Why Is Crypto Down Today? – May 30, 2025

The crypto market stays in the red as the market works to consolidate. All top 10 coins per market cap have seen their prices drop over the past 24 hours. At the same time, the cryptocurrency market capitalization has decreased by 4.5%, falling from $3.55 trillion to $3.45 trillion. The total crypto trading volume is at $130 billion, rising over the past two days.

TLDR:

Crypto Winners & Losers

At the time of writing, all the top 10 coins per market capitalization are down. Bitcoin (BTC) has decreased by 2% to the price of $105,816 from yesterday’s price of $107,940. This is also down from the intraday high of $108,847.

Ethereum (ETH) fell by 3.8%, now trading at $2,623. This is also a drop from the intraday high of $2,732.

The highest drop in this category is Dogecoin (DOGE)’s 8.7%. The coin is currently changing hands at $0.2052.

Of the top 100 coins, one is green today. LEO Token (LEO) appreciated 1.1% to the price of $9.14.

Optimism (OP) recorded the highest decrease in this category, having dropped 12.7% to $0.6863.

According to James Toledano, Chief Operating Officer at Unity Wallet, Bitcoin’s rally has already priced in bullish catalysts like institutional inflows and geopolitical uncertainty.

The COO argues that,

“With open interest still high and funding rates relatively neutral, this sideways movement suggests a temporary breather rather than a trend reversal.”

Now, the liquidity is tightening ahead of key economic data, so “traders are likely adopting a wait-and-see approach,” Toledano says. “I see it as a stabilization and not a stall, reflecting a classic consolidation phase after strong gains earlier in the month.”

‘New Normal Created by Trump Threatens Economic Stability’

In a comment, Toledano opined that price compression at the current level may set the stage for a larger breakout or breakdown. This will depend on macro cues and risk sentiment. Notably, he highlights,

“All bets are off as we brace for what might come out of President Trump’s administration next. This new normal potentially threatens any notion of economic stability and consistency.”

Moreover, Ruslan Lienkha, chief of markets at crypto platform YouHodler, says that the recent activity seems to be a correction rather than a bearish reversal. For much of this year, he argues, BTC has traded within the $90,000–$110,000 range. This has become a key consolidation zone.

“This area is saturated with market orders, suggesting strong trading interest and potential support. Given these dynamics, it is likely that BTC will continue to trade within this range for some time, potentially building a solid foundation for the next leg higher toward a new all-time high,” Lienkha says.

Moreover, comparing BTC and ETH, Lienkha says the former is seen more as a portfolio diversifier, even if allocations remain relatively small. The latter, however, is “still perceived as a more niche or ‘exotic’ alternative, and broad institutional adoption is likely still some way off.” Nonetheless, due to its strong fundamentals, Ethereum is a popular portfolio diversifier among retail investors.

Finally, Lienkha expects Bitcoin to maintain a correlation with US tech equity indices over the medium term, as both are sensitive to macroeconomic conditions such as interest rates and liquidity. However, this correlation may gradually weaken over time as Bitcoin matures as an asset class with distinct drivers.

Levels & Events to Watch Next

BTC is currently trading at $105,816, moving further away from its all-time high of $111,814, which it hit last Thursday. It’s down 5.5% since. It’s still up 1.6% in a week. The coin has largely been trading around the $106,000 level over the last few hours.

However, it broke two support levels in two days. The next one is the $105,000 level, which traders will keep an eye on. Betideas.com spokesman Steven McQuillan commented that BTC grew $15,000 in value in May alone. Traders are predicting the trend will continue. “Our experts are saying there’s an 80% chance that we see a new all-time high in 2025,” he says.

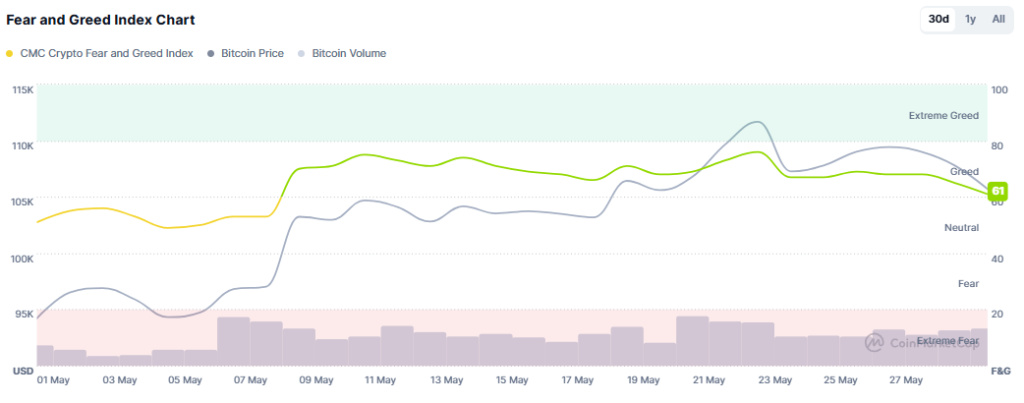

Moreover, the Fear and Greed Index continues falling. It has decreased from 65 to 61 in a day. This is also down from 76 seen last Friday. This is still the greed zone, but it’s moving towards neutral. This suggests that fear is moving in and may potentially drive prices down. While this would mean a red market, it would also present buying opportunities.

Meanwhile, on 29 May, US BTC spot exchange-traded funds (ETFs) saw their net inflow streak broken. It recorded $385.65 million in net outflows. BlackRock is the only one with an increase, recording $125.09 million. On the other hand, US ETH spot ETFs saw $91.93 million in net inflows, including BlackRock’s $50.45 million.

Moreover, Unity Wallet’s Toledano noted that there could well be heightened volatility as markets digest the latest PCE inflation data, jobless claims, and Nvidia’s record-breaking $26 billion quarter.

“The combination of potentially soft inflation, a cooling labor market, and positive tech earnings from a giant like Nvidia could create a supportive environment for Bitcoin [which often tracks tech-driven rallies],” Toledano says. “If the PCE data meets or undershoots expectations, it might reduce concerns about aggressive Federal Reserve policy, further benefiting Bitcoin. However, any unexpected strength in inflation could still introduce volatility and pressure crypto prices, despite Nvidia’s positive influence.”

Quick FAQ

- Why did crypto move against stocks today?

While the crypto market recorded a decrease, the stock market saw a slight uptick. The S&P 500 has increased by 0.4%, the Nasdaq-100 is up 0.21%, and the Dow Jones Industrial Average is up 0.28%. The stock market reacted well to Nvidia’s profits, but the gains were limited nonetheless. Investors are on high alert due to many judicial events related to Donald Trump’s “reciprocal” tariffs.

- Is this dip sustainable?

Analysts argue that the market is currently seeing a correction, rather than a bearish trend, getting ready for the next leg up. However, it’s still highly sensitive to macroeconomic conditions such as interest rates and liquidity.

The post Why Is Crypto Down Today? – May 30, 2025 appeared first on Cryptonews.