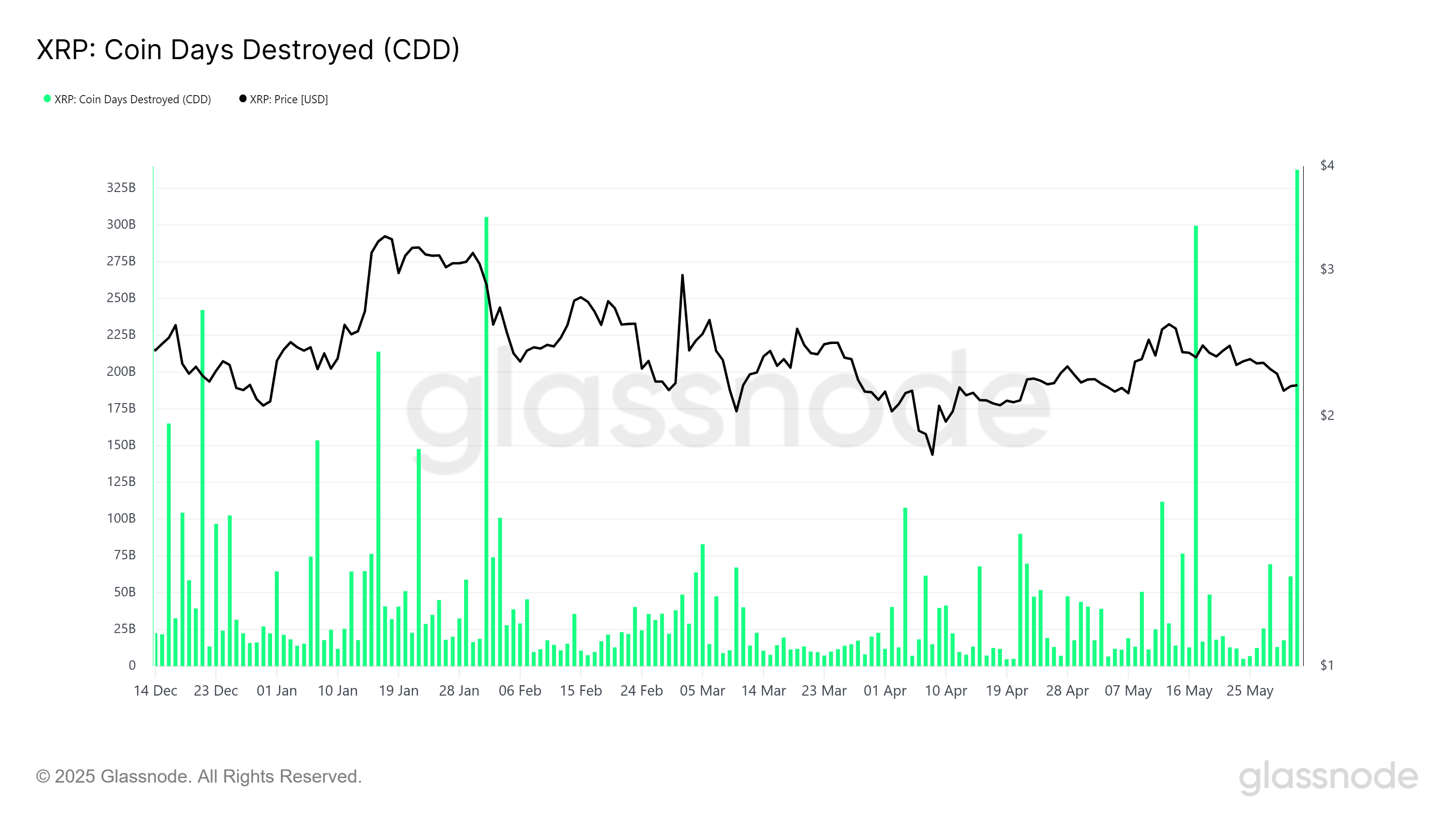

Looking at broader market signals, the Coin Days Destroyed (CDD) metric is showing a sharp spike. CDD is the total number of days that have been destroyed by investors’ selling, particularly from long-term holders (LTHs).

It is measured by multiplying the number of coins spent in a transaction by the number of days those coins were held since their last movement. For example, if 100 coins were held for 10 days before being spent, the CDD equals 1,000 (100 coins × 10 days).

XRP’s CDD currently sits at 337 billion, its highest level since December 2024. This surge in CDD suggests that many LTHs are selling their XRP holdings, likely to secure profits before prices fall further.

The rising sell-off from these seasoned investors points to waning confidence in XRP’s ability to reclaim earlier gains in the near term. Considering LTHs are known as the backbone of an asset, any sell-off from them could impact the price negatively.

Nevertheless, XRP has one good thing going for it, and that is the end of the SEC lawsuit. Scheduled to conclude soon, this will mark a major development for XRP, and Alexis Sirkia, Captain of Yellow, in an interview with BeInCrypto, stated that he believes this will be a key catalyst in fast-tracking the Ripple ICO.

“Of course, everyone is waiting for the SEC lawsuit to be over and for Ripple ICO time. Ripple is the biggest crypto holder in the space, even larger than Strategy. Owning 50% of XRP supply, Ripple if it becomes public should be an attractive investment with over 120 billion USD worth of XRP in treasury which is more than double that of Microstrategy. Ripple would become the largest public crypto holding company in the world which I believe will make it attract attention and investment which should positively affect XRP price,” Sirkia stated.

XRP Price Is Looking At Correction

XRP has been trending downward since mid-May and is currently trading at $2.16. The altcoin remains above a key support level of $2.12, but the outlook points toward potential further declines as bearish momentum grows stronger.

If XRP breaks below the $2.12 support, the price could slip to $2.02 and, failing that, drop further to $1.94. This would mark a two-month low and could lead to intensified selling pressure going forward. The Relative Strength Index (RSI), which sits below the neutral line in bearish territory, supports this outlook. This indicates a lack of buying momentum.

Nevertheless, there is a factor that could alter the altcoin’s direction sooner rather than later if it becomes a reality – XRP ETF. It is one of the most anticipated ETFs, yet to be given the green light. When that happens, it is expected to draw considerable investment into XRP. But Alexis Sirkia stated that the next thing for XRP may not be an ETF.

“There seems to be a shift in interest from ETF’s like Grayscale going down significantly in holdings while companies holding Bitcoin like Strategy seem to be doing better and increasing their holdings. So newcomers to XRP like Hyperscale or VivoPower might actually become more relevant than XRP ETFs when they are approved, and as MicroStrategy (now Strategy) showed us, it might not matter as long as the investor has an option to indirectly invest in XRP,” Sirkia said.

Thus, such exposure could certainly help the price considerably. Furthermore, if smaller investors start accumulating the XRP sold by LTHs, the altcoin could bounce from the $2.12 support level. A recovery past the resistance at $2.27 would invalidate the bearish thesis and potentially propel XRP’s price toward $2.50.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.