XRP Price Drops After Outage and 50% Activity Decline

XRP price remains under pressure, trading within a key range as technical indicators signal potential downside risks. The recent 64-minute outage, which briefly halted transactions, has now been resolved, but it did little to boost investor confidence.

Meanwhile, XRP’s CMF remains positive but has weakened. Also, the network’s active addresses have dropped nearly 50% from its December peak. With a possible death cross forming on its EMA lines, XRP could test lower support levels unless renewed hype and buying pressure push it back above key resistance zones.

XRP CMF Is Still Very Positive, But Consolidating

XRP Chaikin Money Flow (CMF) is currently at 0.19, down from 0.26 two days ago, after briefly dipping to -0.22 three days ago. This decline suggests that buying pressure has weakened, but the indicator has now stabilized around 0.19 and 0.20.

The previous drop into negative territory signaled strong selling, but the quick recovery above zero shows that buyers have stepped in to support the price. However, with CMF lower than its recent high, XRP’s bullish momentum has softened.

The CMF is a volume-weighted indicator that tracks the flow of money into or out of an asset. A positive CMF indicates buying dominance, while a negative reading suggests selling pressure. With XRP’s CMF stabilizing around 0.19 after dropping from 0.26, capital inflows remain positive but have slowed.

If it stays in this range, XRP price could consolidate, but a move below 0.15 may indicate increasing weakness, while a recovery above 0.25 could signal renewed buying strength.

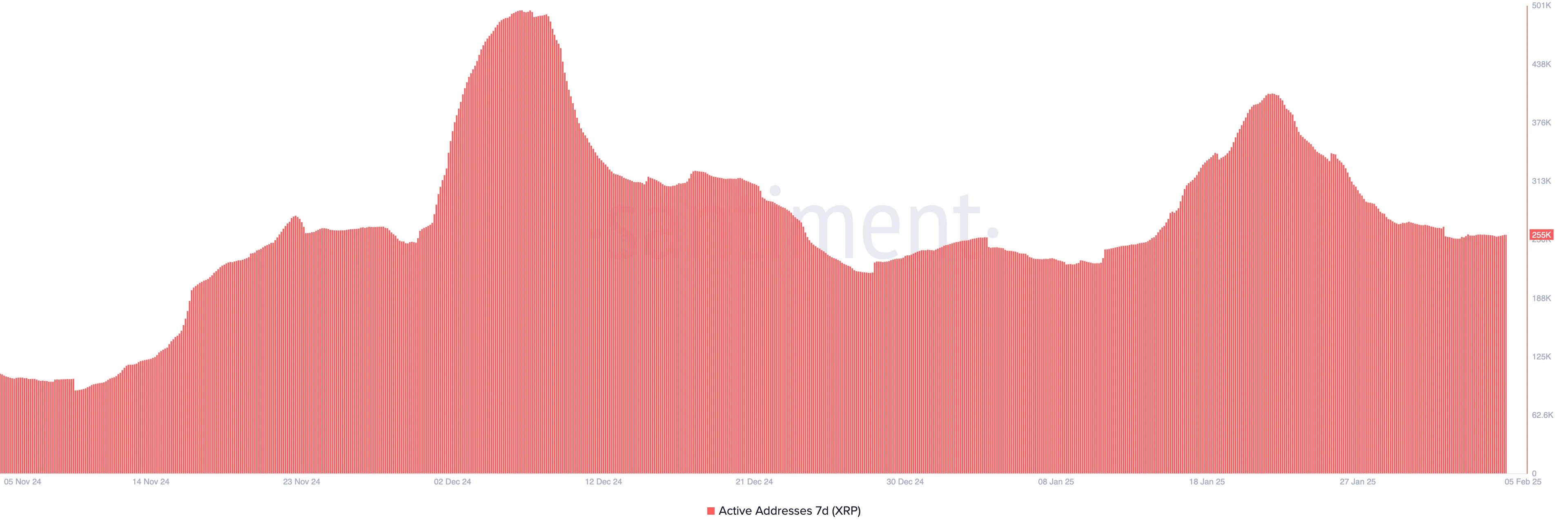

XRP Active Addresses Are Still High, But Down 50% From Its Peak In December

The number of 7-day XRP active addresses is currently around 256,000, down from 407,000 nearly two weeks ago, marking a 37% decline. While this remains a relatively high value compared to most of 2024, it is still nearly 50% lower than the peak reached in early December.

This drop suggests a slowdown in network activity, which could indicate reduced demand or lower transaction volumes. If active addresses continue to decline, it may reflect waning interest or participation in XRP transactions.

Tracking active addresses is important because it measures real user engagement and transaction activity on the network. A higher number of active addresses often signals strong adoption and demand, while a decline may indicate reduced network usage.

Although XRP current count remains elevated compared to most of last year, the sharp decrease from December and January suggests fading momentum.

If this trend persists, it could signal weaker market participation, but a rebound in active addresses might indicate renewed investor and user interest.

XRP Price Prediction: Can XRP Drop Below $2 Soon?

XRP’s EMA lines indicate that a new death cross could form soon, with a short-term line crossing below its longest-term line. If this bearish signal plays out, XRP price may test the support at $2.32, and if that level is lost, it could drop further to $2.20.

A continued decline in active addresses and a weakening CMF could push XRP below $2, with the next key support at $1.99. This would confirm a deeper bearish trend, making recovery more difficult, especially if new outages occur.

On the other hand, if the hype around XRP returns to levels seen in recent months, it could break the $2.60 resistance. A strong breakout above this level could lead to a test of $2.82, and if momentum builds, XRP could push above $3.

A further rally could see it test $3.15 and even $3.40, reinforcing a bullish breakout and increasing the chances of the XRP price reaching $4 in February. For this scenario to play out, buying pressure and network activity would need to improve significantly.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.