XLM Price Prediction For March 28

XLM, the native token of Stellar, is garnering massive attention from traders and investors as it approaches a significant price decline. During its recent upward movement in late February and early March 2025, the asset formed a bearish rising wedge pattern.

XLM Technical Analysis and Price Action

Meanwhile, as market sentiment shifts and the price continues to decline, XRP has reached a crucial lower boundary of its rising wedge pattern and now appears to be consolidating. This ongoing XLM price momentum seems to be driving sentiment in a bearish direction.

XLM Price Prediction

According to expert technical analysis, XLM is at a key level of $0.285, which now appears to be a make-or-break situation for the asset. Based on recent price action and historical patterns, if XLM fails to hold this key level and closes a four-hour candle below $0.28, there is a strong possibility that it could decline by 15% to reach the $0.236 level in the coming days.

On the other hand, if sentiment shifts and XLM’s price soars, closing a daily candle above the $0.31 mark, it could pave the way for a massive upside rally. XLM’s daily chart indicates that the asset is in an uptrend, as it continues to trade above the 200 Exponential Moving Average (EMA) on the daily timeframe.

XLM’s Current Price Momentum

At press time, XLM is trading near $0.286, having recorded a 1% price surge in the past 24 hours. However, during the same period, its trading volume dropped by 10%, indicating lower participation from traders and investors, possibly due to unclear market sentiment.

Traders Bearish View

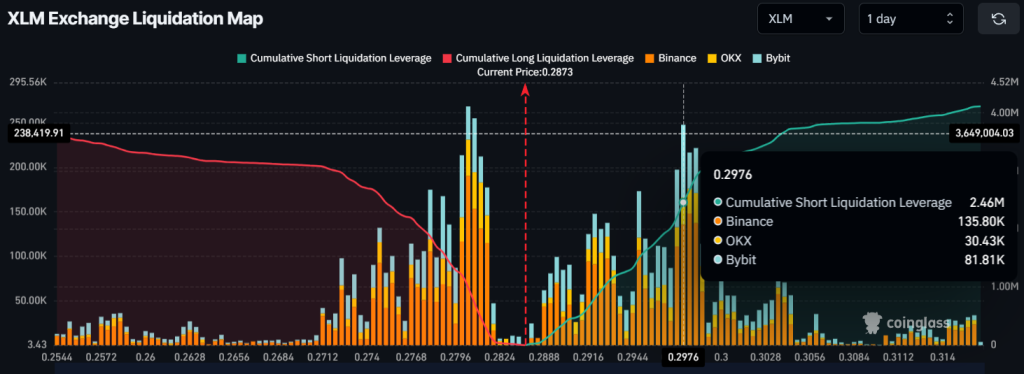

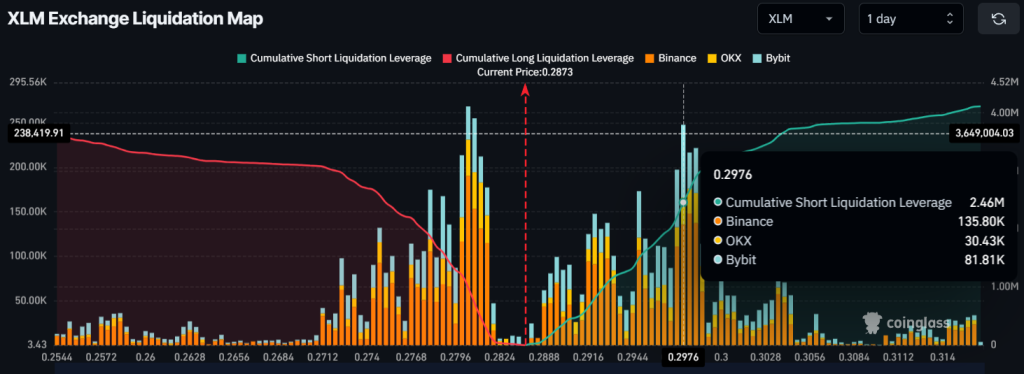

With this bearish price action and market sentiment, traders are strongly betting on short positions.

Data from the on-chain analytics firm Coinglass reveals that traders are currently over-leveraged at $0.28 on the lower side, where they have built $995K worth of long positions. Meanwhile, $0.297 is another over-leveraged level, with traders having built $2.50 million worth of short positions.

This clearly indicates that sentiment toward XLM remains bearish among traders, which could push the asset lower in the coming days.